When “sure thing” trades turn into pervasive market memes, even with careful curation of media and opinion it can be difficult to see through the fog.

When “sure thing” trades turn into pervasive market memes, even with careful curation of media and opinion it can be difficult to see through the fog.

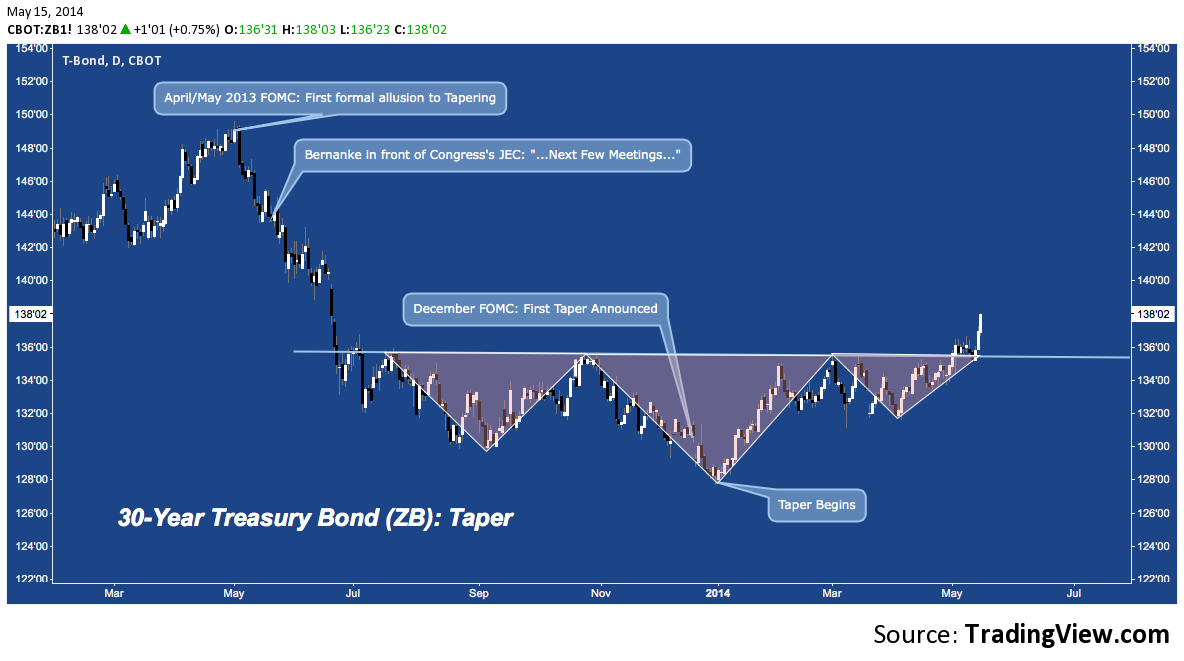

Take the case of the 30-Year US Treasury Bond (ZB). The argument over why yields haven’t risen yet, when they will, whether they must and how long it will all take is raging right now. Last May and June, the straightforward ‘taper causation” advocates were clearly winning as the long-end of the curve spiked hard. But from the point tapering began in mid-December, the 30-Year has now recovered nearly half of it’s losses and is rocketing higher as I write.

Did rates do what traders/investors/strategists/pundits expected? The short answer is “yes and no”. From that, you can guess that the long answer is too nuanced to fit into soundbites or find easy accompaniment from flashy graphics. Suffice it to say, many of the “smartest people in the room” – or at least those with the biggest platform – have been surprised ( and many of them more than once) over the last year.

To be sure, there are some notably complex variables in play here. The Yellen Fed is proving sturdily committed to Tapering: notably despite a stall-speed (but entirely transitory?) Q1 2014 GDP. The LSAP flow is tapering as POMO increasingly shrinks; but the Fed’s balance sheet continues to steadily grow as the Treasury and MBS stock are absorbed by SOMA and maturing securities are reinvested. Does stock or flow matter more; to whom; when and for how long? The Age of Accommodation appears to be coming to an end (or at least shifting entirely abroad), and with it massive portfolio reallocation based fund mandates and risk protocols has and will take place. It’s no wonder debate and general confusion prevail.

As a technician fascinated with macro fundamentals, these questions capture my interest, not least because they are a heavy tributary of data funneling into what ultimately constitutes price. As a technical trader, I see price as a recapitulation of these question; and so that’s where I go for opportunities and and answers. With that said, what is the 30-year saying?

