Global financial markets took it on the chin this week. Not much was spared, as the S&P 500 fell 3.6% and the commodity space was hit hard.

In all reality, the stock market pullback isn’t too surprising, but the continued beat down of commodities paired against a potential Fed rate hike is concerning.

In this week’s “Top Trading Links” we discuss this and more. Let’s become better traders in 3, 2, 1…

MARKET INSIGHTS

@AndrewThrasher notes volatility has been quite subdued. It appears we’ve just entered a phase of increased volatility.

@michaellebowitcz highlights how U.S. Dollar appreciation is the equivalent to global monetary tightening.

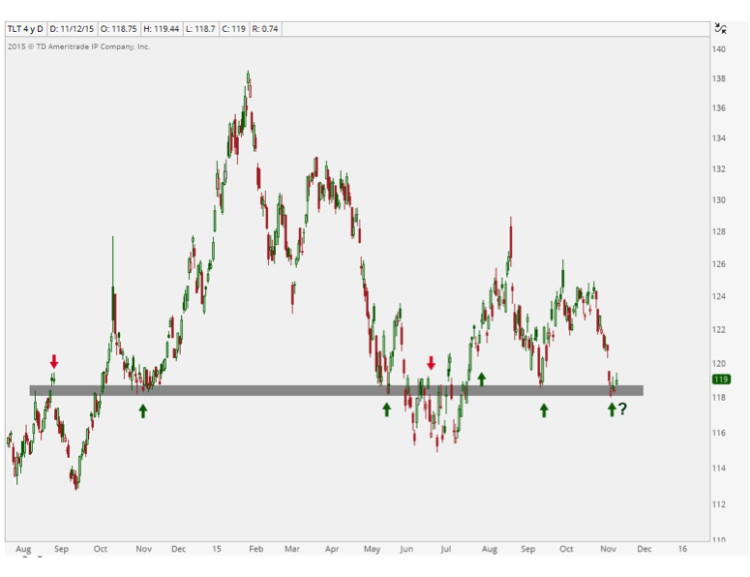

Why long term treasury rates are headed lower. via @allstarcharts

“The 10 month cycle in copper price bottoms says that a bottom is due imminently” – via mcoscillator.com

With the recent dollar strength, maybe it’s time for Small Caps to start out-performing again. @BtrBetaTrading notes that up November and December have been very strong months during the recent bull market.

It’s that time of the year where funds start selling their losers. @mebfaber wonders if it’s finally time to start looking long the biggest loser group of them all; coal.

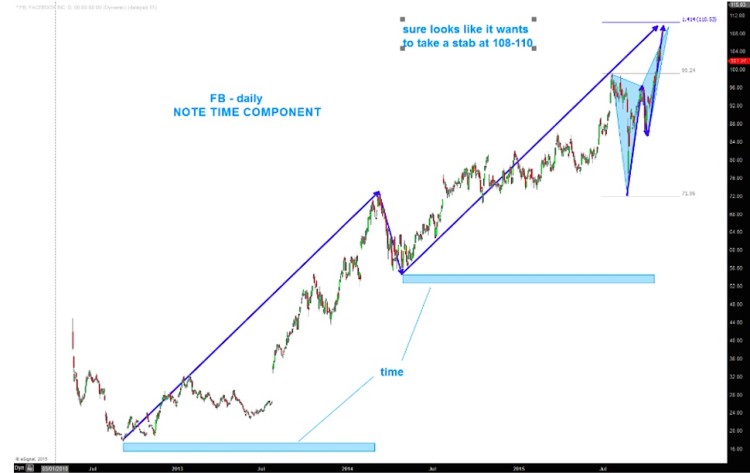

@Bartscharts notes Facebook has approached its near term price target

“There is no question that the pace of Boomer retirement will accelerate in the years ahead” – via @AdvPerspectives

continue reading on the next page…