Determining whether we are in a risk-on or risk-off climate is challenging, especially after a fantastic day of gains in every major US index.

We should be in a risk-on environment. The Chinese stock market even rose, with technology and electric vehicles leading, as investors hoped for a more liberal COVID-19 governmental policy.

With a gain of 4.4%, the Nasdaq composite, which had been the slacker, led gains among major US indices.

The S&P 500 (represented by the $SPY ETF) also surpassed its 200-day moving average for the first time in seven months.

Markets are also approaching critical technical levels, which can accentuate positive or negative data, so keep an eye out tomorrow for PCE, the Fed’s favorite inflation gauge.

Regardless of today’s market action, there are indications that a global recession is imminent, with part of Europe potentially already in a recession and the US possibly next year.

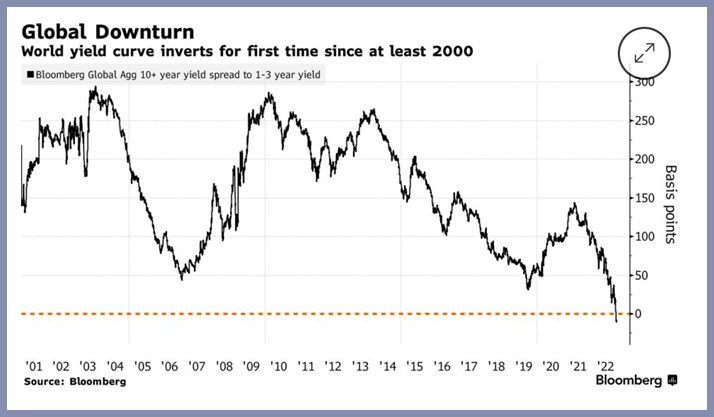

A rare 20-year recession signal is flashing red.

Global bonds joined US peers in signaling a recession, with a gauge measuring the global yield curve inverting for the first time in at least two decades.

According to Bloomberg Global Aggregate bond sub-indices, the average yield on government debt expiring in 10 years or more has slipped below that on short-term bond yields.

On the heels of Fed Chairman Powell’s dovish remarks today, the stock market rallied with heavy volume. Yet global bond yields signal a recession ahead.

Market conditions are ripe with profitable trading opportunities. Investors should pay close attention to commodities, currencies, bond yields, and inflation.

If the PCE print is higher than expected one-third or even more of today’s gains could be erased quickly.

On the flip side, if PCE is lower than expected, stocks might continue to run higher.

It is crucial to proceed with caution as there is the potential for significant volatility in the coming weeks and months.

We believe this ferocious bear market rally still has some legs – but don’t wait too long to make your move, or your portfolio might get clawed quickly.

If you are looking to capitalize on this ferocious bear market rally, our team can help your trading to protect your portfolio while allowing you to benefit from bullish trends.

Mish in the Media

CMC Markets 11-30-22Commodities to watch in December

Stock Market ETFs Trading Analysis & Summary:

S&P 500 (SPY) 402 is support and resistance at 411

Russell 2000 (IWM) 183 support; 191 resistance

Dow Jones Industrials (DIA) 342 support; 349 support

Nasdaq (QQQ) 288 support; resistance 302

KRE (Regional Banks) 62 support; 66 resistance

SMH (Semiconductors) 223 support; 232 resistance

IYT (Transportation) 230 support and resistance at 237.

IBB (Biotechnology) 133 support and 139 resistance

XRT (Retail) 64 support; 70 resistance

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.