Breaking news late last week has made Twitter stock (TWTR) massively compelling as management appears to finally be moving the company in the direction of growth.

WHAT HAPPENED

Twitter stock (TWTR) has been getting crushed even as revenue is exploding higher for one very simple and reasonable explanation: user growth has all but stopped at 320 million monthly average users (MAUs). The thinking therefore is, that even as the company is monetizing its base, that will reach a maximum point, and then we are left with stagnation. But, here’s what we learned on Thursday:

Twitter announced Thursday that it will start showing ads to its “logged out” audience, a group of roughly 500 million people who visit Twitter every month but who don’t have active user accounts.

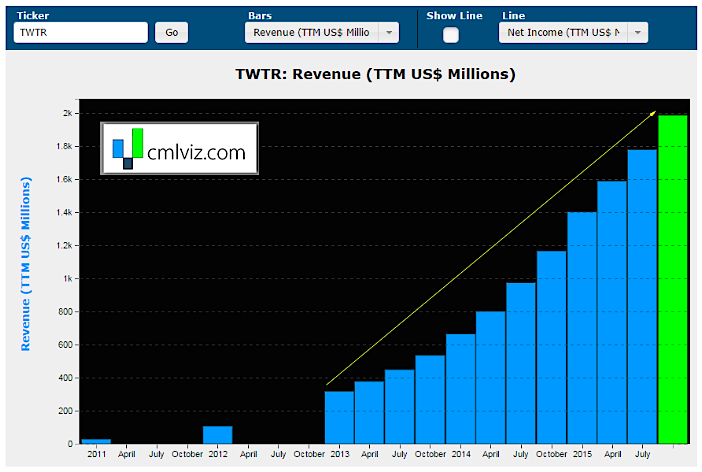

Twitter has long been telling us that the 320 million MAU number is vastly understating its user appeal. And by vastly, I mean, the number looks more like 800 million users. As of yesterday we now know that Twitter is going to start monetizing this base. Here’s the all-time revenue chart, which still looks magnificent and does not include the new monetizing strategy.

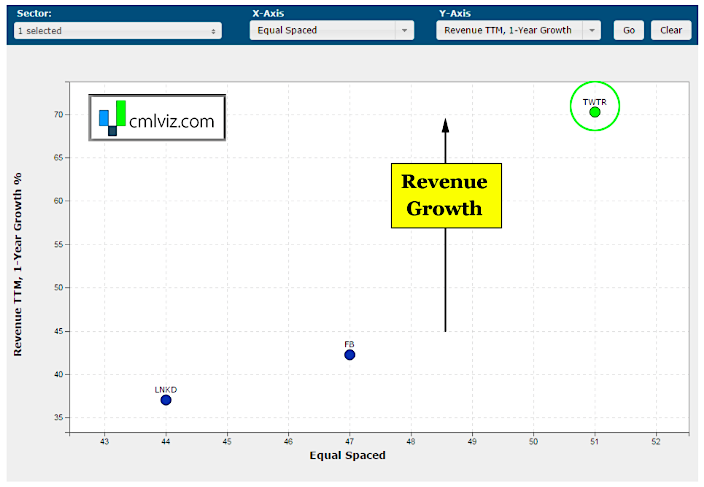

Note that while user growth has all but stopped, monetizing Twitter’s user base is exploding. In fact let’s plot revenue growth in the last year on the y-axis and rank Twitter, Facebook (FB) and LinkedIn (LNKD) on the x-axis.

Even with stagnated user growth, in the context of its two closest competitors, revenue growth is booming. So what does this new strategy potentially add to Twitter and investors in Twitter stock? A lot.

We write one story a day using visuals to break critical news. Join CMLviz: Get Our (Free) News Alerts Once a Day.

NOW WHAT?

On Twitter’s last earnings call, COO and head of revenue, Adam Bain, said that the company believes these ads will monetize at about half the rate of usual Twitter ads (Source: re/code).

So, let’s put some math in here. If 320 million users have generated about $2 billion in sales and growing rapidly, then 500 million more users at half the revenue pace would mean an additional $1.5 billion in revenue. Yes, that’s 75% more revenue essentially turned on like a light switch.

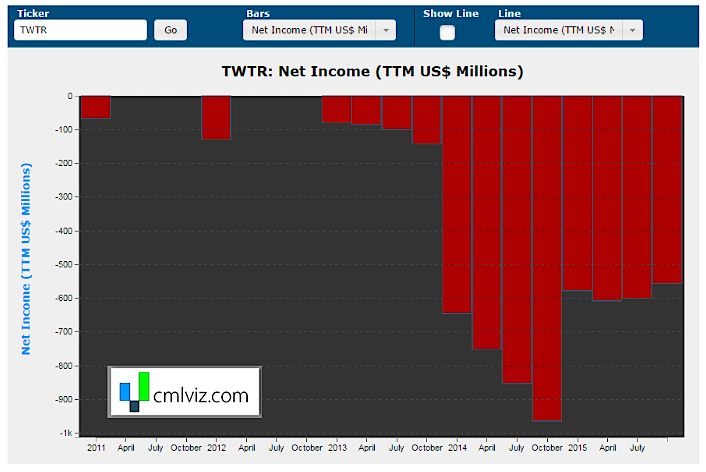

As of right now, here is Twitter’s ugly net income chart (aka after tax earnings). Along with slowing user growth, this is likely weighing on Twitter stock price.

As of now, we’re look at a loss of about $550 million in the trailing-twelve-months (TTM). How does an extra $1.5 billion in future sales with no real change to the company’s infrastructure make that number look? Let’s just say, a lot better.

And there’s more. Months ago, Twitter came to an agreement with Google where tweets now show up in Google searches. This broadens Twitter’s audience by about 3-fold and early numbers show that tweets appear in over 90% of desktop and mobile Google searches, already. With a triple in the number of people getting exposed to Twitter, the hope is that user growth will reignite but no matter what, we know that non-logged in user growth will certainly rise.

So does this make Twitter stock a value play?

continue reading on the next page…