Last week continued the Great Market Travail of 2014, with price action across major equity indices providing exactly zero clue about the path ahead. Here are some high (or low) lights:

- Price Is a Corrupt Deviant: It’s occasionally noted that markets are inherently devious: price will do whatever it has to – even if that means absurd contortions – in order to frustrate the best-laid plans of the largest number of participants. This is either more or less obvious at any given time: last year, it was completely sublimated as only the most obstinate bears were taken to the woodshed. 2014, on the other hand, is easily the most excruciatingly tortuous environment for equities since Q3 2011.

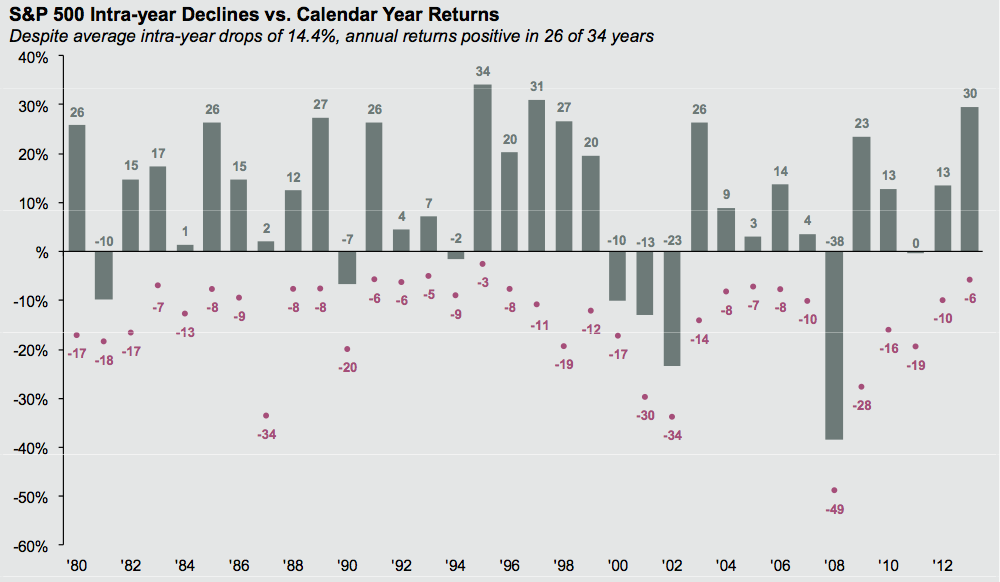

- Market Expectations Are Undergoing a Cyclical Shift. We’ve all felt it, and some of us have spoken about it at length (and then further spoken about it at length-ier-ist): an abrupt change in tone is occurring, affecting a huge crowd with deeply-vested personal interests in the thing that’s changing. Despite a massive outlier scenario in 2013 that would only move much further out the right tail of the bell curve if it persisted in 2014, H1 2014 has amounted to a reactive shock. In case there’s any doubt left over about last year, this chart from JP Morgan should put to bed any hesitation about whether to moderate forward expectations:

- You Are Recovering From Shock. Ever knowingly jumped into icy water with full intellectual cognizance of what you’re about to do? Even in that best-case, mentally-girded scenario it doesn’t mean you won’t be left gasping and struggling with all your might just to keep your head above water as your body is engulfed in hypothermic seizure. If the last 3 months are any indication, equities are enduring something like that participants revert to an outlook of more pedestrian returns. 1995 is the only year in the scope of just about everyone’s trading career that beat out 2013 (and then, only by a nose). 1996 followed 1995 (and 1997-1999); but outside the isolation chamber that is the above chart of annual returns, things couldn’t be more different.