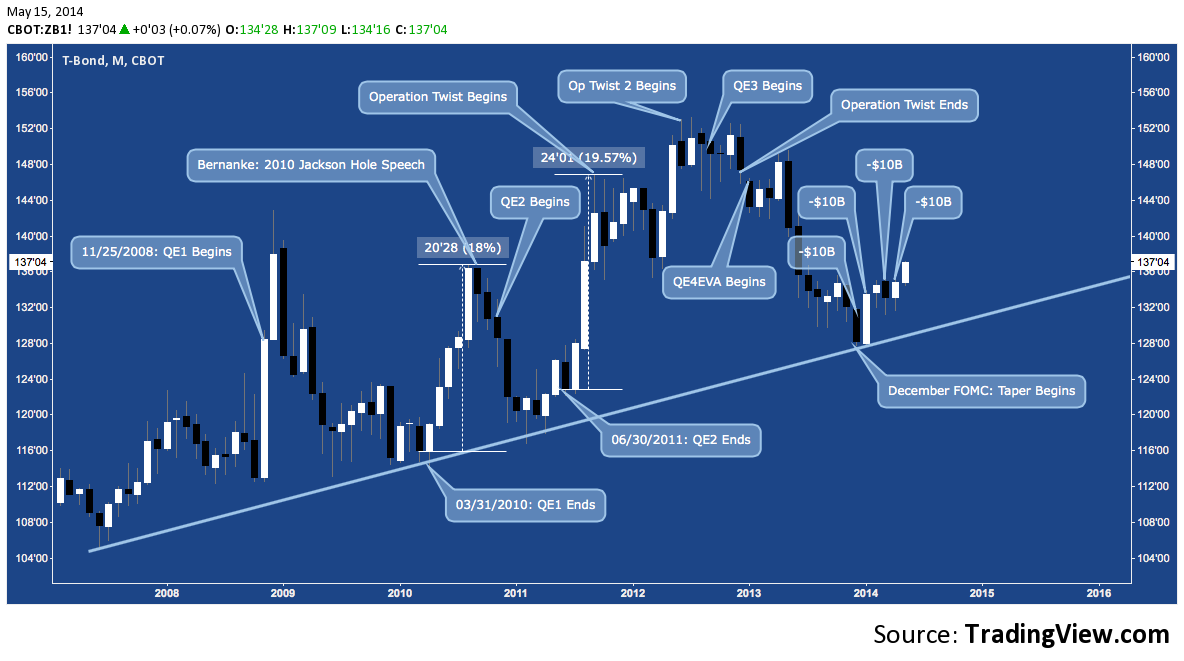

A review of the history of ZIRP (Zero Interest Rate Policy) is a valuable reminder of how counterintuitively longer-data Treasuries have reacted at different points in the Fed’s policy arc:

Looking back at the 30-Year’s writhing path higher over the last 5.5 years (chart below), note 1) the rising trend line; 2) that the long bond decreases (yields rise) leading up to the withdrawal of accommodation (roughly 6 months in each case); and 3) bond rise (yields decline) afterward, whether that’s following the “cold turkey” cutoff of QE1 and QE2 – to the tune of an average +18.7% -or the phased withdrawal of QE3/QE4EVA currently underway. On this basis, is it unreasonable to think bond may continue to rally – just as they did mid-2010 to mid-2012?

Zooming in on 2014 year-to-date (remember, the first Taper installment was announced at the mid-December FOMC and began implementation in January), the 30-year is moving higher in the second motive leg of a measured move up toward 139 (at point D).

