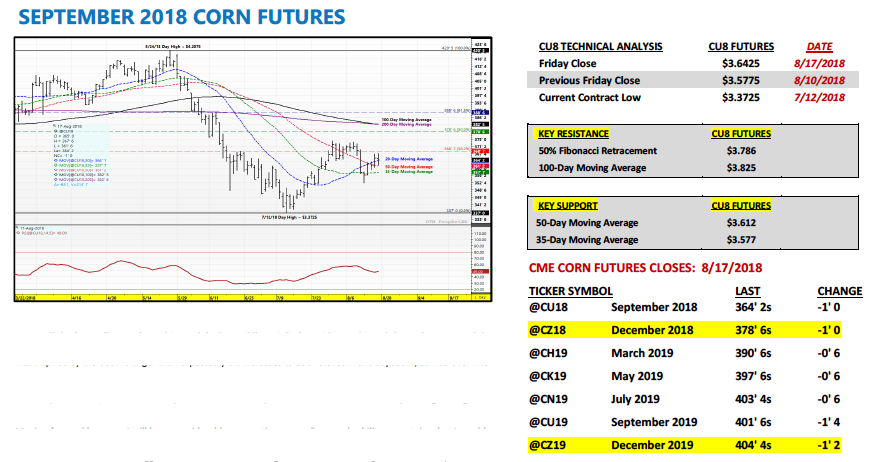

SEPTEMBER corn futures closed up 6 1/2 CENTS per bushel week-on-week, finishing at $3.64 1/4.

Let’s review current themes, news, data releases, and trends for the week ahead (week of August 20):

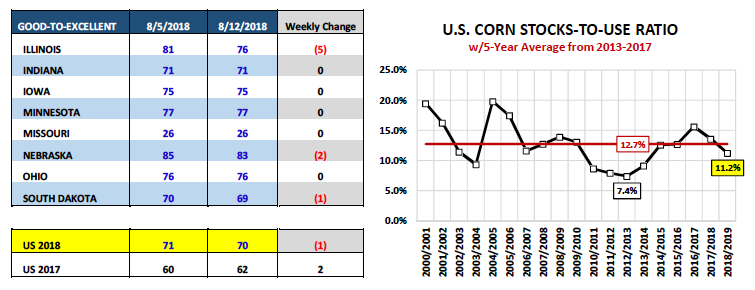

Monday’s Weekly Crop Progress report showed corn’s good-to-excellent rating falling 1% nationally to 70%. This compares to 62% in 2017 as of the week ending August 12th.

And while I wouldn’t consider this minor downward ratings adjustment aggressively Bullish, it is I believe supportive at current price levels considering the USDA’s already projecting a record 2018/19 U.S. corn yield of 178.4 bpa. More specifically, Illinois’s good-to-excellent rating dropped 5% week-on-week to 76%. That’s notable due to the USDA forecasting Illinois’s 2018/19 state corn yield at a record 207 bpa in the August 2018 WASDE report, 6 bpa higher than its previous record high of 201 bpa established in 2017/18.

The other key state whose rating declined to 83% good-to-excellent was Nebraska, down 2% versus a week ago. And again…similar to Illinois, Nebraska’s rating still suggests they will have an excellent crop this year (no debate there).

That said, in last week’s August 2018 WASDE report the USDA estimated Nebraska’s corn yield at 196 bpa, which if realized would be 11 bpa above its previous record high of 185 bpa from 2015/16. Point being continued ratings slippage over the next 3 to 4 weeks in both states might suggest final corn yields in IL and NE slightly below the USDA’s August estimates, which could have a negative impact on the national corn yield due to the size of Illinois’s and Nebraska’s harvested acreage bases (20.2 million harvested acres combined; which equals 25% of total U.S. corn harvested acreage base for 2018/19).

