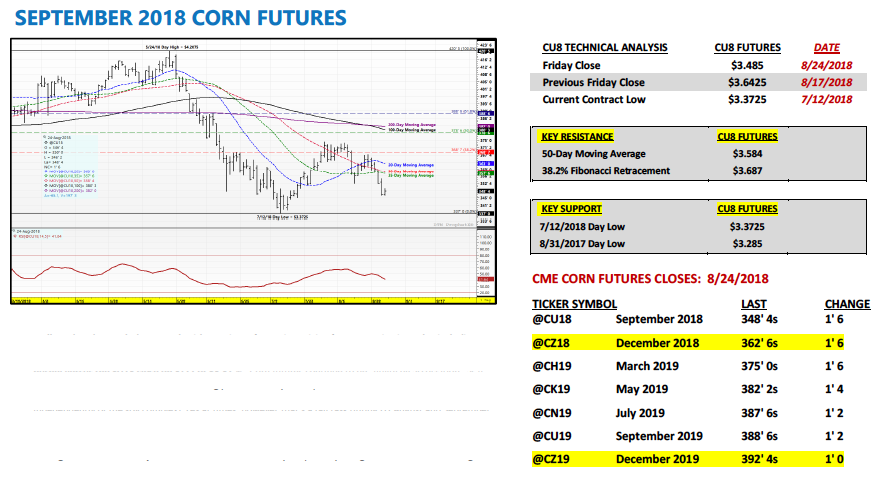

SEPTEMBER corn futures closed down 15 3/4 CENTS per bushel week-on-week, finishing at $3.48 1/2.

Let’s review current themes, news, data releases, and trends for the week ahead (week of August 27):

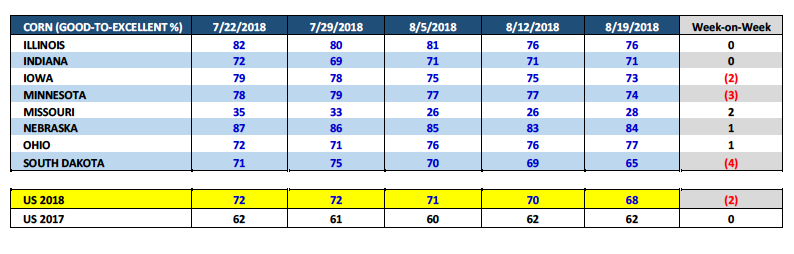

Monday’s Weekly Crop Progress report showed the U.S. corn good-to-excellent rating dropping 2% week-on-week to 68%. This compares to 62% versus the same week a year ago.

Three of the top five U.S. corn producing states either saw their ratings unchanged or slightly higher. Illinois and Indiana’s ratings were stagnant at 76% and 71% good-to-excellent respectively with Nebraska’s rating up 1% to 84%. Meanwhile the other top two producers experienced minor ratings declines. Iowa’s rating was off 2% week-on-week, fading to 73% good-to-excellent with Minnesota’s rating down 3% to 74% good-to-excellent.

I do believe the downward trend in ratings since the end of July suggests the USDA might not raise the national yield once again in its September 2018 WASDE report.

