With the equity markets in a steady melt up, multi-day implied volatility spikes have all but disappeared. Any dip in equities now lasts mere minutes before the dip buyers arrive and push prices into the green.

While this price action won’t continue forever, it does prompt us to look at shorter time frames if we want to capitalize on any price weakness in the current environment.

We’ve written extensively about using daily spikes in the Russell 2000 volatility index (RVX) and the VXST/VIX ratio to trigger long equity trades (see all my trading posts here). Another pattern that holds promise is intra-day spikes in the UVXY (NYSEARCA:UVXY) and VXX volatility ETFs (NYSEARCA:VXX).

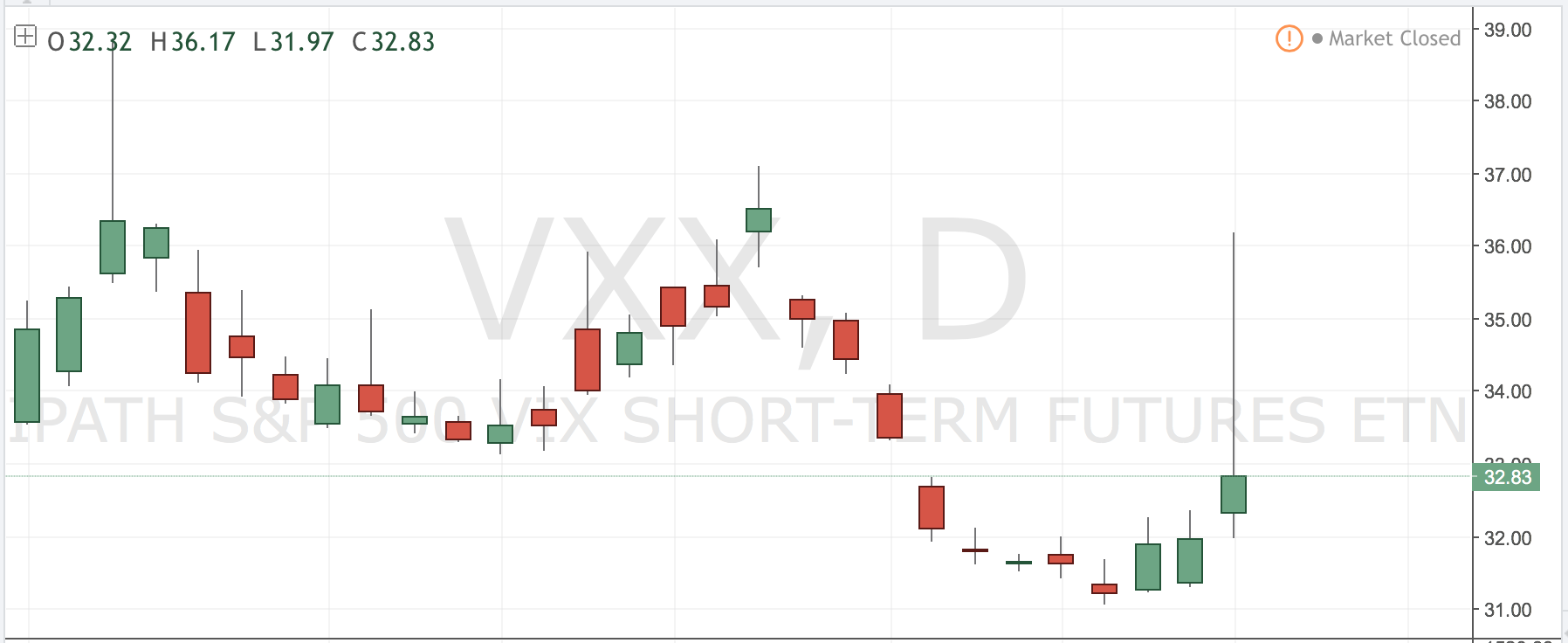

VIX Short-Term Futures (VXX) Chart

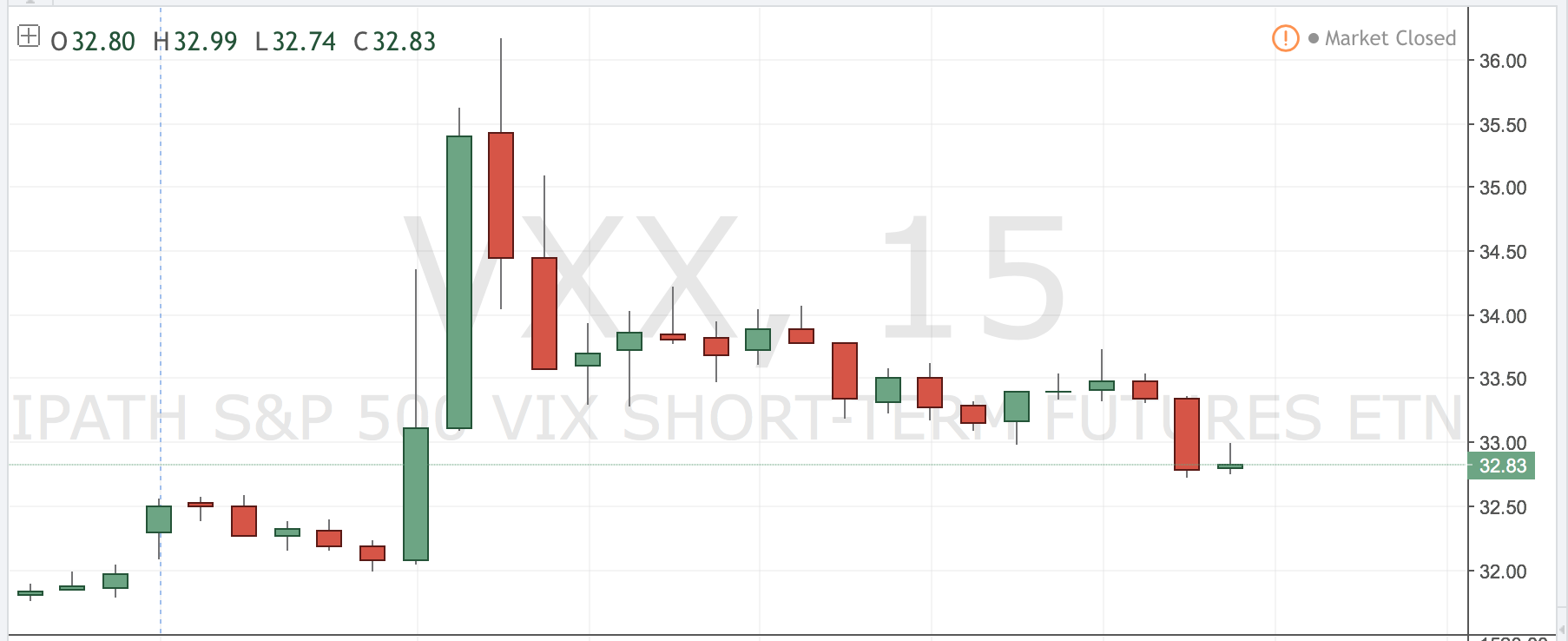

As we saw in the reaction on Friday morning’s news announcement to the Flynn deal, VXX jumped from an open at 32.30 to an intraday high of 36.16. That’s an 11.95% move off the low in a 45 minute window. We wondered if, in strong up-trending markets like the one we currently have, would a 5% spike in the VXX ETP serve as a good place to short VXX?

VIX Short-Term Futures (VXX) – 15 minute Chart

Initial Results

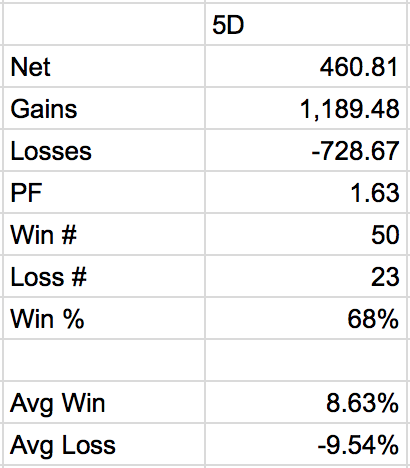

Using 5% as our threshold, we looked at shorting VXX anytime it hit or exceeded the 5% level. For testing purposes, we assumed a short entry at 5% above the open, even if the VXX continued higher during the day (as it did on Friday). After holding for five days, the numbers were solid, with a positive win rate (over the past three years) but a lower profit factor (total gains divided by total losses)than we would like to see.

