The following are charts and data showing non-commercial futures trading positions as of November 28, 2017.

This data was released with the December 1 Commitment of Traders Report (CoT). Note that these charts also appeared on my blog.

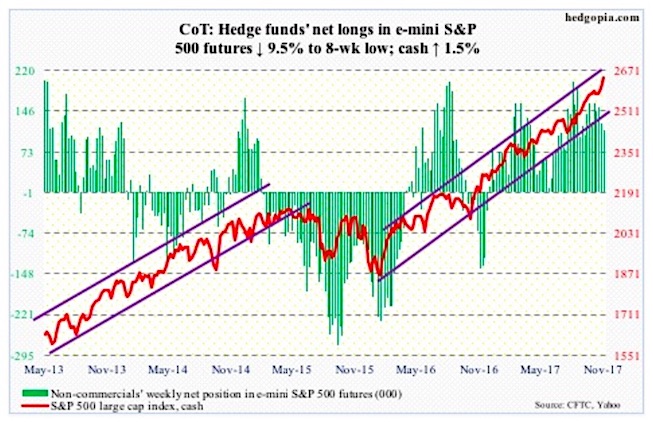

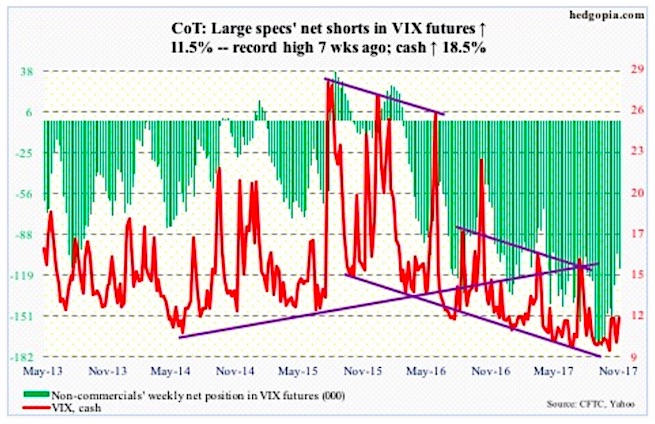

The charts below look at non-commercial futures trading positions for the S&P 500 and VIX Volatility Index.

S&P 500 Futures (E-mini): Currently net long 112.5k, down 11.8k.

The S&P 500 cash index (INDEXSP:.INX) rallied all along the daily upper Bollinger band in the past eight sessions, with the last four well outside.

Friday’s intraday 1.6-percent dip was bought near the 10-day to end the session down 0.2 percent.

The atmosphere is complacent. Investors Intelligence bulls have been 60 percent or higher in the past eight weeks, with the ratio of bulls to bears north of four or higher in six of those and the other two at 3.95 and 3.99. Investor complacency.

Our own Hedgopia Risk Reward Index has turned lower after entering the red zone.

Seasonality favors the bulls, but risks are rising that a pullback occurs soon – duration and magnitude notwithstanding.

In the week to Wednesday, per ETF.com, $252 million flowed into VOO (Vanguard S&P 500 ETF) and $52 million into IVV (iShares core S&P 500 ETF). But this paled in comparison to $1.3 billion in withdrawals from SPY (SPDR S&P 500 ETF).

U.S.-based equity funds did attract $2.4 billion, though. In the last eight, inflows have totaled $29.4 billion (courtesy of Lipper).

VIX Volatility Index: Currently net short 114.8k, up 11.8k.

The VIX Volatility Index (INDEXCBOE:VIX) is acting strange. For the week, the VIX rallied 18.5 percent, even as the S&P 500 rallied 1.5 percent. They normally have an inverse relationship.

Friday’s was even stranger. VIX rallied intraday to 14.58 but only closed up 0.15 to 11.43. This has the look of a spike reversal candle. Early next week will be crucial.

Other metrics show complacency is building.

Using a 10-day moving average, the CBOE equity put-to-call ratio Friday registered 0.57, which was the lowest since December 19 last year, while on Wednesday the ISEE index (equity) stood at 165.9 – the highest since April 28, 2015. (The ISEE is a call-to-put ratio – more here.)

Thanks for reading.

Twitter: @hedgopia

Author may hold a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.