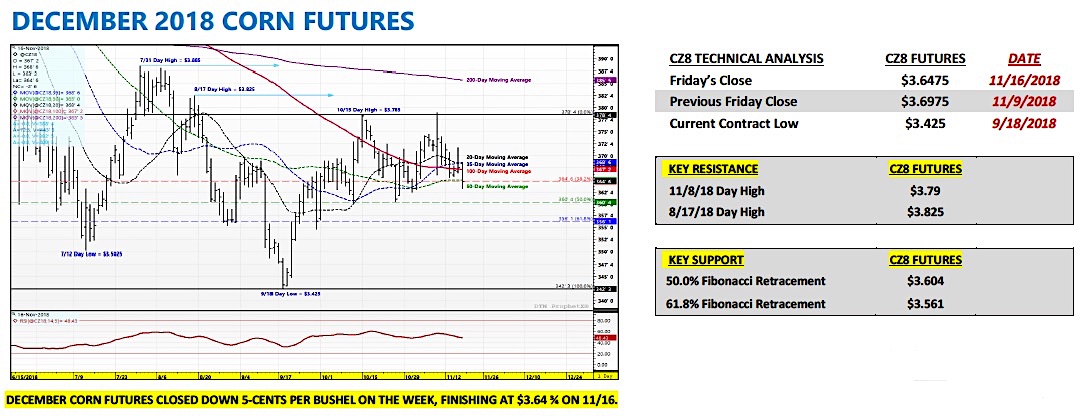

December corn futures closed down 5 cents last week to close at just under $3.65.

How much of the prolonged malaise is related to Ethanol… and what does the outlook for Ethanol look like for Corn bulls?

Let’s review the latest data and market trends with a look to the week ahead (November 19).

Monday’s Weekly Crop Progress report showed the U.S. corn harvest improving to 84% complete as of the week ending November 11th, 2018 versus 81% a year ago and the 5-year average of 87%.

One notable state with some work left to do was Nebraska, which was just 77% harvested versus 83% a year ago and 86% on average. Nebraska’s total harvested corn acreage was estimated at 9.25 million acres in the November 2018 Crop Production report (3rd largest corn acreage base in the U.S.).

Therefore Nebraska still has approximately 2.1 corn million acres left to pick. It’s worth mentioning that Nebraska’s 2018 state corn yield is currently estimated at a record high 195 bpa.

The elephant in the room right now in the corn market is U.S. ethanol margins.

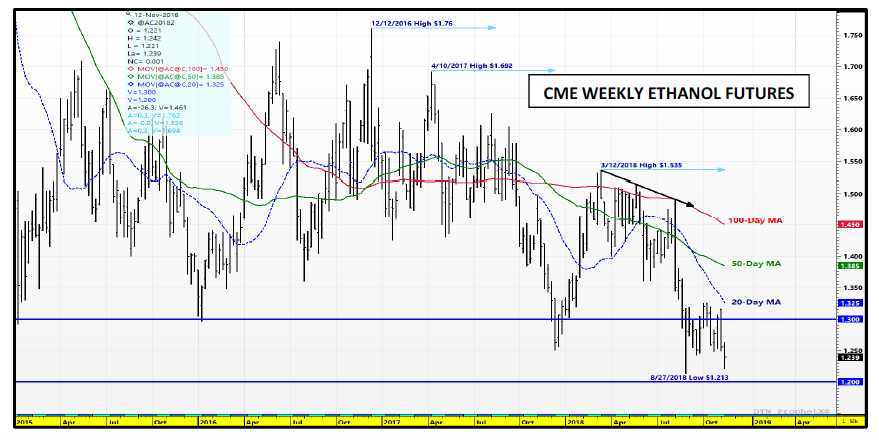

“Industry Average” ethanol margins are negative and have been negative for quite some time (since essentially the beginning of August 2018). This has been due to a variety of factors including historically cheap ethanol prices; CME ethanol futures continue to trade at their lowest level since June 2005 (low-to-mid $1.20’s per gallon). This has occurred almost simultaneously with significant increases in variable expenses including natural gas. Natural gas futures have rallied from the low $2.80’s per mmBtu in early August to a day high on Thursday of $4.929 per mmBtu.

Meanwhile even though corn futures have remained range bound to the upside, the physical corn basis that ethanol plants (and commercial grain handlers) have had to pay to source corn has not, specifically in states in such as Iowa and Minnesota. Post-harvest corn basis values have appreciated substantially in just the last two weeks. In the November 2018 Crop Production report Iowa’s corn yield was cut 6 bpa to 198 bpa with Minnesota’s corn yield lowered 7 bpa to 184 bpa.

The decline in corn yields in both states has undeniably been felt by ethanol plants and commercials alike with substantially less corn moving at harvest to off-farm storage during Oct/Nov compared to the last two years.