VXX definitely showed a tendency to drop back below that 5% level, except for the instances when the markets were experiencing some turmoil and the 5% spike was just the beginning of a bigger move in the VIX and VIX-linked products. And since we’ve been in a multi-year uptrend for equities, we wanted to ensure that this approach wouldn’t get us into too much trouble when the market regime changes.

Using a volatility filter to refine the signals

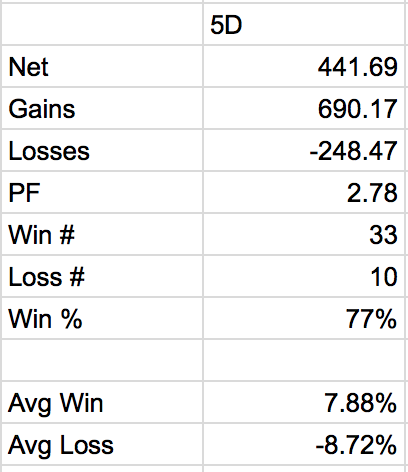

So we went back to one of our favorite volatility ratios to see if we could selectively take the short VXX signals when the market was in a stronger position. Using the same entry logic – intra-day spikes in VXX greater than 5% – we only took the short signals if the VXST/VIX ratio was below 1.

We frequently use this ratio to characterize the VIX futures term structure as being in contango or backwardation. Without going into the details of the structure here, we are checking to make sure that the price for short-term portfolio protection is not greater than the cost for longer term insurance. If short term costs are elevated, then risk levels are high, traders are nervous and it is a poor time to be putting on short volatility positions.

Adding the filter made a significant difference. The profit factor nearly doubled, the win rate climbed above 75% and the average loss size decreased. All with the same entry logic and hold period.

Next Steps

There’s much work to do to turn this model into a live trading strategy. Smarter exit strategies, position sizing and optimal trade structures/vehicles (VXX puts, XIV long, VXX short, UVXY short, etc.) would be good places to start. A focus on reducing the average loss size would go a long way to boosting the profit factor.

But it is worth noting that a simple intraday price threshold can serve as a systematic way to trade vol products. Thanks for reading – best of luck in the markets!

Thanks for reading!

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.