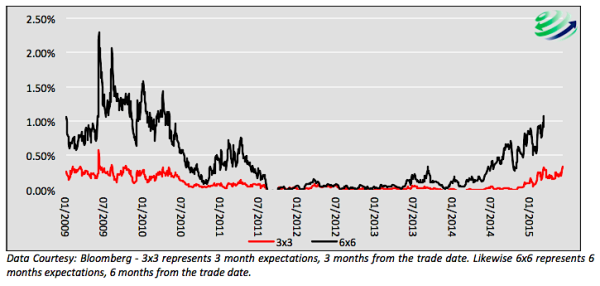

Investor Optimism: Fed Funds Futures Expectations vs. Realized Fed Funds –

The red and black line plot the markets over-estimation of Fed Funds versus that which actually occurred. Every point on the graph represents an over-estimation of where Fed Funds were in the future and the degree of the error.

11/12/2009 – Wall Street Journal – “Economists in the latest Wall Street Journal survey, on average, expect the Federal Reserve to raise interest rates around September 2010”.

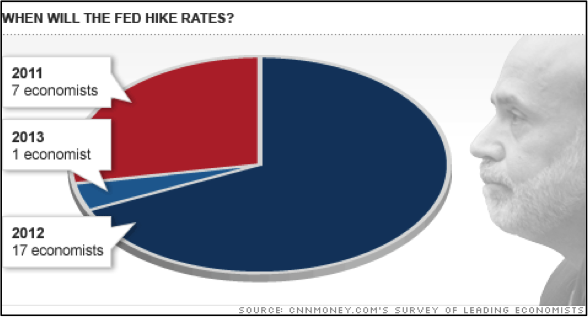

12/23/2010 – CNN Money-

4/7/2011 – Fed Governor Jeffrey Lacker – “Rate hikes by year end certainly possible”.

5/5/2011 – Fed Governor Narayana Kocherlakota – “Under my baseline forecast, it would be desirable for the (Fed) to raise the fed funds target interest rate by a modest amount toward the end of 2011”

1/25/2012 – CNNMoney – “The economy is improving, the Federal Reserve said Wednesday, but not enough to warrant higher interest rates for at least two-and-a-half more years.

The central bank indicated that it expects to keep the federal funds rate near historic lows until late 2014 — an extension from the Fed’s original pledge to keep rates low through mid-2013”.

2/6/2012 – Fed Governor James Bullard (as reported by Reuters) – “Fed should raise rates in 2013”

2/10/2015 – Fed Governor Jeffrey Lacker (as reported by the Wall Street Journal) – The Federal Reserve Bank of Richmond President Jeffrey Lacker said on Tuesday that interest rate hike in June is “the attractive option” for him.

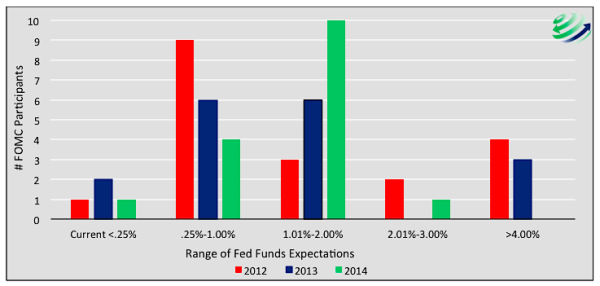

Finally, the bar chart below shows the individual Federal Open Market Committee (FOMC) participant projections in the years 2012, 2013 and 2014 of their expectations for the Fed Funds rate in 2015. Only 1 Federal Reserve member in 2012 and 2014 and 2 in 2013 believed the Fed Funds rate would be at its current level.

Thanks for reading.

Twitter: @michaellebowitz

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.