- The Tapir! Interestingly, this change-up rather neatly coincides (more on this below) with the onset of the Taper in January. The Fed’s decelerating accommodation is occurring in measured steps and still amounts to a massive $45 Billion per month (annualized, that’s nearly a whole QE2) – and so the Fed’s stock of Treasuries and MBS continues to grow, but the market’s expectations are moving on. More on this in the surprisingly informative Chairmanwoman Yellen-narrated video (courtesy of the Ministry of the Forward Guidance and the Truth) here:

- Maximum Noise. Among practiced market players, this environment has all the hallmarks of one to tread lightly in: less

is more when frustration and confusion become dominant themes; and even a cursory glance across social finance suggests this is the case. When the market crowd is stamping, agitated, and obviously lacking in clarity – as they are now – it is usually dangerous to stake capital and confidence on a strongly-held conviction. It can be tempting to lean in; but in this kind of environment it is almost always driven by a desire to get rid of indecision-fatigue or about being right. Check your motives; and remember there are a lot of battle-tested practitioners taking a circumspect path here.

- Everyone That Matters Is Skittish. The message from the men at SALT (that anyone’s paying attention to for the next 15…er, 14 minutes, at least) is, on balance, to be more careful from here. Meanwhile, celebrated technical analyst Ralph Acampora has a “sick feeling” that the “stealth” bear market underway will culminate in -20-25% declines for the Russell 2000, S&P 400 Midcap and NASDAQ 100.

- (Too) Fast Money. As for newsletter author and guru-aspirant Dennis Gartman; is his pen pointed toward or away from his nose in the still CNBC uploads his latest timing call video with? If toward his nose and it’s a bearish call, expert pundit augurs consider this a negative confirmation; but if away and it’s bearish, this is a positive divergence (and of course the converse applies for bullish calls). No firm word as we go to print on whether the inadvertent ink smear across his upper lip last week is indicative of Gartman being long of an imminent face-ripper or crash in cheap studio-issued ballpoint pen terms.

- Single File Bulls at the Prom. The question becomes this: if – as Josh Brown notes here – some of the smartest guys in the room are noting many of the ominous tidings, will they be able to exit in an orderly fashion as the building catches fire? And even if “the professionals” escape unscathed, can everyone do the same? Equities at ATHs means just about everyone – even if fewer and fewer equities, by count – is still dancing and taking long libation-laden slugs from the punch bowl; but by definition the majority of working capital will still be working in the high school gym when some catalyst goes full-Carrie on those who moments ago were having the time of their lives.

- Maybe What Happened in 2013 Should Stay in 2013. Part of waiting out the noise probably involves detoxing your brain from the obstinately sticky recency bias residue last year left behind: as Robert Lesnicki reminded us last month, this isn’t the 2013 playbook anymore.

- Your Mom Called. She Saw That Bonds Are Rallying on CNN. If you need them, here are 10 plausible reasons why. Or, if prefer your markets without a glaze of causal narrative cohesion, it’s worth considering that there’s a simple but compelling correlation between QE ending and Treasuries rallying set in the last several years.

