The stock market roller coaster continues.

Stocks reversed lower on Friday as investors fear of tariffs and trade conflicts between U.S. and China escalated. Well today was a re-run. Price volatility persists.

Over the weekend White House officials attempted to calm investor concerns by pointing out that tariffs have yet to be enacted and that this will be a two- to three-month period of negotiation with China and other countries. The U.S. may end up changing its stance on tariffs in exchange for an agreement from China to back down on its theft of our intellectual property rights and better access for U.S. companies in China. The market is also reacting to concerns about inflation and rising interest rates and regulatory crackdowns on big technology companies.

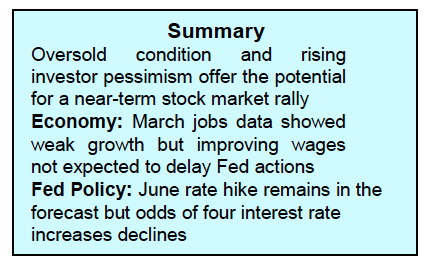

Additionally, a mixed March jobs report showed weaker-than-expected payroll growth, an unchanged unemployment rate, and slightly higher wage growth. Bear markets break out due to warning signs of a recession. Most economists view recession risks as low.

Analysts are looking for a strong earnings season in response to the recent corporate tax cuts. Stocks entered the new week oversold and underbelieved which, using contrary opinion, is favorable.

The technical indicators support the prospects for improving stock market conditions near term. Last week’s performance was marked by reduced selling pressure as fewer issues made new 52-week lows. Despite the S&P 500 Index falling below 2600 intraday last week, the percentage of issues trading above their 50-day moving averages made a higher low from what was seen at the February 8 bottom.

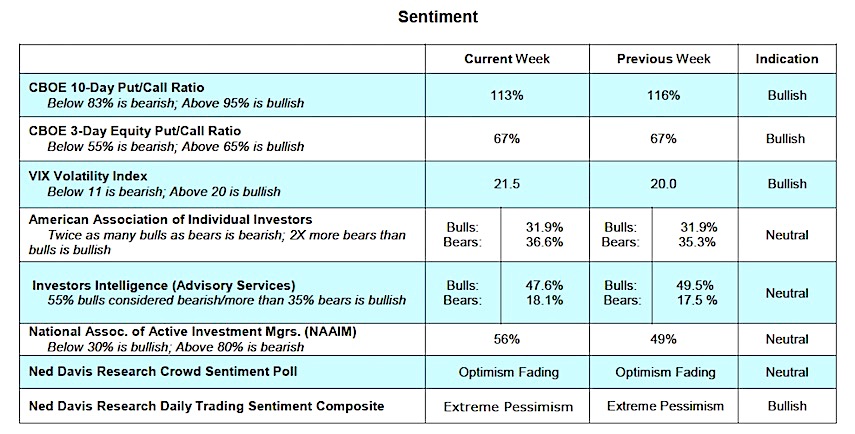

Investor sentiment moved closer to extreme pessimism last week, which is seen as a positive development as it suggests that liquidity is building on the sidelines. The latest survey from the American Association of Individual Investors (AAII) shows the percentage of investors who are pessimistic about the short-term direction of stock prices is at its highest level in nearly seven months. The latest report from Investors Intelligence (II), which tracks the opinion of Wall Street letter writers, shows the fewest bulls since the cycle low in September 2017. Additionally, the demand for put options continues to soar indicating that too many are looking down. The important missing element remains the inability of the equity markets to break the downside momentum which has caused all rallies to abort. In order to argue that the current decline has run its course, we need to see at least one session where upside volume overwhelms downside momentum by a ratio of 9-to-1.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.