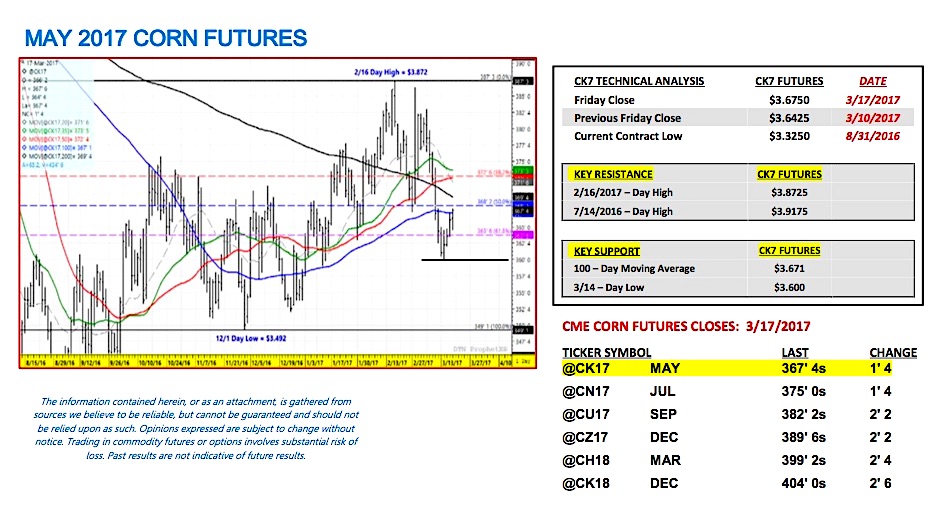

May corn futures moved slightly higher this week, closing up 3 ¼-cents per bushel week-on-week, finishing on Friday (3/17) at $3.67 ½.

Friday’s positive close was important for corn bulls with May corn futures under significant selling pressure from March 6th through March 14th, breaking 23-cents per bushel from high-to-low over that time period.

WEEKLY MARKET HIGHLIGHTS

2017 Planted Acreage Update: On Monday (3/13) Informa Economics issued its revised 2017 U.S. planted acreage forecasts for corn and soybeans. Informa estimated corn planted acreage at 90.8 million acres versus the USDA’s Ag Outlook projection of 90.0 million with soybean planted acreage forecasted at 88.7 million acres versus the USDA’s Ag Outlook figure of 88.0 million. May corn futures responded by closing down 3 ¼-cents per bushel that afternoon.

And although Informa’s corn planted acreage estimate was only slightly higher than the USDA’s most recent projection, I believe for Corn Bulls their perception was that Informa’s upward revision would only further stoke current trade rumors suggesting spring acreage intentions for corn are indeed increasing not decreasing.

The combination of higher corn prices during the month of February (which created a spring insurance guarantee price for producers of approximately $3.96 per bushel in December 2017 corn futures versus $3.86 a year ago) along with a warmer Midwestern weather pattern in February, have clearly bolstered a storyline now pointing to farmers potentially adding corn acres this spring. This is something Corn Bulls wanted very much to avoid in their quest for $5.00 December corn futures.

Strong Weekly Export Sales: In Thursday’s (3/16) Export Sales summary for the week ending 3/9/2017, weekly U.S. corn exports were reported at 49.4 million bushels for the 2016/17-marketing year. This pushed crop year-to-date U.S. corn exports up to 1,787.5 million bushels versus just 1,183 million bushels a year ago (up 604.5 million bushels or +51%). The current sales pace exceeds the weekly pace necessary to achieve the USDA’s current 2016/17 U.S. corn export sales forecast of 2,225 million bushels.