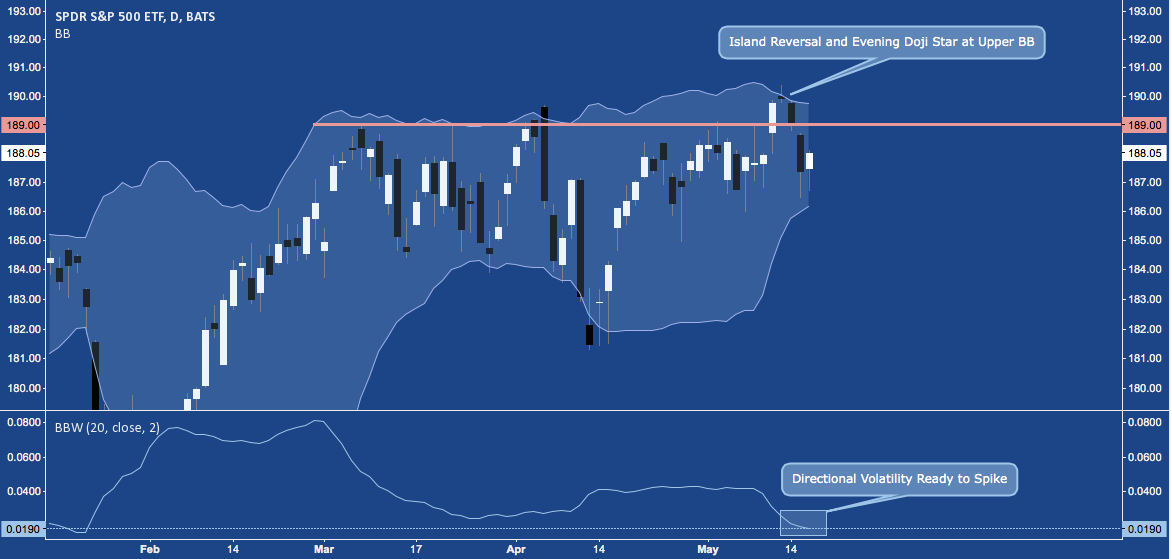

- SPY posted a spinning top candlestick for the week, poking above a 2-month range only to fade into a failed breakout in the end that resulted in a close below the week of 03/03/2014. No punishing downside here; but the inability of upside momentum to seize on Tuesday’s new all-time highs is glaring. Look no further than Andrew Thrasher’s perfectly-timed piece last Tuesday for a recap of the market’s state of indecision.

- Speaking of which, technical practitioners will recognize Monday-Wednesday above as an evening doji star, a 3-candle pattern (so-called because it signals night-fall) that a) provides a well-defined stop overhead, and b) has a demonstrable downside edge. Thursday confirmed the pattern; but all it has accomplished is the reintroduction of ambiguity that was – if only for a day – thought to be finally resolved.

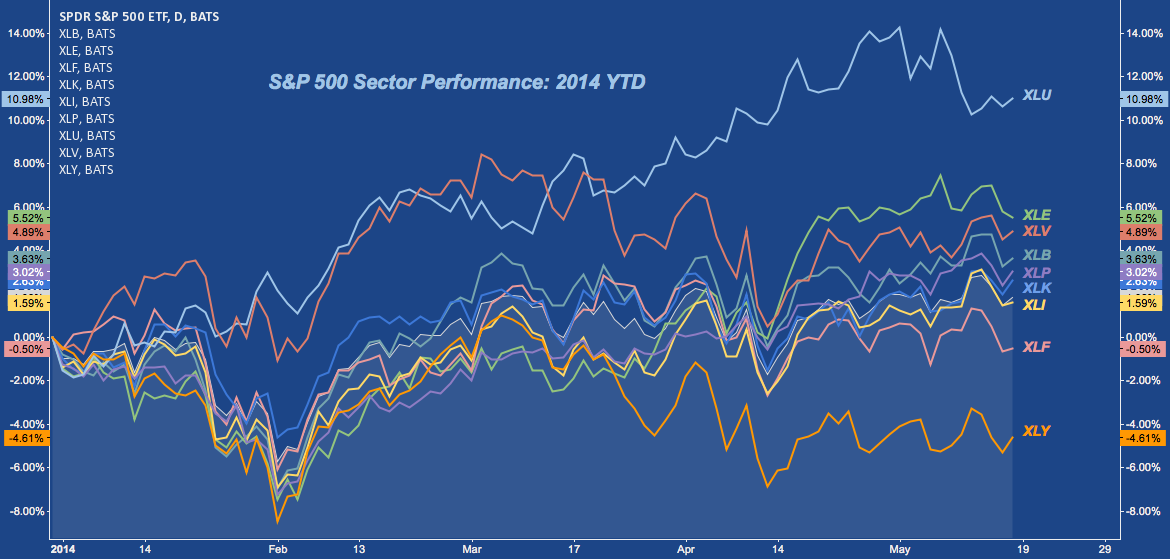

- Your Mom Called Back to Find Out If Bonds and Utilities Are the Same Thing. I Told Her “Yes”. “Utes” – as they’re abbreviated by seasoned traders (because any regressive, half-literate society holds that “Utilities” involves a syntactically reprehensible number of vowels, amirite?) – have taken one on the chin the past several sessions; but keep in mind the sector is still +11% net for 2014 and outperforming the next strongest sector (Energy) 2:1 (see chart below).

