The Weight of Evidence Offers Bullish Message For S&P 500 (INDEXSP:.INX) Into Year-End

Highlights:

- Central Bank Patience Could Be Tested

- Global Economy Providing Upside Surprises

- Seasonal Patterns Argue For Fourth Quarter Strength

- Market Breadth Trends Show Improved Rally Participation

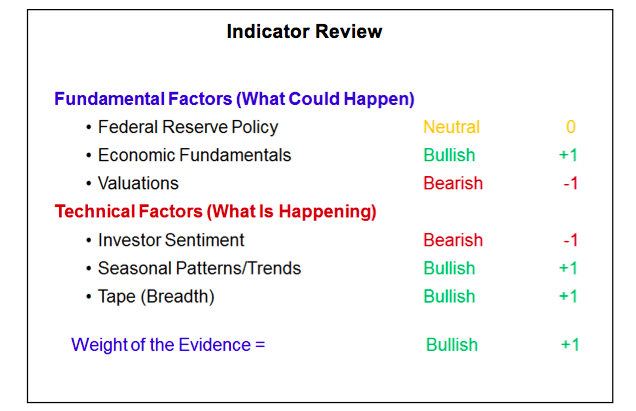

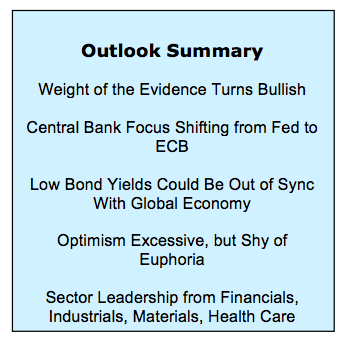

Improving seasonal patterns have shifted the overall weight of the evidence from neutral to bullish. This suggests that stocks could follow a path of least resistance higher into 2018. Global economic conditions remain strong, and broad market trends are heading in the right direction. Historically stocks and the S&P 500rally as year end approaches, although strength over the entire fourth quarter would be a bit surprising (but about on par for what we have witnessed so far in 2017). Optimism is elevated which could argue for some near-term rockiness. Valuations suggest stock prices have already priced in a robust recovery in earnings.

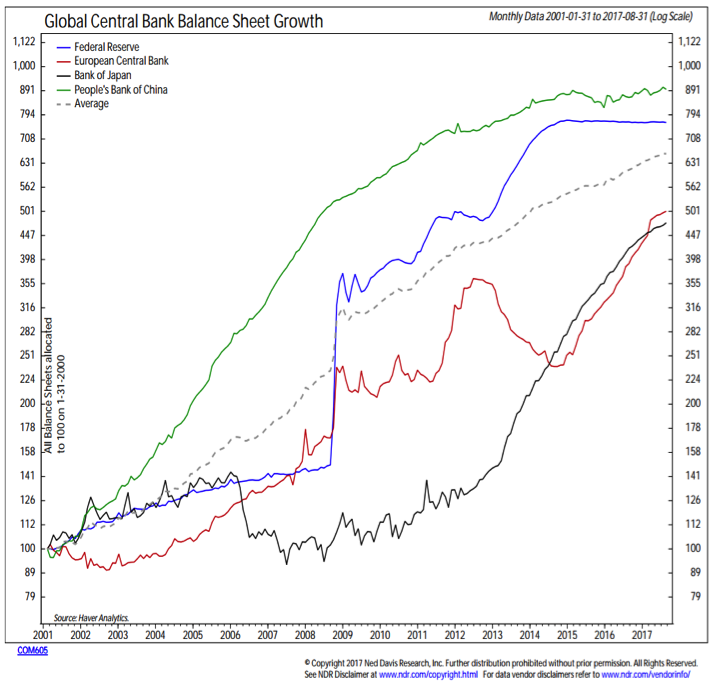

We are keeping a close eye on the sole remaining neutral factor: Federal Reserve Policy (or global central banks, more generally). The Fed has telegraphed the beginning of their balance sheet drawdown and the market has priced in one more rate hike yet this year. Central bank surprises are more likely to come from Mario Draghi and the ECB. A faster-than-expected pivot from the current do-whatever-it-takes quantitative easing program to a discussion of quantitative tightening could turn overall central bank policy into a headwind for stocks. Evidence of accelerating inflation could put upward pressure on global bond yields, and that could get to the point of being a headwind for stocks as well. While this shift in central bank policy may be timely, it remains very much in experimental mode. We do not have evidence, now, that central banks have become a headwind for stocks. That may come in 2018, but not here yet. For now, central bank policy is neutral, the weight of the evidence has turned bullish, and stocks appear poised to work higher into year end.

Federal Reserve Policy is still neutral. The Fed has begun to reduce the size of its balance sheet (ever so slightly) and has signaled to the market its expectation that rates will be raised one more time in 2017 (likely in conjunction with the December FOMC meeting). The pace of tightening (still described as policy normalization) has been both gradual and clearly signaled by the Fed. This has helped keep Fed policy as neutral and limited any disruptive impacts. While the Fed has stopped its easing program, the ECB and the Bank of Japan have continued theirs, and central bank balance sheets overall have continued to expand. A more abrupt-than-expected shift from easing to tightening by the ECB could turn central bank policy into a headwind for stocks and may be a significant story as we move into 2018.

