The markets are idling. It seems that investors are simply waiting for “the move” but doing nothing. From experience, the stock market could be setting up for an uptick in volatility that may include a false move (or moves).

For the week, the S&P 500 Index (INDEXSP:.INX) was down 0.7%. But the week ended with an exclamation point as news about the FBI reopening the Hilary Clinton email case caused a quick selloff friday.

This year’s election has been wild, to say the least. And it seems that we’re seeing a reverberation of the in the global bond markets (be sure to read Callum Thomas’ post from this morning). Yields have surged, only adding to investor uncertainty.

The election is just around the corner and the markets are still in flux. Have a plan, stay disciplined. And enjoy this week’s “Top Trading Links” as a look inside the markets.

MARKETS

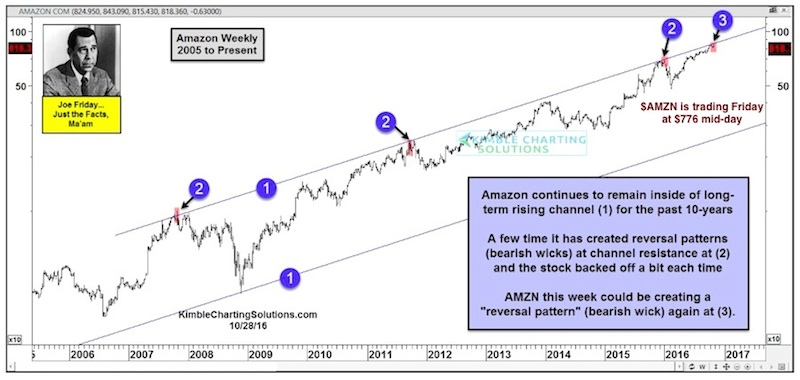

Amazon shares have reached some major resistance – Kimble Charting

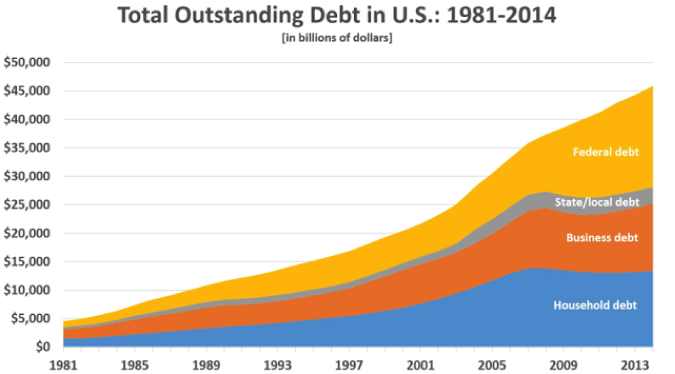

Has U.S. debt reached a tipping point – The Fat Pitch

Global Investor cash levels, by one measure, are at 15 year highs – Bloomberg

Housing ETF ITB has lost support. An in depth look at housing – Hedgopia

Buying blood on the street is only easy in hindsight – Ivanhoff Capital

How to profit from post earnings announcement drift – Stockbee

SELF-IMPROVEMENT

How to study people you admire – Darius Foroux

Changing how we think – Farnham Street

Dealing with toxic people – Barking Up The Wrong Tree

RESEARCH

AI and life in 2030 – Stanford

A socionomic view of demographic trends – Socionomics Institute

Demographics are pushing wages lower – Credit Writedowns

How Solar Energy can create value – McKinsey

6 election issues investors can’t ignore – Columbia Threadneedle

Prices are skyrocketing, but only for things we need – Visual Capitalist

Scientists may have found the protein that controls aging – Futurism

Be sure to check back next weekend for more links to high level trading blogs and investing research. Thanks for reading “Top Trading Links”!

Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.