- On the Defensive. Despite the S&P’s position at all-time highs, the stuff that makes it up doesn’t reflect complacency. Simply put, the roster of sectors leading in the first half of 2014 – in order: Utilities, Energy, Healthcare, Materials and Consumer Staples – says “nearing/at a market peak”. If “tops are a process”, it’s worth considering the last 5 months could be part of one.

- The S&P’s stalling participation certainly agrees. But keep in mind: if the sector/breadth orientation changes, the outlook does as well.

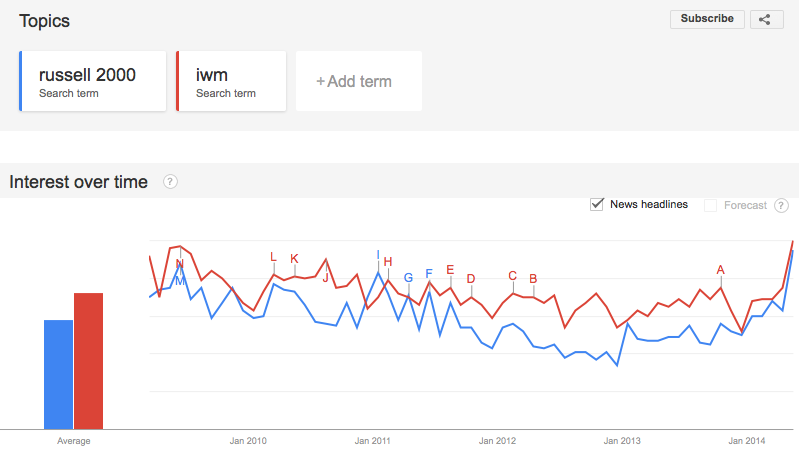

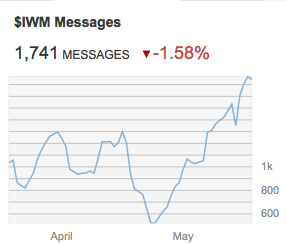

- Small Caps Get Their 15 Minutes (at least). When confused speculators

and the pundits who make a living off their obsessive occupationally-driven curiosityfeel adrift like flotsam in a violent gale of confused money flows, market themes are chewed up and spat out at a rapid clip. Early last week, this search for a firm narrative anchor to create context and restore a true bearing turned to the divergence between Small Caps and Large caps. There was a prodigious amount of interest voiced (and thus copy written) on the topic, ending with Reuters’ almost elegiac appeal to not give up Small Caps for dead. Google search spiked to recovery-era highs (left), coinciding with a social finance-specific volume spike according to Stocktwits’ analytics (right):

In sum, the market has a seedy bowling alley’s worth of balls up in the air. The most constructive advice in this context is: 1) keep it light; 2) find (or re-find) your process (hint: if it’s a) on a longer time horizon than daytrading AND b) isn’t telling you to stay away here, find another one) and 3) do whatever it takes (which probably includes walking away) to safeguard your psychological capital. Directional volatility will return, and with it many constructive opportunities.

The true mark of a trader versus a gunslinging speculator from here ’til then will be whether one can stay alive, remain true to their process and retain their confidence in the meantime.

Lastly, a few remarks about See It Market itself.

- Welcome to the Next Episode. Assuming you made it down here, you’re reading this and other content on the completely revamped See It Market site. SIM Impresario Andy Nyquist has been hard at work masterminding a new platform from which all kinds of new content and media will spring in the coming months. Hats off to him and the 20-contributor community who have made the site what it is.

Twitter: @andrewunknown and @seeitmarket

Author holds net short exposure in Russell 2000 at the time of publication. Commentary provided is for educational purposes only and in no way constitutes trading or investment advice.

“Grandfather Mountain Heavy Fog Bridge to Nowhere” image copyright Dave Allen via fineartamerica.com

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.