Two key things are happening in markets right now. That monster jobs report is sending many messages across various asset classes and the stock market has entered the most bullish time of the year from a seasonality standpoint.

The process with which market participants reconcile these these themes will play a hand in how the markets perform into year end.

Let’s dig into the latest research from around the financial web to see what the markets are telling us in this week’s “Top Trading Links”.

MARKET INSIGHTS

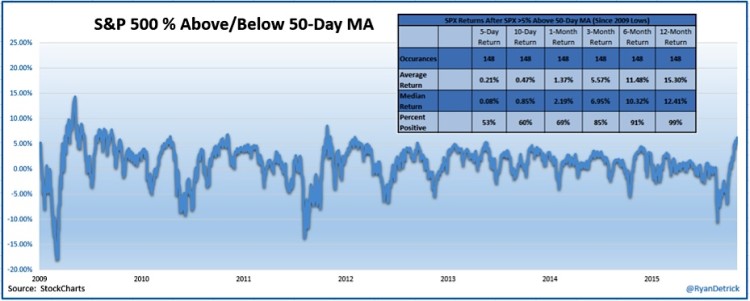

@RyanDetrick notes the S&P 500 is the most overbought in 3 years! Also, that’s not such a bad thing for stocks.

Stan Druckenmiller spoke at the DealBook Conference (video). Hat Tip to @sobata416

@harmongreg takes a look at emerging markets. A notable move is coming.

The US Dollar Index could be nearing a major break out. @andrewnyquist looks at the global implications of the strength.

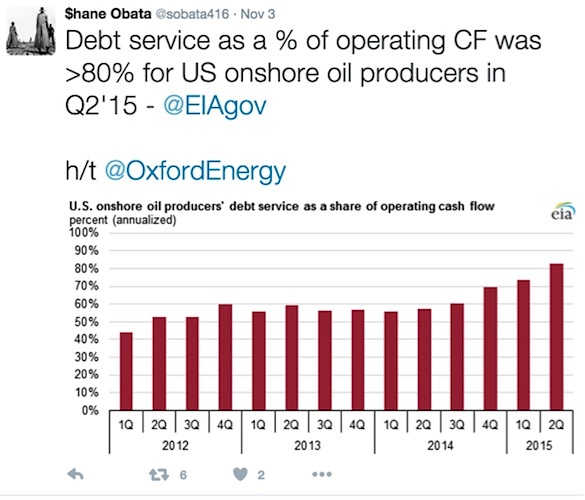

Times are tough for US oil producers. This amazing stat from @sobata416 shows the dire straights of the industry.

@BartsCharts notes the strength in Intel (INTC) and the implications of its longer term chart.

Howard Marks: China is undergoing growing pains (video) via @cnbc

@WillieDelwiche’s Market Overview notes a large surge in sentiment and a key look at breadth.

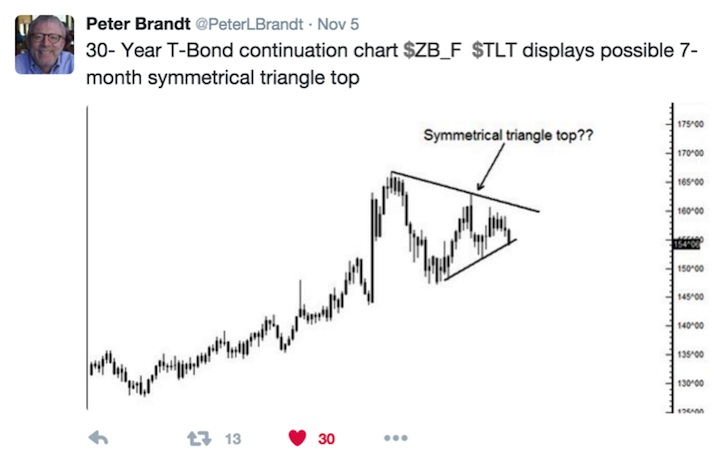

@PeterLBrandt notes a potential large top in the Long Bond.

continue reading on the next page…