This show of relative strength in cash could be a huge change in the market. Does anything else signal a bear market like this? Hat Tip to @snyder_karl.

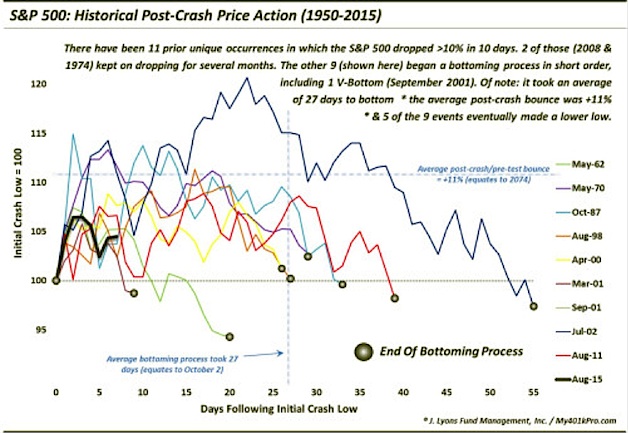

What happens after a crash via @JLyonsFundMgmt:

I think the reason why Dave suggests this is because in tough times dividend stability is an extension of balance sheet stability. Also, the balance sheet is just a much more critical piece to the puzzle than excess cash flow.

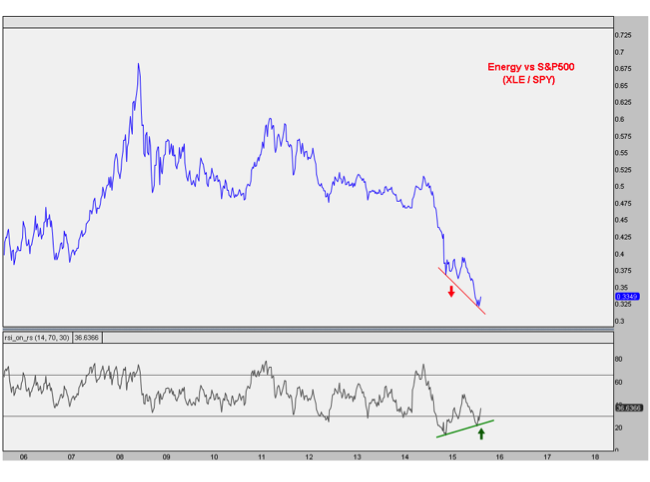

@allstarcharts thinks energy is set to outperform the broad markets going forward. This chart caught my attention and price action in various stocks suggests investors are stepping in. Relative out-performance doesn’t suggest prices will go up, but it’s still time to do some work on the group.

@EvergreenGK discusses the potential ripple effects of the Yuan’s devaluation. This is a much bigger deal to financial firms across the globe than we really understand right now.

@calculatedrisk breaks down the August jobs report. The numbers are solid underneath the ugly surface, but cracks are apparent. Remember that the market is a discounting mechanism and it’s likely once again a step ahead of the economy.

MARKET OPERATOR INSIGHTS

”There has been no psychological correction” via @davebudge.

@chicagosean sat down with Dr. Brett Steenbarger in the latest Stocktwits #TheMustFollowPodcast. Here are a few of my notes:

- Traders don’t achieve inconsistent returns not just because of emotional ups and downs, but because markets are inconsistent. We have to understand different market environments.

- Pattern recognition is a function of the amount of observation and the degree of focus during that period of observation.

- When volatility expands it’s normally due to an increase of market participants in the market.

- In any career field, effort is correlated with success.

- However, smart work is more important than hard work.

- The majority people who fail in markets have not found an edge.

- Confidence is earned.

Live life how you want to trade via @steenbab.

”If possible, give yourself time to make decisions since research shows that emotions are short-lived and humans typically go back to “baseline states” after some time” – via Fastcompany.com