The following is a recap of The COT Report (Commitment Of Traders) released by the CFTC (Commodity Futures Trading Commission) looking at futures positions of non-commercial holdings as of November 10, 2015. Note that the change in the COT report data is week-over-week. (Due to Veterans Day, a Federal holiday, the CFTC released numbers on Monday.)

10-Year Treasury Note: “Muted global economic growth will not support a significant reduction in government debt or allow central banks to raise interest rates markedly.”

The above quote is from a Moody’s report last week stating that the world economy’s ability to fight shocks is dented, and that the hoped-for growth in both developed and emerging markets has not materialized.

As if to vouch for Moody’s rather gloomy outlook, the OECD cut its forecasts for global growth to 2.9 percent for this year, but continues to be optimistic beyond 2015. Next year, it expects 3.3 percent growth and 3.6 percent in 2017. In September, 2015 was expected to show growth of three percent, and in June this was 3.1 percent. The 2016 forecast runs a risk of downward revision.

This also applies to the United States. Real GDP grew 2.4 percent in 2014. This year, the economy is forecast to grow 2.2 percent. Next year? The consensus expects growth of 2.6 percent.

In this scenario – if it comes to pass, that is – the Fed would have trouble defending the need to keep the Fed Funds anchored at zero.

Last week, Bill Dudley, president of the New York Federal Reserve and otherwise a dovish voice within the FOMC, talked about the need to get off the zero rate policy.

With all this, markets will be awfully disappointed if the Fed does not move in December. That is, unless stocks retreat substantially between now and then, and/or the November jobs report is a disappointment.

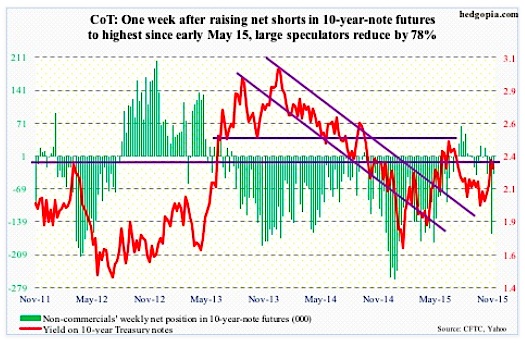

Per recent COT report data, non-commercials are a confused bunch. Last week, they raised net shorts to the highest since early May. This week, they cut back significantly.

COT Report Data: Currently net short 36.9k, down 127.3k.

30-Year Treasury Bond: This week’s major economic releases are as follows.

On Tuesday, four different reports are published: the consumer price index (October), industrial production (October), the NAHB housing market index (November), and the Treasury International Capital (September).

In September, consumer prices fell the most in eight months – down 0.2 percent. In August, they fell 0.1 percent. In the 12 months through September, the CPI was unchanged after rising 0.2 percent in August. Core CPI rose 0.2 percent, after rising 0.1 percent in August. Core CPI, however, jumper 1.9 percent in the 12 months through September – the largest increase since July 2014.

In September, capacity utilization was 77.5 percent, down from the cycle high of 79 percent in November last year. Year-over-year, utilization has dropped for five straight months, and in 11 of the last 14 months month-over-month.

Builder sentiment is elevated. The NAHB/Wells Fargo housing market index was 64 in October – a 10-year high.

Despite all the hand-wringing and fear over if post-yuan devaluation China would start liquidating its holdings of Treasury securities, that is yet to happen. By August, China held $1.27 trillion in Treasury securities. The devaluation took place on August 11th. If China sold these securities, this should begin to get reflected in September data.

On Wednesday, we get housing starts for October. At a seasonally adjusted annual rate of 1.206 million, September was essentially in line with 1.211 million in June, which was the highest since 1.26 million in October 2007. Momentum has been building of late. Builders are putting their money where their mouth is.

Also on Wednesday, minutes for the October 27th-28th FOMC meeting are published.

Four FOMC members are scheduled to speak on weekdays.

COT Report Data: Currently net short 16.7k, down 5.2k.

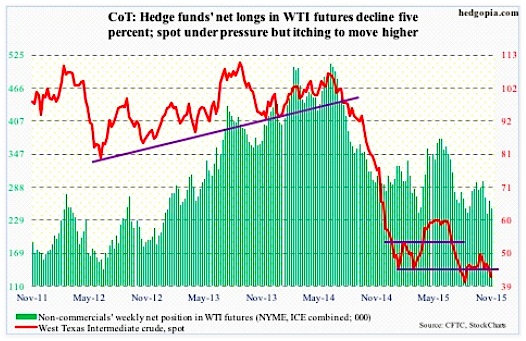

Crude Oil: For the week ended November 6th, U.S. gasoline stocks fell 2.1 million barrels, to 213.2 million barrels – a 12-week low. As well, refinery utilization continued to inch up, rising 0.8 percentage point, to 89.5 percent. It has now risen 3.5 percentage points since October 9th. Utilization peaked at 96.1 percent in the August 7th week. All positives! The rest of the data was anything but…

Distillate stocks rose 352,000 barrels, to 141.1 million barrels. The prior period was at a 17-week low… Crude oil production rose by 25,000 barrels per day, to 9.19 million barrels per day – a 10-week high. Oil production peaked at 9.61 mbpd in the June 5th week. Rig counts have plunged in recent weeks/months, but has not impacted oil production much… Crude oil imports rose 434,000 barrels per day, to 7.38 mbps… The final nail in the coffin came from crude oil stocks, which jumped 4.2 million barrels, to 487 million barrels. This was the seventh straight weekly increase, and stocks were at the highest since the April 24th week.

