The S&P 500 (SPY) and the Nasdaq 100 (QQQ) continue to trek upwards along with the Dow Jones (DIA).

While DIA and QQQ still need to clear their 200-day moving averages, the 4th major index flashes a warning sign (The Russell 2000 – IWM).

When watching the major index, it is always important to note when one is straying away from the pack.

Moves, where all 4 are aligned, can be powerful and show that the overall market is in an agreement.

With that said, the small-cap Russell 2000 (IWM) does not agree with the rest of the pack as it has yet to clear key resistance over $209.

Therefore, along the 200-DMA sitting as the next resistance point for QQQ and the DIA to clear, we need to watch for IWM to clear its double top of $209.

If these levels are not cleared, this would show weakness and a possible retracement towards the 50-DMA (blue line) in the indices.

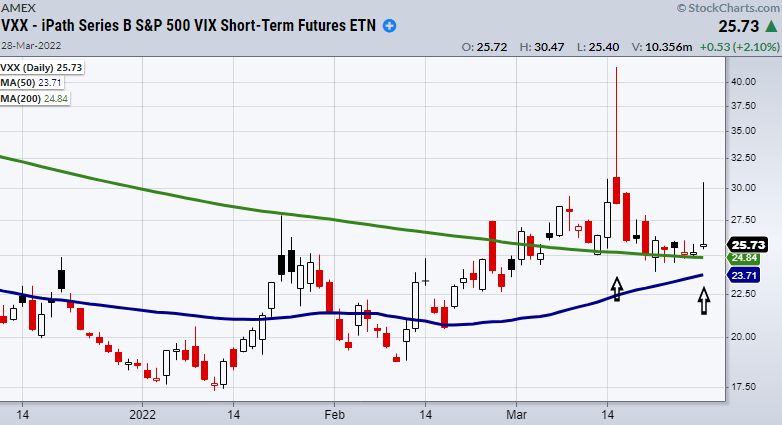

On another note, volatility through the S&P 500 VIX (VXX) has shown its ability to hold over the 200-DMA (green line).

While the recent spikes in price have failed to hold as seen on Mondays and 3/15, the VXX is still holding its major moving average.

This shows we should be extra cautious as the VXX which tends to move inverse to the index’s is standing its ground.

Stock Market ETFs Trading Analysis and Summary:

S&P 500 (SPY) price resistance is 458.

Russell 2000 (IWM) needs to clear 209.

Dow Jones Industrials (DIA) 350 is price resistance.

Nasdaq (QQQ) 348 is price support. 368 is resistance.

KRE (Regional Banks) Rangebound with 72 to clear and 69 to hold.

SMH (Semiconductors) 268 is price support.

IYT (Transportation) 270.60 needs to hold.

IBB (Biotechnology) Watch to hold the 50-day moving average at 127.79

XRT (Retail) 80 is price resistance.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.