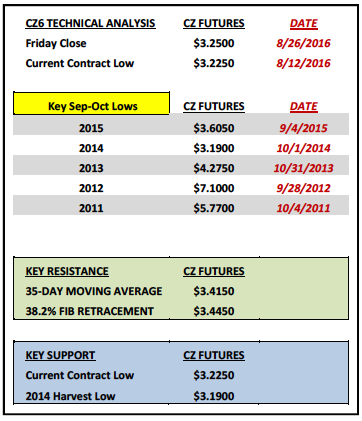

This begs the question, “Is CZ6 now poised to take out the current contract low of $3.22 ½ early next week?” Key considerations are as follows:

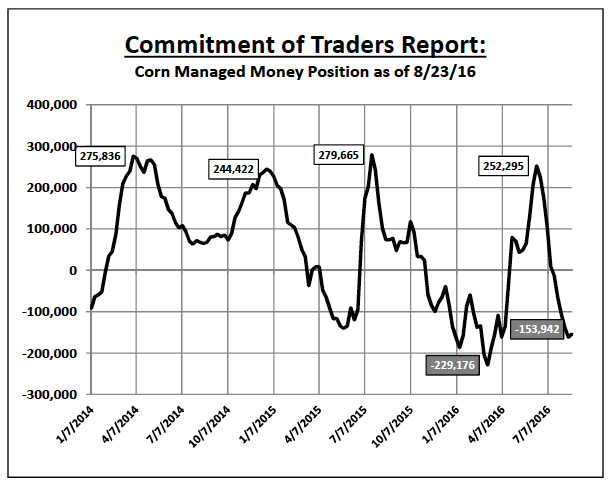

1). Friday’s Commitment of Traders report showed the Managed Money short in corn slightly less than a week ago; however at -153,942 contracts it’s still an aggressive net short for this time of year. Additionally today’s figures from the CFTC did not include positions taken after Tuesday’s close. December corn futures closed down another 12 ¼-cents per bushel versus the close on Tuesday, 8/23. Therefore I’d add another 10,000 to 15,000 corn shorts to the figure reported this afternoon. That said I don’t see the incentive to adding to an already sizable Managed Money short with front month corn futures trading at their lowest level since September 2009.

2). In Pro Farmer’s summary on Friday they issued a 2016 U.S. corn yield estimate of 170.2 bpa for total production of 14,728 million bushels versus the USDA’s August estimates of 175.1 bpa and 15,153 million bushels. That’s a 425 million bushel downward adjustment in production. Additionally their final state yield estimates for Iowa (193 bpa), Illinois (194 bpa), Nebraska (179 bpa), Minnesota (175 bpa), Indiana (172 bpa), South Dakota (142 bpa), and Ohio (154 bpa) were all definitively lower than the USDA’s August projections. Once again I believe this supports future yield decreases from the USDA in proceeding monthly crop reports.

Therefore both of the above points suggest to me that CZ6’s downside risk under $3.20 should not only limited but also relatively short-lived. HOWEVER…if soybean futures continue to sell-off (which they could considering Money Managers are still net long in excess of 100k soybean contracts) corn could struggle to gain traction until SX6 carves out an intermediate bottom.

Thanks for reading.

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

Data References:

- USDA United States Department of Ag

- EIA Energy Information Association

- NASS National Agricultural Statistics Service