According to recent PPI and CPI prints, inflation has plateaued. Some analysts will argue that inflation has hit its zenith.

However, what if one of the next catalysts to even higher inflation is spurred by the potential and recent peak in the U.S. dollar?

Looking at the price chart of the inverse ETF to the dollar or the Invesco DB US Dollar Index Bearish Fund, the U.S. Dollar is losing steam.

As momentum often proceeds price, certainly our Real Motion indicator points in the direction of a dollar price peak.

The U.S. dollar has been on a tear in recent months, bringing it to its highest valuation versus other major developed currencies for decades.

The U.S. dollar strength has begun to eat into profit and revenue margins for U.S. large-cap stocks, not to mention the havoc dollar strength has caused in commodity markets, developed, and developing economies, and country stock market indexes worldwide.

With Bank of England, Japan and China all trying to add liquidity to help stop the bleed of their currencies, could that bring the U.S. dollar down further?

What are some implications to your investing if this scenario plays out?

The U.S. dollar changing course will have profound effects on commodity prices and cascading outcomes throughout global equity and bond markets.

One such implication will be on precious metals.

Gold and silver are steadily confirming signs of a new mini rally at the same time as the US dollar retreats from recent historic highs.

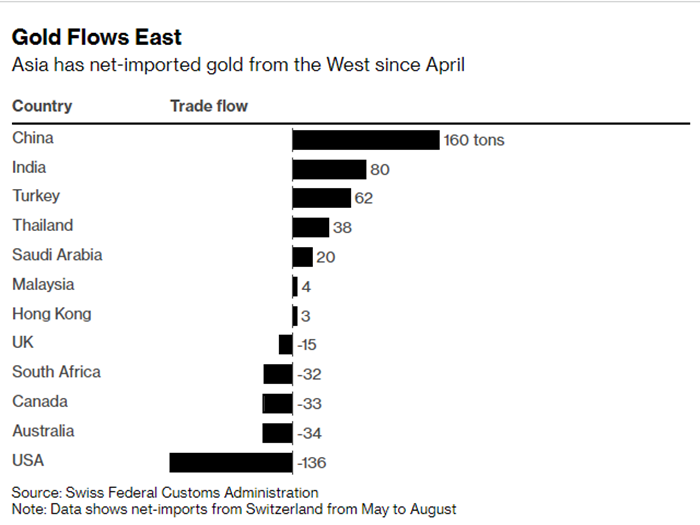

The above chart shows that the US has been selling gold reserves while some other countries have bought in record amounts.

Silver found a bottom in early September. Gold could be forming a double bottom.

Food prices have barely budged from their highs, particularly when you look at where they were pre-pandemic.

US dollar bearishness points to a monumental global shift and will play into commodity price strength, most likely visible first in precious metal prices.

And although initially, a dollar drop could be good for equities, caution is still warranted.

In the face of the dollar declining in price and momentum, our yields are still rising.

There have been increasing calls for the Fed to pause hikes to allow the economy time to absorb previous ones, but most Fed members seem unphased by this rhetoric.

We are not expecting a pause from the Fed anytime soon, but we do expect the US dollar to peak before the Fed raises rates next month.

This puts the credibility of the Fed’s monetary policy in further question.

If yields are rising, equities fall or stagnate, yet the dollar drops, and commodities rise-

Yes, that equals more inflation and a real conundrum for the Fed and the U.S. government regardless of the outcome of the mid-term elections.

Are you looking for some trading assistance in the market?

As we head towards the end of 2002 and into a new year, are you ready to take advantage of the upcoming opportunities?

Mish in the Media

Benzinga 10-21-22

Pre-Market Prep

Stock Market ETFs Trading Analysis & Summary:

S&P 500 (SPY) Still 360 pivotal support and resistance at 380.

362 caution; 360, 351, 340; potential upside levels: 380, 385, 390

Russell 2000 (IWM) 170 support and 177 resistance

Dow Jones (DIA) 306 was resistance and is now support; 314 is resistance

Nasdaq (QQQ) 275 was previous resistance; 270 support and 278 resistance

Regional banks (KRE) 58.60 support and 62 resistance

Semiconductors (SMH) Support at 181 and resistance at 190

Transportation (IYT) support at 198 with 205 resistance

Biotechnology (IBB) still holding 115 support and 122 resistance

Retail (XRT) still holding long-term support at 55 and resistance at 62

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.