Friday’s 8 percent rally in oil prices was an exhibit in short covering. The rally only amounted to a few bucks higher in Crude Oil prices, but 8 percent is 8 percent. The oil short covering rally was triggered by a report from Baker Hughes showing that rig counts dropped by 7 percent last week.

Over the weekend I wrote a quick research note on Crude Oil looking at Friday’s rally and how it created a long white weekly candle, the first of its kind in some time. It was NOT a bottom calling piece, but a thoughtful piece reminding traders of the prospect for a rally (or even some sideways action). It is also important to note that the price action in Crude Oil carries implications for the broader markets and related equities.

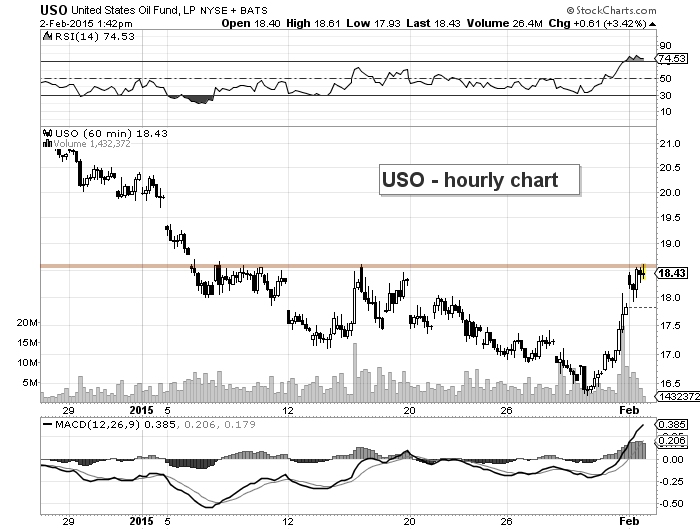

The oil short covering rally carried over to today as well, with the United States Oil ETF (USO) jumping as much as 4 percent by early afternoon. But that rise took the Oil ETF right into stiff price resistance around $18.50 to $18.70. Note that this is the equivalent of $49.50 to $50.00 on Crude Oil Futures (March).

United States Oil ETF (USO) – 1 Hour Chart

For the record, I sold half of my USO trading position into resistance and raised my stops. A breakout above resistance would be constructive. That said, the reality is that this is likely an oil short covering rally and the only way that it turns into something more (with longer duration) is if the first pullback is bought and higher lows are made, and the ensuing rally leads to new highs. Either way, keep Crude on your radar.

Thanks for reading.

Follow Andy on Twitter: @andrewnyquist

Author carries a trading position in USO at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.