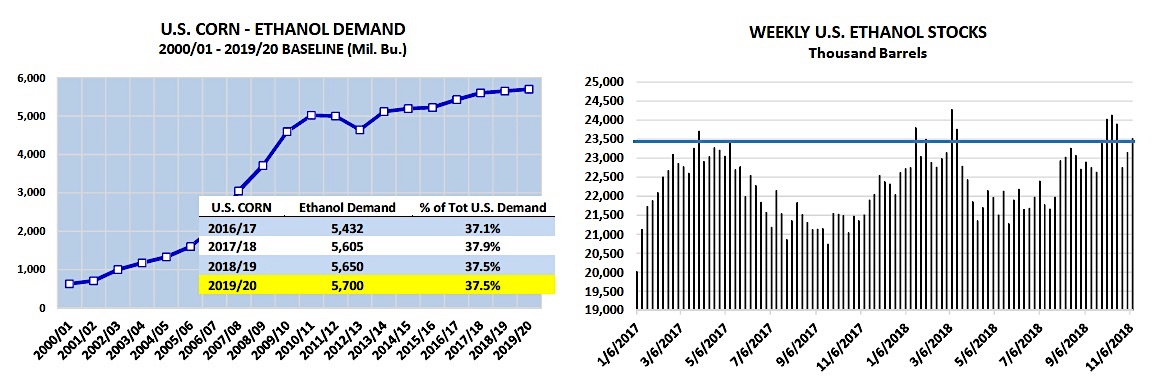

The reality then for a number of ethanol plants has been having to pay basis premiums for corn ownership at a time when industry ethanol margins don’t necessarily support the higher values. For this reason, a growing chorus of ethanol insiders believe plant slow-downs are inevitable with the industry quickly approaching an inflexion point. Any prolonged slow-down would over time have a negative impact on the amount of corn ground to make ethanol, which as of the November WASDE report was estimated at 5.650 billion bushels for 2018/19.

Is there a quick fix to alleviating downward pressure on U.S. ethanol margins?

Unfortunately if you examine the current ethanol S&D mix in the U.S. it doesn’t appear so. The current weekly U.S. ethanol production rate for the week ending 11/9/18 was 1.067 million barrels per day. This was well above the 2018 average weekly ethanol production rate of 1.047 mmbpd, and even higher than the most recent 4-week average production rate of 1.055 mmbpd. Meaning the vast majority of ethanol producers in the U.S. still have not slowed their plant run-rates as a result of negative ethanol margins.

Furthermore, U.S. ethanol stocks climbed to 23.5 million barrels for the same week ending 11/9/2018. U.S. ethanol stocks have only exceeded 23.5 million barrels on 8 occasions since 2017. Therefore even if U.S. ethanol plants start to tap the brakes on production, it’s going to take a while to chew through surplus U.S. ethanol inventories before we see a sustained, positive price response from ethanol values.

December Corn Futures Weekly Trading Forecast

December corn futures leaked lower again this week with buyers showing no sense of urgency with respect to adding additional market length at this time. CZ18 is now trading approximately 20 to 22-cents above its contract low of $3.42 ½ from September 18th, 2018.

The immediate hurdles to short-term corn rallies are many not the least of which is the price seasonal/time of year.I’ve stated this before but it’s hard to rally the corn market in November, regardless of a potentially supportive U.S. corn S&D. I continue to believe that an additional yield reduction could be in the offing for the 2018/19 U.S. corn yield however no adjustment will be made now until the USDA’s January 11th, 2019 WASDE report. That said the market’s entering a quiet period for relevant, price altering news. Such periods have historically led to sideways to lower markets. I see the current corn market as essentially no different.

Is the concern over widespread, negative U.S. ethanol margins and the potential for plant slow-downs contributing to some of the recent weakness in corn futures?

I don’t believe so. The reality is plants don’t like to slow-down for a day longer than they have to (for a variety of reasons). Furthermore every ethanol plant’s operating efficiencies and cost structures are slightly different. Therefore trying to gage just how close a plant is to reducing its run-rate is very hard to do from afar. There’s also a difference between having a negative margin and running at negative EBITDA. Typically until there’s an extended “cash burn” plants won’t slow down. All of this suggests to me that even if the U.S. ethanol industry sees a dip in weekly production it will likely prove short-lived.

Ethanol margins tend to cycle and are also very seasonal in nature. Therefore I fully expect that any minor improvement in margins or even any perceived improvement in margins via a pending seasonal will be used as an immediate justification to start running again at full capacity. All things considered, I don’t foresee more than a 25 to 50 million bushel cut to U.S. corn-ethanol demand moving forward and even that I wouldn’t expect to see from the USDA until the January or February WASDE reports. The EIA’s latest weekly data has yet to show any industry-wide ethanol production decreases.

Corn Bulls will need to exercise patience. December corn futures closed right on the 38.2% Fibonacci retracement of $3.646 on Friday afternoon and a tick below the 50-day moving average of $3.65. The next area of key price support is $3.604.

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

Data References:

- USDA United States Department of Ag

- EIA Energy Information Association

- NASS National Agricultural Statistics Service