A VALUE PLAY?

Twitter stock (TWTR) has quickly become, in a really odd way since it’s a company with negative earnings, a sort of value play.

If we compare Twitter to Facebook and LinkedIn in terms of price to sales, we’ll find something else stunning. Just look at this chart and what it says about valuation.

Even though Twitter is growing revenue faster than its social media peers, it has the lowest valuation as measured by price to sales. And again, none of these charts have been impacted by this potentially massive new revenue source just announced yesterday.

CONCLUSION

I’ve written it and said it on TV several times ad nauseaum, but it’s simply true: There’s a window for Twitter to follow in the footsteps of the Telegraph and the Telephone as the next major step forward in communications. It can be the end-all-be-all of real-time communications on a global scale.

But, Twitter also faces existential risk if that opportunity is not realized. Competitors are on its heels. Regardless of what the tweeps think about Facebook, if Mark Zuckerberg turns his attention to real-time communicase before Twitter masters it (and then owns it), friends Twitter is in serious trouble.

Facebook has 1.55 billion monthly average users and just crossed 1 billion daily active users. And let us not forget about other social media platforms getting awfully close to the real-time event driven mastery. We’re talking about Meerkat (a direct competitor to Periscope), Snapchat, and many, many others.

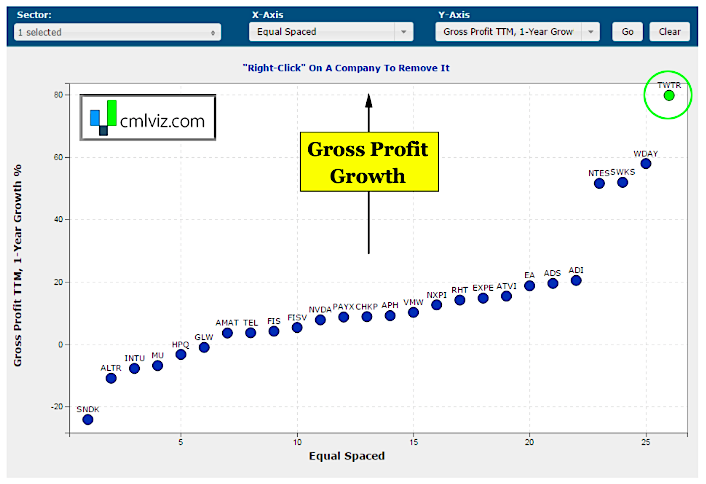

But, that was the thought process when we considered Twitter as a social media company with 320 million users. How does it look with 820 million users? Keep in mind, gross profit growth at Twitter, when compared to all technology companies with market caps between $15B and $30B is already extremely high. This time we will equal space the x-axis(rank) and plot gross profit on-year growth on the y-axis.

Twitter is in fact growing its gross profit faster than every technology company in this peer group. Again, let us understand the difference between user growth and revenue growth.

Twitter must see a jump in user growth from ‘Moments,’ Google search and Periscope (or some combination), even if it’s just circumstantial. Moments of course is brilliantly aimed at pushing Twitter’s only truly differentiated core competency forward — timely delivery of information and news.

We know the argument for Periscope, which is simply that mobile video is crushing it and found out that large advertisers are happy to work within the confines of unscripted live feedback as long as they can reach millenials. And finally, now that tweets are indexed in Google search, triple in the number of people getting exposed to Twitter. The hope is that user growth will reignite.

But, the monetization of around 500 million more users that was announced yesterday is a huge move that gives the company cash flow, and perhaps even profitability within a year. The investment thesis for Twitter (TWTR) has abruptly changed over night.

As of this writing I am long call options in Twitter and my household is long Twitter stock. Thanks for reading.

Read more from Ophir on CMLviz.com.

Twitter: @OphirGottlieb

The author has a current position in TWTR stock at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.