If I had just one thing to use to understand the markets and predict what was coming next, it would be a daily chart of the S&P 500 index. If I had a second chart? It would absolutely involve market breadth.

My Morning Coffee Routine involves a number of charts covering market breadth, because breadth is all about participation. If the major averages are in a bull/bear trend, what about all the individual stocks that make up those indexes?

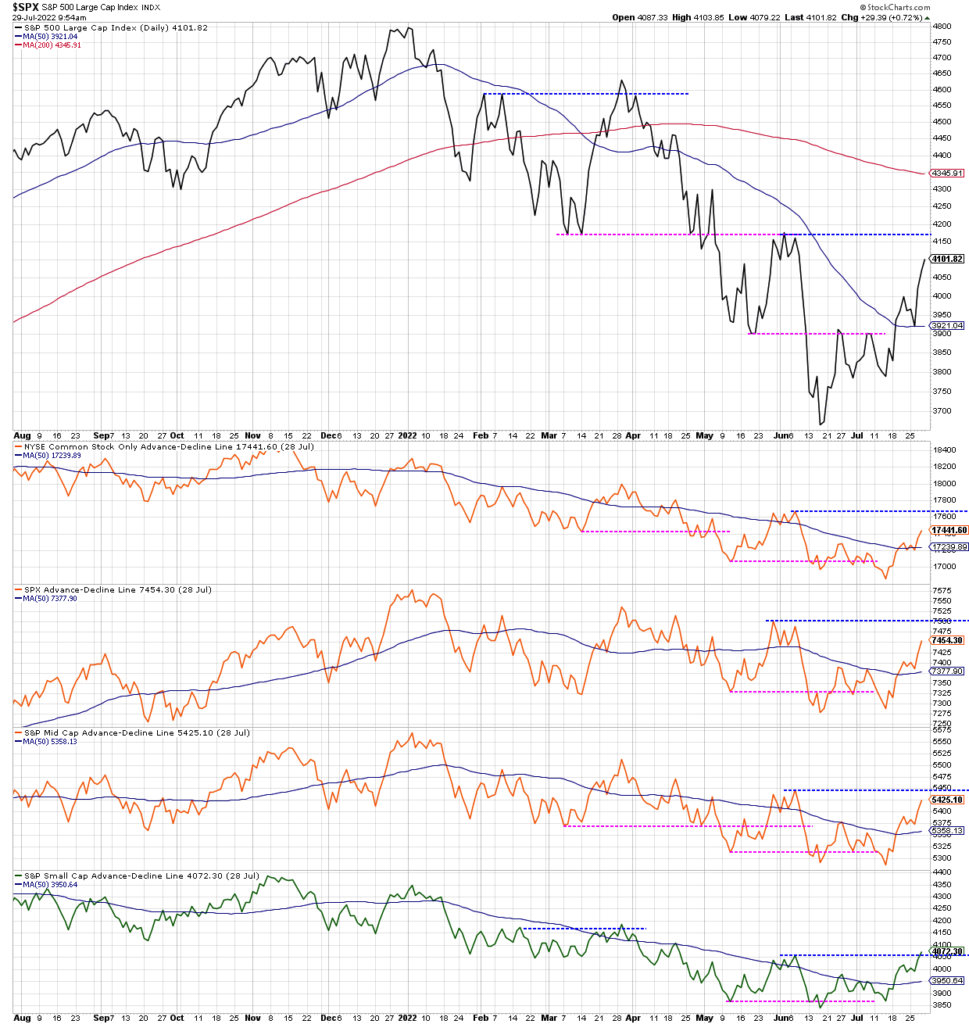

At major market turning points (for example, Nov 2021-Jan 2022) you will often find a divergence between the major equity indexes and key measures of breadth. This is because individual names will already start to rotate into the new direction before the indexes themselves begin to change.

Today I’ll share my chart of cumulative advance-decline lines, which I feel is the most important chart to watch as the S&P 500 index breaks above 4000. Are we in the later stages of a bear market rally, or the early stages of a broader market recovery? This chart will help us answer that particular question. See chart further below.

In today’s video, we’ll discuss why advance-decline lines are so vital to understanding the underlying strength of the equity markets, and why this one chart can help us anticipate future market moves.

- How do advance-decline lines track individual stock participation, and how should we compare them to the major equity indexes?

- Why is there often a divergence at market turning points, and have we seen one recently?

- How can this chart help us confirm a new bullish phase for stocks, and what would we see here that could convince us otherwise?

For deeper dives into market awareness, investor psychology and routines, check out my YouTube channel!

(VIDEO) Market Breadth: Cumulative Advance-Decline Line

Advance Decline Market Breadth Chart

Twitter: @DKellerCMT

The author may have positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.