Spot West Texas Intermediate crude oil collapsed nearly nine percent last week.

To rub salt in the wound, the International Energy Agency said Tuesday its core expectation is for oil prices to return to $80/barrel by 2020, but the odds of it remaining stuck between $50 and $60 well into the 2020s cannot be ruled out.

The next OPEC meeting is on December 4th. Last November, the cartel decided against production cuts. Despite calls from countries like Venezuela and Algeria to cut oil production, odds are the Saudi Arabia-dominated group will maintain the status quo.

Put all this together, and the fact that spot WTI was once again rejected at the $48 level last week, it is not hard to fathom why oil bulls are leaving. With this, crude oil has now lost two-plus-month support at $43. On a weekly basis there is room for downward pressure still, but daily conditions are oversold – a good opportunity for bulls to put their foot down.

COT Report Data: Currently net long 248.9k, down 14.2k.

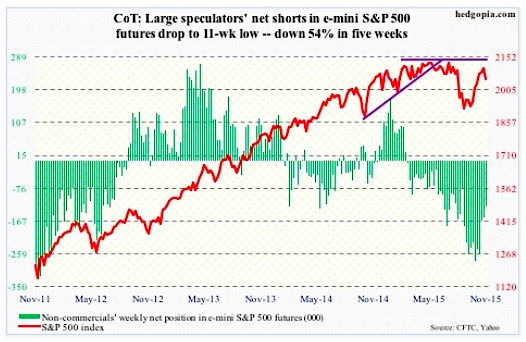

E-mini S&P 500: As elevated as short interest is, it almost feels like equity bulls have been unable to cash in on the squeeze opportunity to the fullest possible extent.

Not that shorts did not get squeezed. They did, and stocks had a nice move. During the September 30th-October 15th period, the SPDR S&P 500 ETF (SPY) for instance, rallied 5.6 percent, even as short interest dropped 10.6 percent. In the October 15th-October 30th period, the ETF only rose 2.8 percent, while short interest declined 15.8 percent.

The possible culprit for the lackluster rally in stocks in the second period? Lackluster inflows. The rally since the September 29th low was driven less by fresh money willing to get in on the action, and more by short-covering.

Since the week ended September 30th through this Wednesday, cumulative inflows into U.S.-based equity funds have totaled $11 billion (courtesy of Lipper). That’s it! The S&P 500 index rallied 13 percent between the September 29th low and the November 3rd high. And this was not enough to tempt new money into action in the stock market.

That said, non-commercials have built sizable net shorts, and have been cutting back. This has helped stocks stay elevated.

COT Report Data: Currently net short 127.8k, down 29.8k.

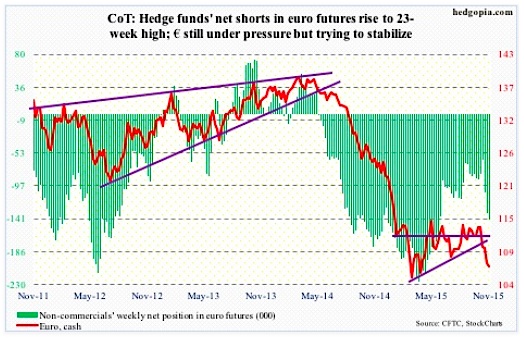

Euro: Eurozone industrial production fell by 0.3 percent in September from August – yet another data point pointing to subdued economic activity in the region.

No wonder Mario Draghi, ECB president, continues to talk dovish… most of the time anyway.

Speaking to the European Parliament last Thursday, he said inflation dynamics had somewhat weakened and that a sustained normalization of inflation could take longer to achieve than thought, hinting that additional stimulus could be announced in December.

He expressed similar sentiment at a press conference in October (after the conclusion of the governing council meeting). Also on Thursday, ECB executive board member Benoit Coeure said the debate on more stimulus in December was still open.

That said, between October 14th and November 10th, the euro lost seven percent. The currency is acting as if the announcement of additional stimulus in December is a sealed deal. Watch out if Mr. Draghi disappoints. Or for that matter, a ‘buy the news, sell the rumor’ phenomenon could materialize. The euro remains oversold on both a daily and weekly basis.

COT Report Data: Currently net short 142.9k, up 8.6k.

Next up is Gold.

continue reading on the next page…