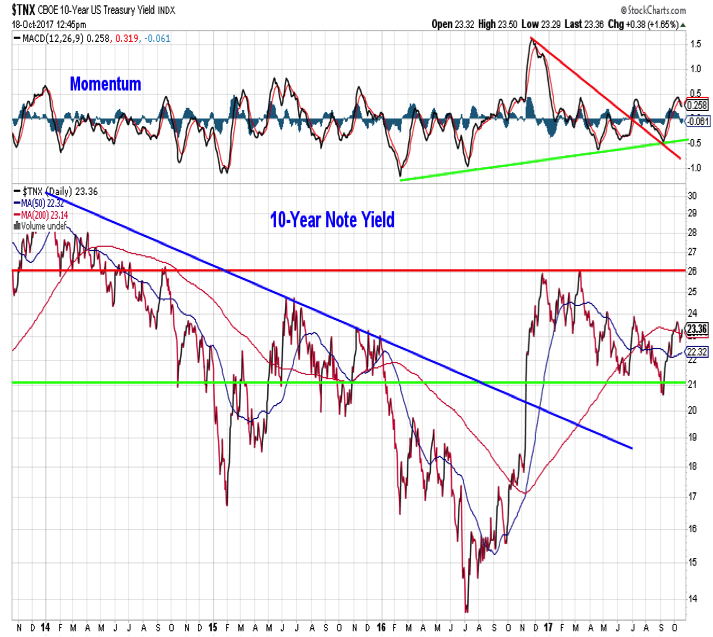

Experimental policy on the part of global central banks has helped keep bond yields low. A shift from balance sheet expansion to balance sheet contraction could put upward pressure on yields. To some extent a modest rise in bond yields would reflect confidence in the recovery being seen in the global economy, but at some point (our guess would be around 2.6% on the 10-year Treasury Note Yield -INDEXCBOE:TNX) this could become a headwind for stocks. A relative lack of inflation pressure and muted inflation expectations provides central banks with the chance to proceed at a modest pace. If this dynamic shifts inflation pressures build, central bank tightening schedules may need to be accelerated.

Economic Fundamentals remain bullish. After slipping relative to expectations over the course of the summer, the global economy is back to providing upside surprises. This has been the case for most of the past 18 months. Economic growth has not only been stronger than expected in aggregate, it remains broadly based. 97% of country-level purchasing manager indexes are above 50 (indicating an expansion in activity) and 90% are higher than they were a year ago.

The rebound in growth is helping support a rebound in corporate revenue and earnings. While S&P 500 earnings estimates for 2017 have come down slightly since the beginning of the year, the pace of downward estimate revisions has slowed, particularly over the course of the third quarter. As of now, S&P 500 operating earnings are expected to rise nearly 20% this year, followed by another 13% gain in 2018 (source: Ned Davis Research).

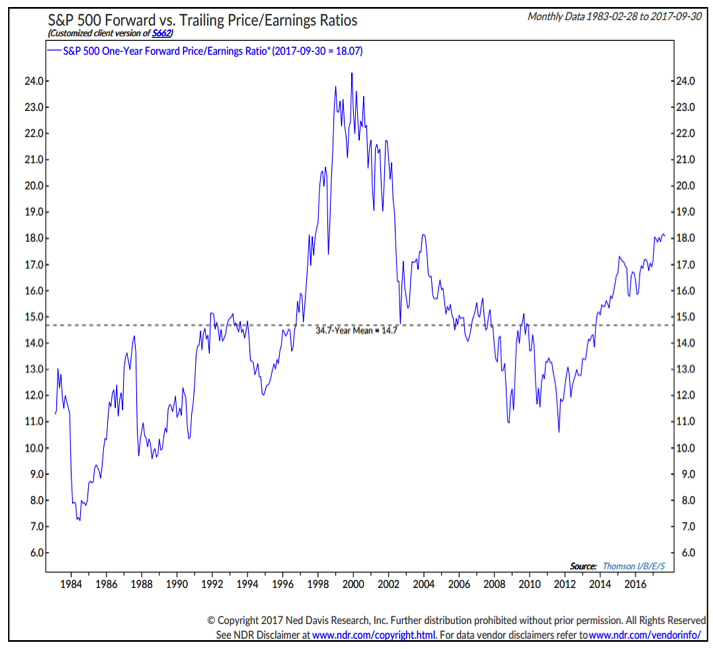

Even with the improving economic growth fueling an improved earnings backdrop, Valuations remain bearish. Stock prices have already risen in anticipation of the rebound in earnings that is being seen and which is expected to continue. Valuations are elevated based on both trailing earnings and one-year forward earnings. The best case scenario, given current valuations, may well be for the price rally to pause for a time while the recovery in earnings continues.

continue reading on the next page…