U.S. equity market indices seeing new record highs include the S&P 500 Index (INDEXSP:.INX), the NASDAQ Composite (INDEXNASDAQ:.IXIC) and the Dow Utilities. But the dynamic in the markets may be shifting a bit.

The unusual combination of growth stocks and utilities issues hitting 52-week highs suggests that the equity markets are now being supported by low interest rates and a soft dollar as opposed to improving economic fundamentals.

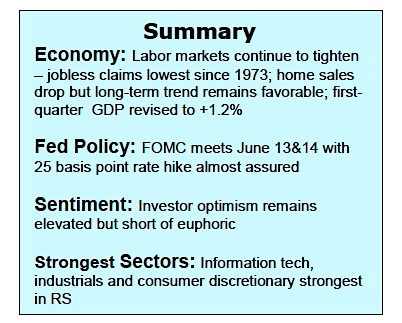

Although first-quarter GDP was revised upward last week, most of the recent economic data has surprised on the downside. As a result, growth stocks and high dividend payers have taken over as market leaders. Despite the poor start for the U.S. economy, there is evidence that business conditions are improving. Capital spending climbed at more than an 11% clip in the first quarter, the largest increase in five years. Capital spending is critical to the economy and corporate profits as it leads to stronger productivity, which ultimately leads to a stronger labor market.

The Federal Reserve appears focused on the potential for stronger growth going forward as it is widely anticipated to raise interest rates in mid-June. Janet Yellen seems determined to reduce the Fed’s balance sheet later this year, which is a firm indication that the Fed visions the economy growing stronger in the second half of the year. Meanwhile, the low interest rate/low inflation environment suggests that bonds and commodities offer little competition for stocks.

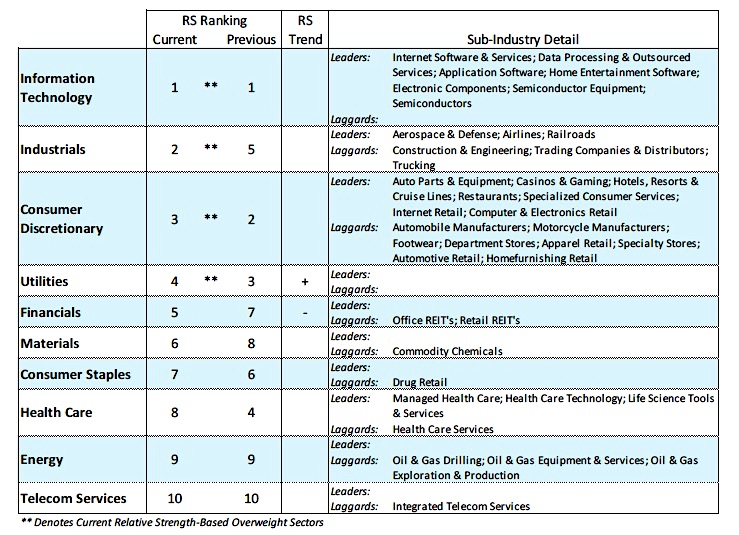

The technical indicators continue to offer mixed signals. Long-term trends remain bullish but the advance has narrowed since early this year, where only a few stocks are providing most of the performance. More than half of the 8.0% gain in the S&P 500 this year has been provided by only five issues. Although it is not uncommon for only a select number of market themes to carry the market higher, the fact that market breadth peaked in the first quarter and failed to expand as the averages hit new highs is problematic. This is not interpreted as a significant problem given that many of the broad-based indices including the Russell 2000 are near record highs.

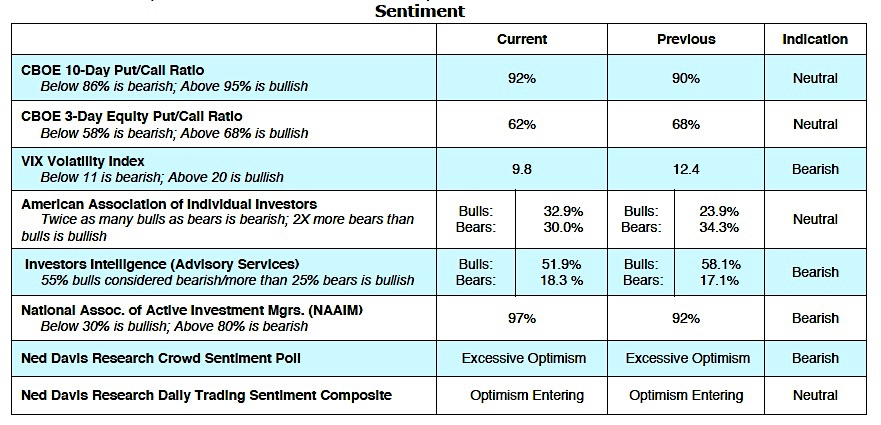

If the broad market continues to be an anchor, significant gains from current levels are less likely. Market indicators of investor sentiment offer conflicting messages. Investors Intelligence (II) and the National Association of Active Investment Managers (NAAIM) data shows high levels of confidence. A survey by the Conference Board of consumers’ outlook for the equity markets shows less than 20% of participants expecting a significant market decline. Countering the optimism found in the above surveys is the fact that investors are pulling money out of U.S. stocks and funneling the money into overseas markets. The bottom line is that despite some technical flaws, the path of least resistance remains to the upside.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.