The NBA Finals have been highly entertaining this year. Surprisingly Matt Dellavedova has quickly become a cult figure. Is he more talented than league Most Valuable Player Steph Curry? Hell no, but it’s painfully obvious he wants the championship more. The point is: there is one heck of an upside to being desperate and hungry.

The NBA Finals have been highly entertaining this year. Surprisingly Matt Dellavedova has quickly become a cult figure. Is he more talented than league Most Valuable Player Steph Curry? Hell no, but it’s painfully obvious he wants the championship more. The point is: there is one heck of an upside to being desperate and hungry.

And this applies to trading as well.

Are you going to read all these links and find 10 more papers to read this weekend? Are you going to manually scan through 1000s of charts to get an updated feel for the markets and various groups? If you’re not, keep in mind that other people are. Stay hungry.

Here are some of this week’s Top Trading Links.

VIDEO: Paul Tudor Jones on re-thinking capitalism. Hat Tip to @SJosephBurns

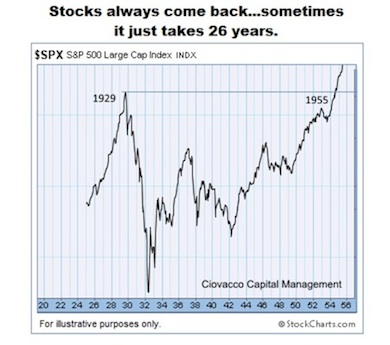

@CiovaccoCapital makes some important points for ‘buy and hold’ investors to consider

@TheReformedBroker on bond market liquidity:

Are financials setup for long term leadership? via @JBeckinvest

Howard Marks’ latest investor letter

@RyanDetrick notes flows into international funds have been very strong

Mark Chandler of Marc to Market looks at the key drivers of the U.S. Dollar

The Dollar/Yen is at a major crossroads via @kimblecharting

What is staying power via Fundoo Professor. Hat tip to @jtkoster

@FZucchi shares some wisdom on the credit market

@JLyonsFundMgmt lays out key levels in Dow Jones’ Europe Stoxx 50

Education

@farnhamstreet pens Buffett on temperament “Success in investing doesn’t correlate with IQ,” he has said. “Once you have ordinary intelligence, what you need is the temperament to control the urges that get other people into trouble in investing.”

– The market is unreliable when it comes to timing the next Fed hike

“all of the things that helped us survive as a species tend to make us horrible investors“ via @jposhaughnessy

@jtkoster on exceptional businesses: “Exceptional businesses enjoy competitive positions that are more nuanced. Their competitive protections enable pricing power over their customers and control over their input costs from suppliers. This means that they can maintain and increase profitability without having to spend excessively to protect their turf.”

Brenda Jubin at Reading the Markets: “mental toughness means different things at different times”

How to use Fibonacci extensions for targets and reversals via @corymitc

Uncertainty is here to stay – deal with it via Lisa Whitsett

Happenings / Research

Activists are still gaining influence via @FactSet

A look at Cyber Crime risk and credit quality via @SPCapitalIQ

Via IDC’s statement on their recently released research series:

“The ripple effect of IoT is driving traditional business models from IT-enabled business processes to IT-enabled services and finally to IT-enabled products, which is beginning to disrupt the IT status quo.”

NPD’s look at how American taste buds are changing via @CNBC

Greece’s leadership just doesn’t care via @BBC. Greece doesn’t matter because they might default. It matters because they’re pushing the edge of an antiquated system.

Thanks for reading!

Be sure to check out our Top Trading Links archives for a goldmine of investing research and trading education.

Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.