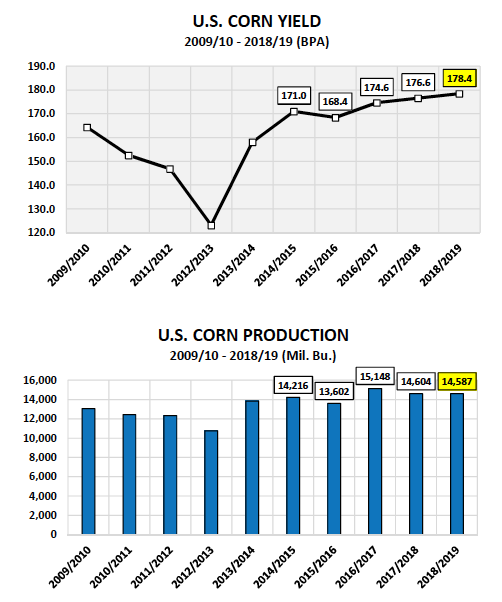

Recalling again that in August the USDA estimated the 2018/19 U.S. corn yield at a record high of 178.4 bpa. Several traders were quick to point out immediately thereafter that the yield continued to go up last year following the August Crop report however that was after the USDA forecasted the 2017/18 U.S. corn yield at just 169.5 bpa in August 2017 (versus an eventual final yield of 176.6 bpa). Therefore the USDA had considerable room to move the yield higher in the Oct – Jan WASDE reports. That said the USDA’s most recent 2018 August yield estimate was far from conservative. Therefore I do NOT believe future yield adjustments in the USDA’s monthly WASDE reports will mirror the gains from 2017.

Results continued to flow in this week from the Pro Farmer Midwest Crop Tour with data samples from several key corn growing states/districts essentially confirming what the USDA already implied with its record 2018/19 U.S. corn yield forecast of 178.4 bpa in August.

This year’s U.S. corn crop is going to be very, very good. However if there was a slight disconnect between the USDA’s August state corn yield estimates and what Pro Farmer’s crop scouts found it came in Illinois. Key powerhouse corn growing counties in IL such as McClain county revealed surprisingly low ear weights and inconsistent ear counts. That trend continued in other areas of the state leaving many with the impression that IL’s 2018 corn crop might not be as good as last year’s record of 201 bpa. Considering in the August 2018 WASDE report the USDA estimated IL’s 2018 state corn yield at 207 bpa I still feel strongly that’s too high, too soon. I remain unconvinced that higher plant populations will completely offset lower ear weights.

For this reason I believe Illinois’s corn yield will eventually come down in the September and October WASDE reports by approximately 5 to 6 bpa (final yield of 201 to 202 bpa), which would lower state corn production by 54 to 65 million bushels. Once again that still implies Illinois’s final corn yield could be record large, just not by 6 bpa.

SEPTEMBER CORN FUTURES TRADING OUTLOOK

Corn Bulls endured a tough down week with a variety of negative pricing factors coming into play including…

September soybean futures traded sharply lower on the week, trading down as much as 40-cents per bushel versus the SU18 close on 8/17 of $8.81 ½. Corn futures continue to be “guilty by association” as it relates to influence of the consistent selling pressure in soybeans (and Bearish S&D forward view associated with 2018/19 U.S. soybean ending stocks estimated at 785 million bushels). Can corn futures trade independently of the soy complex? Yes at times; however that’s a tall task during LH August and September.

The Pro Farmer Midwest Crop Tour didn’t find a “smoking gun” of substancein any of the key corn producing states in the country to suggest the USDA vastly over-estimated the 2018/19 U.S. corn yield in its August 2018 WASDE report. I referenced Illinois’s corn yield possibly being less than the USDA’s August forecast of 207 bpa. That said Pro Farmer’s data samples from IL still supported Illinois having a massive corn crop. In fact other than Minnesota, most of Pro Farmer’s state field samples were higher than what they found a year ago. Therefore it’s not going to be an easy sell to convince the masses that the USDA will indeed lower its 2018/19 U.S. corn yield forecast in the September WASDE report. In fact there are still those that believe the national corn yield could eventually exceed 180 bpa. Clearly that mentality is putting a low ceiling on corn futures prices.

The 5 and 10-year price seasonals in corn shift lower (and sometimes aggressively lower) in LH August and September. This is due to any remaining “summer” weather premium being extracted from prices, once the market feels comfortable about the size of the U.S. corn crop. And secondarily, as is the case this year, farmers are forced to price their remaining old-crop corn, creating space for the 2018 corn harvest. As I mentioned last week, 2018/19 U.S. corn carryin stocks are already estimated at 2.027 billion bushels; the 3rdlargest total since 2000. That said there’s a percentage of corn that farmers will have to move/sell whether they want to or not as it relates to the price they will receive.

I am Bullish corn futures LONGER-TERM…however the timing’s just not right at present.

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

Data References:

- USDA United States Department of Ag

- EIA Energy Information Association

- NASS National Agricultural Statistics Service