Part II of this piece, soon to be released, will chronicle one example of the ills of uncontrolled money printing, namely the actions that ultimately led to the French Revolution (1789-1799). This example is not as well-known as recent money printing schemes such as the Weimar Republic in 1923, Argentina in 1981 or Zimbabwe in 2008, but the lesson it provides is invaluable. The scale of money supply growth today is enormous but far from those achieved in the aforementioned countries. Nonetheless, all investors should have an appreciation for the path we are on and the fate that befell others that took similar paths.

The Era of Easy Money

Without a mandate for gold or silver to back a currency, most nations can freely increase or decrease the supply of money with few restrictions. The Federal Reserve (Fed) and many other central banks have done just that. Central banks now use their ability to manipulate the money supply to help them decrease interest rates, incent borrowing with the intent of spurring economic growth. Consider the stark differences in the annual growth of the money supply before and after Nixon’s removal of the gold standard:

- Post WWII era (1950-1970): +3% annualized

- Removal of gold standard until the financial crisis (1971-2008): +19% annualized

- Period since financial crisis (2008-today): +29% annualized

It is important to highlight that the Fed has quadrupled the money supply since 2008, dwarfing the 100% increase in the money supply during the great depression.

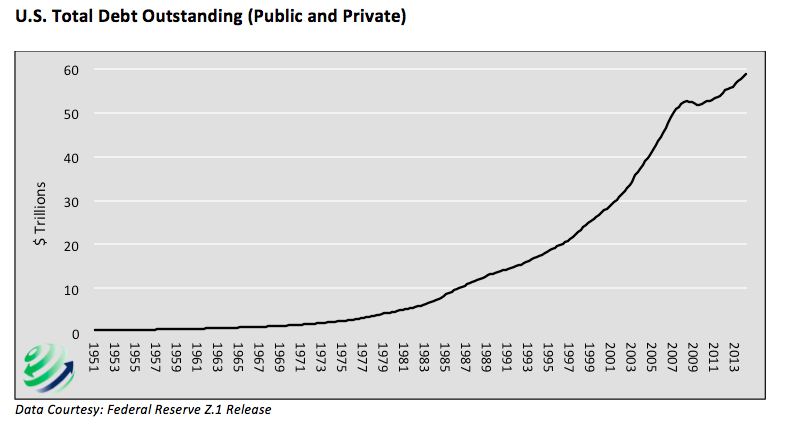

This “get rich quick” mentality generated limited shots of synthetic economic growth instead of fostering productivity to nurture and support lasting organic economic growth. This strategy is not without cost. In the words of Aldous Huxley: “One can’t have something for nothing”. Laying in the wake of money printing and extraordinarily low interest rates is an unprecedented accumulation of public and private debt, the decline of productivity growth and a fragile economy. These costs have been mounting for years, requiring higher degrees of central bank intervention to avoid paying them.

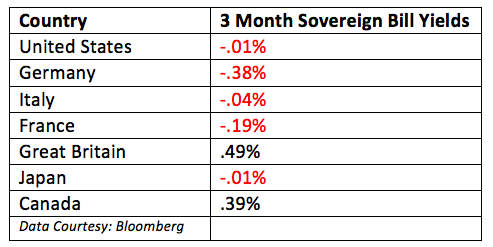

It is becoming more and more apparent that the so called “era of easy money” is quickly coming to an end. Debt levels are at a point where they challenge the economy’s ability to grow them, let alone service them. Interest rates have been lowered to zero with some countries now targeting negative rates. As stressed earlier, the U.S. money supply has quadrupled since 2008 and those of other economic powers have done likewise. Productivity growth has ground to a halt in the U.S. and is in decline in most major economies. To put the situation in blunt economic terms: the Minsky moment has arrived. The saying, derived from the works of Hyman Minsky, describes the sudden collapse of assets values which were driven higher by the gross misallocation of capital. Years of easy money and unregulated money printing has created this condition today.

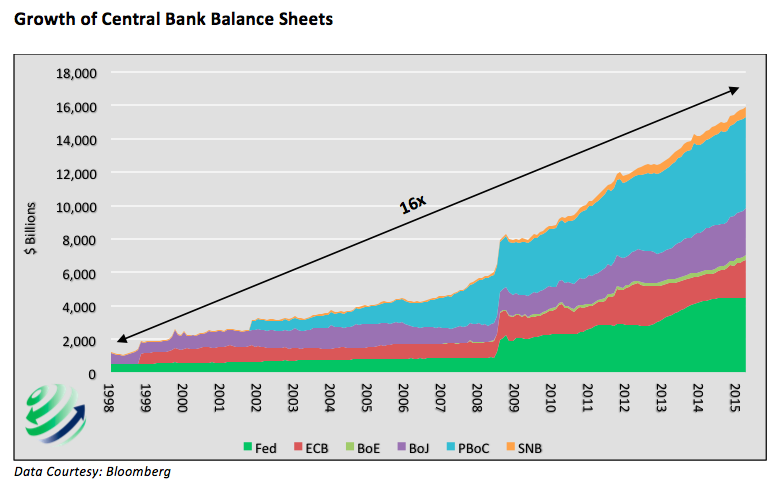

The graphs below help visualize the enormous growth of central bank balance sheets and total U.S. debt outstanding. The table following the graphs show the stunningly low current level of short term interest rates of selected major economic powers. 5 of the 7 countries in the table have interest rates below zero.

Why Gold

Gold is denominated in US dollars meaning it is quoted as the amount of dollars required to buy or sell one ounce of gold. The price of gold rises and falls with supply and demand for gold however a big determinant of its price is the value of the U.S. dollar.

Commonly, the U.S. dollar is quoted as an index or ratio. For example, the closely followed Dollar Index (DXY) is currently trading at 96.00 and the dollar’s exchange rate versus the Euro is 1.12. These are valid price indicators, yet also misleading, as they solely describe the value of the U.S. dollar relative to other currencies. If another country debases their currency more aggressively than the U.S., the dollar may rise in price but has it truly gained value? The exchange quotes and pundits may say yes but the answer is clearly no.

The only proper measure of the value of a dollar is its purchasing power. In the 1950s, $1 bought a couple a full meal at McDonalds including a burger, fries and a shake. Not only that, but the couple walked away with change. Today a similar meal at McDonalds would run the couple well over $10.

continue reading on the next page…