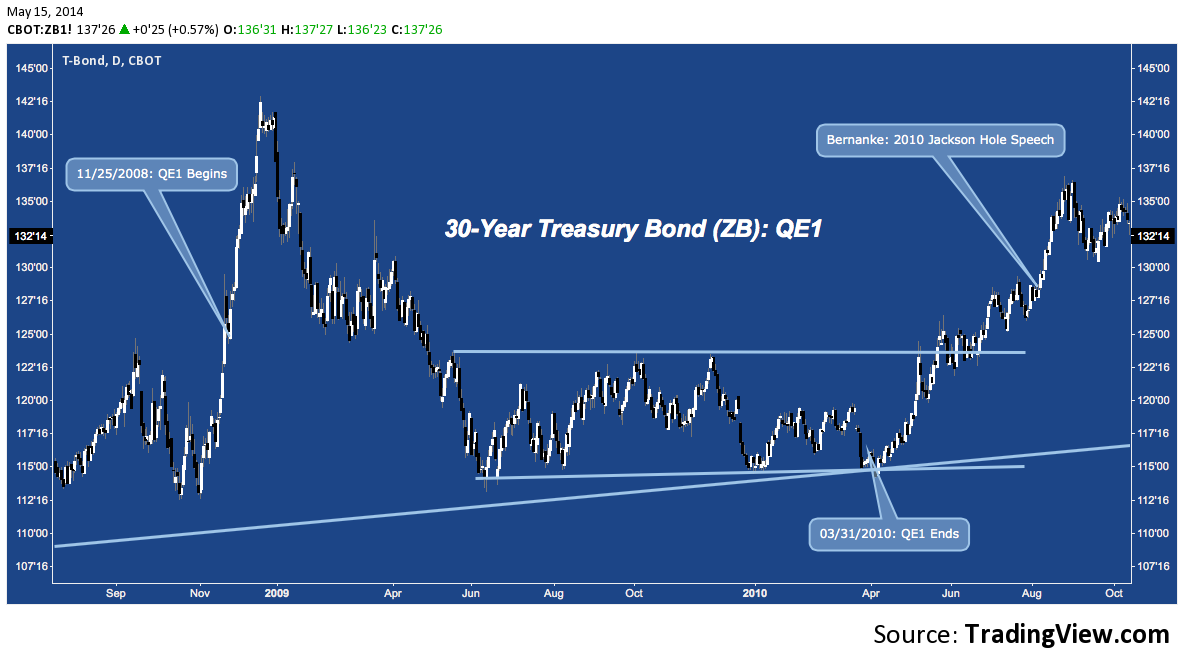

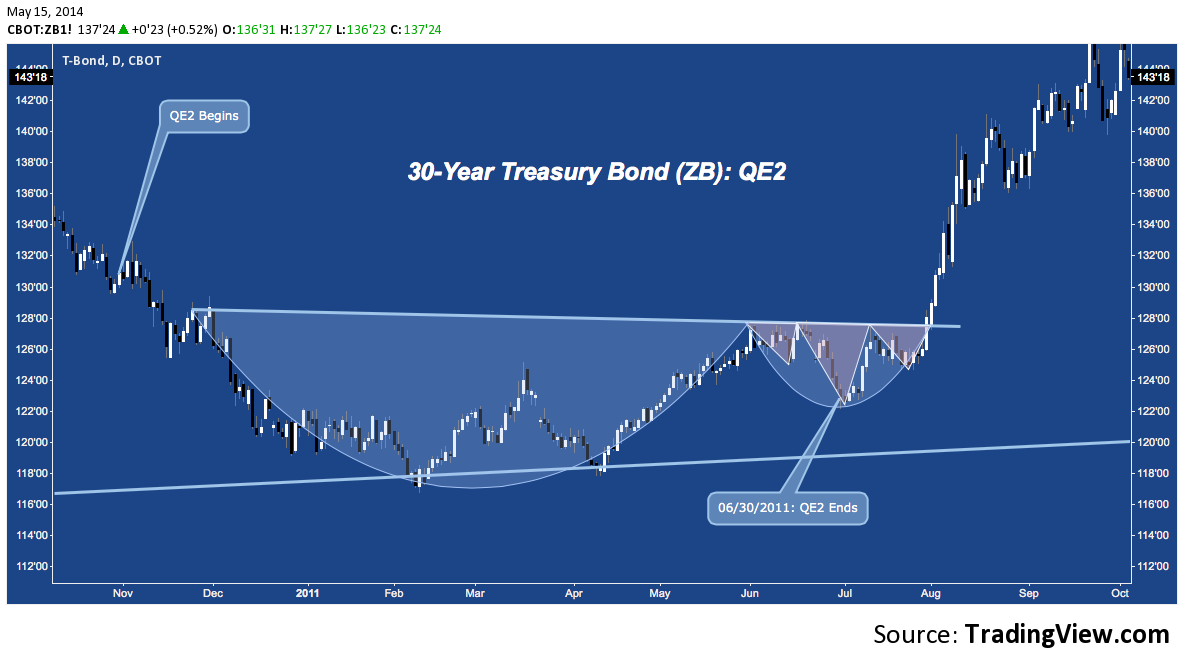

Scanning back over the trend line touches above, this action looks remarkably like the end of QE1 and QE2.

30-Year US Treasury Bond (ZB): QE1

30-Year US Treasury Bond (ZB): QE2

Will a comparable treasury rally unfold this time? No one can say; but it’s past time to entertain the notion that it’s already happening.

30-Year US Treasury Bond (ZB): Taper

Twitter: @andrewunknown and @seeitmarket

Author holds no position in securities mentioned at the time of publication. Commentary provided is for educational purposes only and in no way constitutes trading or investment advice.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.