This article was written by Bradford A. Evans, CFA – Portfolio Manager.

The near-record margins large companies have enjoyed the past few years highlight just how favorable the climate has been for many businesses.

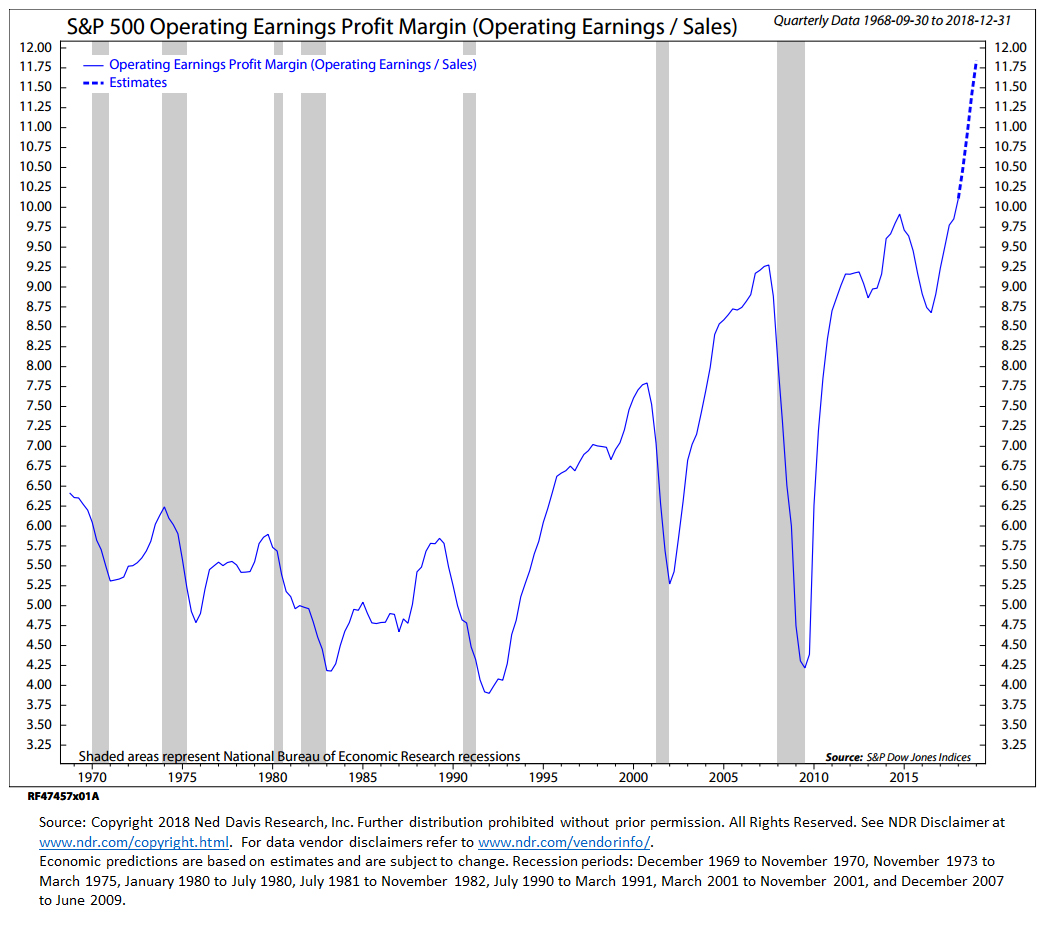

Slow wage growth, benign inflation and historically low interest rates have kept a lid on costs and helped boost profit levels, as shown.

Not surprisingly, investors have cheered this phenomena and have been willing to pay a premium in hopes that the good times will never end.

S&P 500 (SPY) Operating Earnings Profit Margin Chart – Ned Davis Research

But as the S&P grinds higher, we believe piling into companies with margins at historic peaks—and trading at elevated multiples—sets the stage for disappointment. Raw material prices are on the rise, interest rates are up and likely headed higher and wages are poised to climb in an already tight labor market.

Any one of these developments alone could pinch operating margins, but together, the effect could be significant. Once margins come under pressure, we expect multiples will follow.

A more prudent approach, in our view, is to seek companies where margins are at or nearing an inflection point. Fortunately for investors, many of those names have been overlooked and are trading at discounts.

Heartland Advisors Disclosure: Past performance does not guarantee future results.

Investing involves risk, including the potential loss of principal. There is no guarantee that a particular investment strategy will be successful. Value investments are subject to the risk that their intrinsic value may not be recognized by the broad market.

The statements and opinions expressed in this article are those of the presenter. Any discussion of investments and investment strategies represents the presenter’s views as of the date created and are subject to change without notice. The opinions expressed are for general information only and are not intended to provide specific advice or recommendations for any individual. Any forecasts may not prove to be true. Economic predictions are based on estimates and are subject to change.

Heartland Advisors defines market cap ranges by the following indices: micro-cap by the Russell Microcap®, small-cap by the Russell 2000®, mid-cap by the Russell Midcap®, large-cap by the Russell Top 200®.

Small-cap investment strategies, which emphasize the significant growth potential of small companies, have their own unique risks and potential for rewards and may not be suitable for all investors. Small-cap securities are generally more volatile and less liquid than those of larger companies.

Foreign investing involves special risks such as currency fluctuations and political uncertainty.

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.