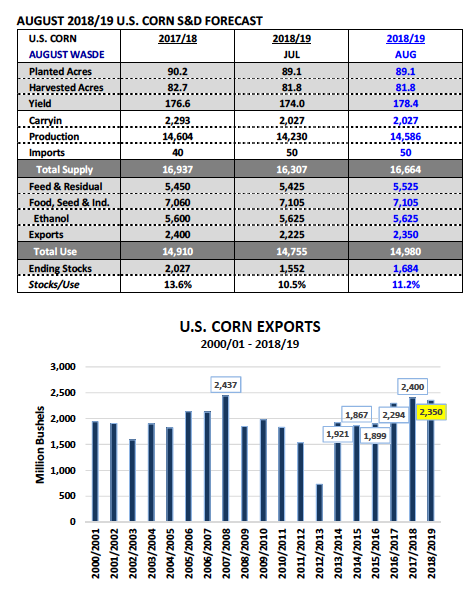

U.S. corn export business remains exceptionally strong; highlighted by the USDA’s 125 million bushel increase to its 2018/19 U.S. corn export projection in the August 2018 WASDE report.

In that report U.S. corn exports were forecasted at 2.350 billion bushels. This compares to the 5-year average from 2013-2017 of 2.076 billion bushels. U.S. corn exports continue to benefit from Brazil’s 2017/18 corn crop falling 16% below the previous crop year (83 MMT versus 98.5 MMT; Brazil is the world’s 2ndlargest corn exporter). This in turn reduced Brazil’s 2017/18 corn export forecast 8.6 MMT (or 339 mil. bu.) versus 2016/17. Fast forward to 2018/19…Brazil’s first corn crop won’t be harvested until March 2019.

This then implies the U.S. should have the ability to capitalize on Brazil’s 2017/18 corn production shortfall well into the 2ndquarter of 2019. Most recently…Thursday’s USDA Weekly Export Sales report showed impressive U.S. corn exports of 54.5 million bushels for the week ending 8/9/2018; with 41.1 million of that total attributed to 2018/19. Clearly the positive export trend continues…

And finally the last newsworthy story of the week dropped on Thursday morning when White House economic advisor Larry Kudlow confirmed that the U.S. and China would resume trade talks later this month. That announcement alone was enough to generate a 28-cents per bushel higher close in September soybeans futures that afternoon. HOWEVER it should be noted…Kudlow downplayed the notion that a compromise on tariffs was in the offing despite the simple acknowledgement of a meeting taking place.

SEPTEMBER CORN FUTURES TRADING OUTLOOK

Corn Bulls had to walk away from this week feeling mildly satisfied considering the meltdown that occurred the prior Friday (8/10), following the release of the USDA’s August 2018 WASDE report.

That selling pressure, which was inspired by the USDA’s larger than expected yield increases to both U.S. corn and soybeans, carried over into Monday’s session. This led to September corn futures trading down to a day low of $3.52 ¼ on 8/13. However that proved to be the low tick for the week with corn futures gradually working higher into Friday. Furthermore on Friday afternoon, CU18 successfully fended off an attempt to close back under the 50-day moving average at $3.612. Therefore all things considered…the week’s price action was far from a disaster.

Moving forward however I still have considerable reservations regarding corn’s ability to sustain what I would define as “meaningful” rallies beyond $3.75 to $3.80 in September corn futures. The 5 and 10-year price seasonals in corn futures do suggest that values could work higher into the end of August. That said September and October have notoriously been two heavy down months for corn values. The reality is with large U.S. corn carryin stocks currently estimated 2.027 billion bushels and another +14.5 billion bushel U.S. corn crop waiting to be harvested, that pattern is likely to continue. The supply side hedge pressure of those bushels transferring to Commercial storage is likely to outpace any Managed Money buying.

Longer-term I’m certainly more Bullish corn futures considering 2019/20 U.S. corn carryin stocks are likely to be the lowest since 2014/15. Therefore the market will need to “buy” corn acres to preserve sufficient 2019/20 U.S. corn ending stocks. Furthermore, World Corn ending stocks will also be much more price supportive. HOWEVER those market fundamentals aren’t likely to gain significant traction until the U.S. harvests its 2018 corn crop.

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

Data References:

- USDA United States Department of Ag

- EIA Energy Information Association

- NASS National Agricultural Statistics Service