The equity markets turned in one of the best performances of the year last week with the popular averages gaining more than 2.00%.

Stocks are up 3.00% in May and 2.00% for the year.

The current rally is being supported by favorable news on the U.S. economy, stronger-than-expected first-quarter earnings and most recently by reports that producer and consumer inflation pressures remain moderate.

The inflation news sparked a mid-week rally as it calmed fears pricing pressure would prompt the Fed to be more aggressive with monetary policy.

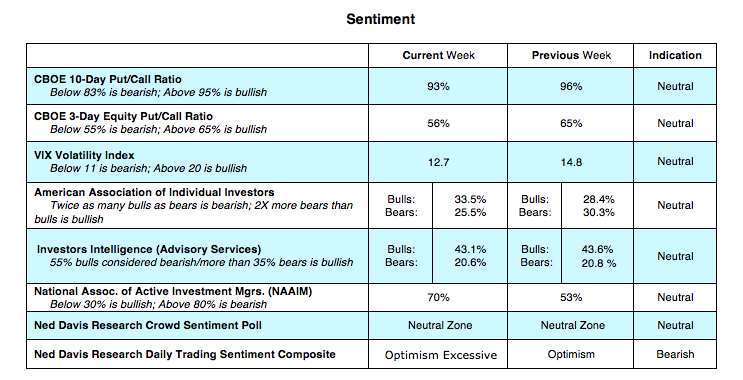

The fact that the markets were able to overcome the rise in tensions abroad and the threat of higher oil prices suggests that much of the negative news was already built into current prices. As a result, investor psychology appears to be shifting from what could go wrong to what could go right. Evidence of this is found in the persistent decline in the CBOE Volatility Index (VIX) which is used as a measure of investor anxiety. The drop in the VIX to levels last seen in January is considered a positive as it suggests that investors are now focusing on the potential for the economic expansion to carry into 2019.

This implies that the current rally in the equity markets is likely to continue into the new week.

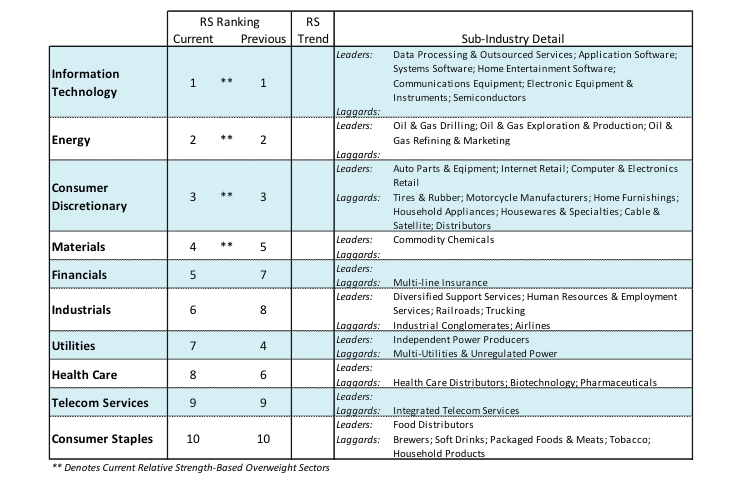

Modest improvement in the technical indicators last week suggests additional upside is likely over the near term. We are particularly encouraged by the return of growth sectors as the market leaders which is an indication of an increased propensity toward risk. Markets are typically vulnerable when defensive sectors rise to the top of the relative strength leaderboard. The fact that tech, consumer stocks, commodity issues and financial issues are leading argues for further strength.

Indicators of investor sentiment also support further progress. Although pessimism melted away into last week’s rally, there is no evidence that investors are becoming excessively optimistic.

From a contrary opinion perspective, this suggests that stocks have additional room on the upside. From a longer-term perspective the overriding technical issue is the lack of upside momentum.

Despite the rally, significant improvement in upside volume over downside volume has yet to surface. We would also like to see an expansion in the percentage of issues trading above their 50-day moving averages. Currently 62% are above this zone but we would need to see 80% to suggest market breadth has turned bullish and new highs for the year are directly ahead. The significance of stock market breadth cannot be understated. In a healthy bull market nearly all areas are in harmony with the primary trend.

Bottom line, stocks are likely to attempt to move to the upper end of the trading range near 2775. If accompanied by significant breadth improvement this would argue for a full test of the January high at 2872 using the S&P 500 Index.

CHART

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.