It was another up and down week in the markets. Is this a bottoming process or a downside continuation setting up? That’s the big question for markets across the globe.

We’ll examine that and more in this week’s ‘Top Trading Links’.

MARKET INSIGHTS

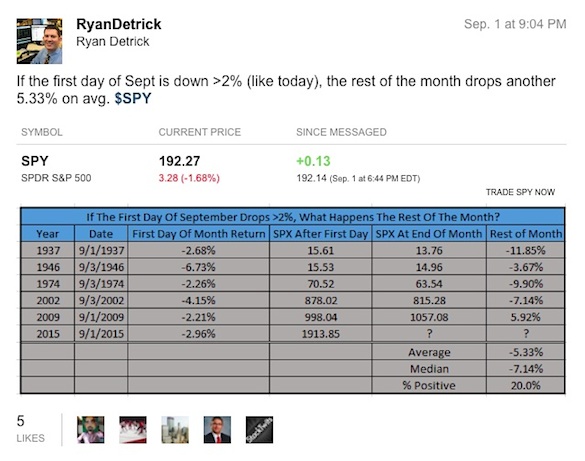

It’s shaping up to be a rough September, if the first day of the month is any indication. The environment is absolutely there for an awful month. Bulls need to respect risk.

Are we close to a bottom?

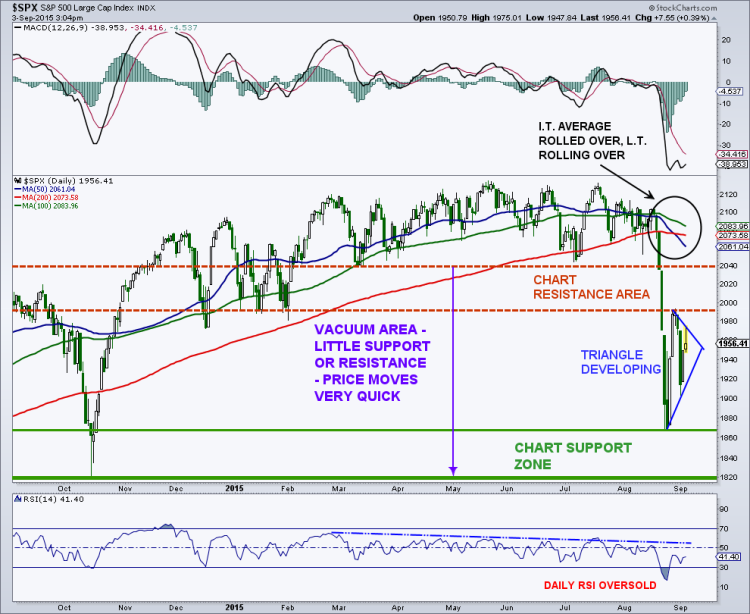

In the short term, @MarkArbeter notes the consolidation pattern in the major indices. To end the week, we dipped below it the lower bound of the triangle. Stocks appear to be setting up to re-test the lows this week. Also note how the market would have none of the pre-holiday seasonal strength trend.

We’ve seen a pretty hearty correction of late. Are stocks cheap? via @CharlesSizemore. The answer? A resounding NO.

@CiovaccoCapital charts out the numerous bottoming processes of the last 25 years. Obviously, we’re not that close to one yet.

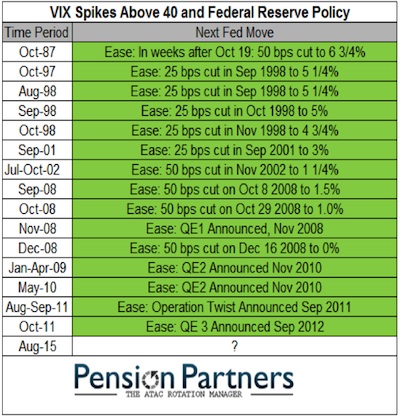

@MktOutperform notes that when the VIX spikes over 40 in the last ~30 years, the Fed has refused to rock the boat by raising rates. The question is, why would that change now? (see graphic to right)

@cullenroche explains why a rate hike shouldn’t even be considered right now. His argument is extreme and suggests that a rate rise may further exacerbate the global economic slowdown. This flies in the face of the zero interest rate policy (ZIRP) leads to global overcapacity argument. Maybe the overcapacity argument is over hyped.

@bill_emmott looks at the disaster that seems to be EVERY emerging market. The key theme here is NOT JUST the drop in commodity prices, but a lack of political leadership, economic structure and stability.