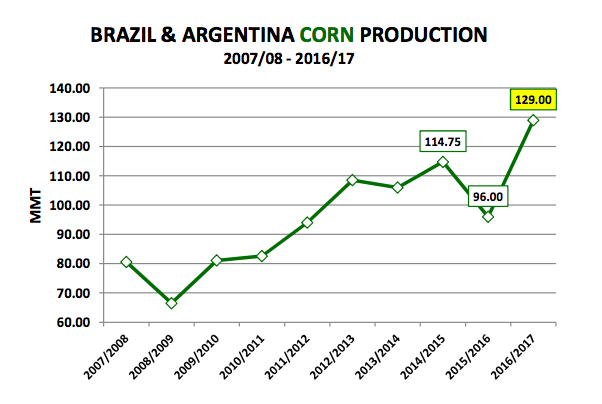

That said, I still believe the USDA will hesitate before making any upward adjustments to its current export projection given the USDA’s recent increases to both Brazil’s 2016/17 corn production and export estimates in the March WASDE report. One interesting takeaway this week however was the notable buying presence of Mexico, who accounted for 11.8 million bushels of the U.S. export sales total. It’s apparent that despite recent statements suggesting Mexico would look to shift its corn import needs to another non-U.S. origin that plan at least for now has not materialized. This isn’t to say it won’t eventually happen (in some scale) following Brazil’s safrinha corn harvest in June, July, and August; however short-term it appears to be a non-issue.

MAY CORN FUTURES PRICING CONSIDERATIONS FOR THE WEEK: May corn futures (CK7) closed on Friday (3/17) at $3.67 ½ finishing up 3 ¼-cents per bushel week-on-week.

Key takeaways from this week’s price action:

- The one fundamental price support that continues to perform for Corn Bulls is strong corn-ethanol demand. In Wednesday’s (3/15) EIA Weekly Petroleum Status report, U.S. ethanol production for the week ending 3/10/17 averaged 1.045 million barrels per day. The 4-week average improved to 1.034 million bpd versus 989,000 bpd over the same time period in 2016 (+4.5%). In the March WASDE report the USDA increased 2016/17 U.S. corn-ethanol demand 50 million bushels month-on-month to 5,400 million bushels versus 5,224 million in 2015/16. Could the USDA increase its corn-ethanol demand estimate even further? Current data supports the following: Average U.S. ethanol production for this crop year (September 1st – March 10th) has been 1.021 million bpd. If this production pace was sustained through the end of August 2017, 12-month total U.S. ethanol gallons produced would approximate 15.609 billion gallons. After applying an industry average ethanol yield of 2.875 gallons per 1 bushel of corn, 2016/17 U.S. corn-ethanol demand projects to 5,429 million bushels. Therefore it appears there is some room for additional increases in the U.S.’s current usage forecast; however they aren’t likely to exceed 25 to 50 million bushels.

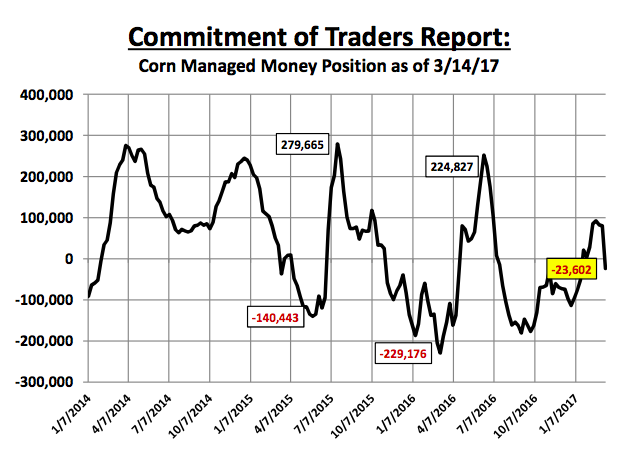

- Technically the one disappointing market feature that can’t be overlooked by Corn Bulls was Friday’s Commitment of Traders report, which showed Money Managers aggressive sellers of -103,683 corn contracts week-on-week (as of Tuesday’s closes). That shifted the corn Managed Money position to a net SHORT -23,602 contracts. By comparison, just 3-weeks ago that position was nearing a net LONG +100,000 contracts. Clearly the “money” has turned negative on corn at least short-term, which I think has a lot to do with recent private estimates suggesting potentially more U.S. planted corn acres this spring coupled with the USDA’s sizable increases to both 2016/17 Brazilian corn production and exports in its March WASDE report.

May corn futures need to hold Tuesday’s day low of $3.60 per bushel early this week to avoid further Managed Money selling…

Thanks for reading.

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

Data References:

- USDA United States Department of Ag

- EIA Energy Information Association

- NASS National Agricultural Statistics Service