The equity markets were virtually unchanged last week during a period that witnessed political uncertainty in the Eurozone, the Administration’s announcement to implement previously announced tariffs on steel and aluminum imports from the European Union, Mexico and Canada, and the May jobs report.

Political uncertainty in Italy and increased trade tensions triggered a sharp drop in the averages mid-week.

However, investors’ concerns eased late in the week when the two large anti-establishment parties in Italy formed a coalition government, which temporarily resolved a political crisis.

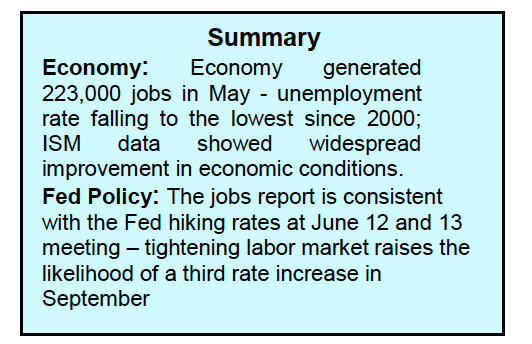

More importantly, stocks rallied on Friday on a report from the Labor Department showing stronger than expected job growth in the month of May which surpassed expectations. The unemployment rate fell to an 18 year low. And wage inflation increased to 0.3%.

Other reports showed strength across the U.S. economy with widespread improvement in manufacturing, retail and construction. The stronger reports with modestly higher inflation raise the likelihood that the Federal Reserve will increase short-term interest rates at the June 12 and 13 meeting by 25-basis points with a good chance of another rate hike in September and again in December. Trade tensions will continue but, as in last week’s performance, investors seem to shake off trade concerns and focus more on the economic good news.

The bottom line is that the fundamentals support the prospects for the continuation of the bull market with continued volatility courtesy of slowly rising interest rates, trade talks and mid-term elections that historically show stocks struggling until after the elections.

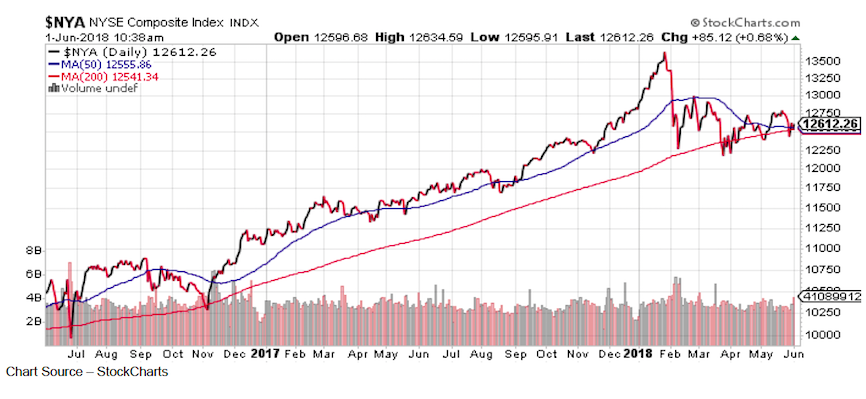

The technical condition of the stock market showed modest improvement last week. Despite the popular averages showing no measurable improvement the past three weeks, the percentage of industry groups within the S&P 500 that are in defined uptrends expanded to 68% from 60% three weeks ago. This is considered a positive in terms of overall market breadth. However, we are still waiting on a significant increase in upside volume over downside volume that would send a signal that a breakout to the upside is imminent.

Additionally, the fact that the New York Stock Exchange Composite Index (NYA) that is comprised of more than 2000 issues remains 7% below its January peak and argues that stock market leadership remains narrow.

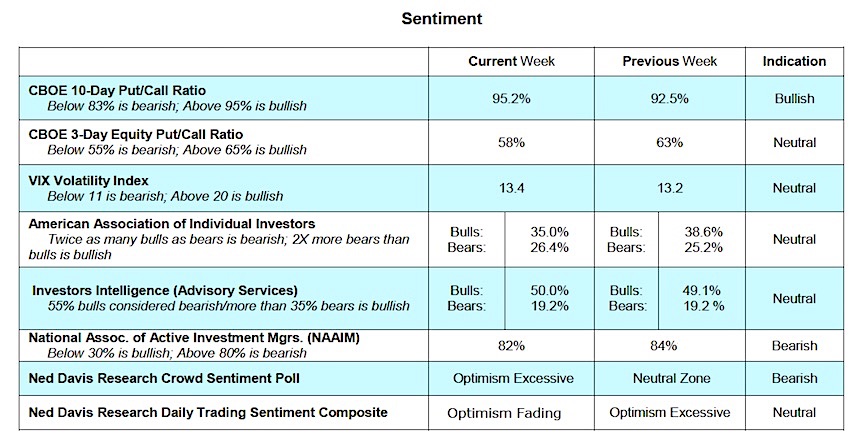

The message from the sentiment indicators remains mixed but we were encouraged by a substantial increase in the demand for put options on the CBOE and the sharp rise in the CBOE Volatility Index that jumped more than 30% mid-week, which is a sign of caution entering the market. Using contrary opinion this is a positive development but falls short of providing a high level of conviction that the consolidation period has run its course. Entering the final month of the second quarter, we see a continuation of the trading range with the short-term risk to 2625 using the S&P 500 Index.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.