Tag: stock market indicators

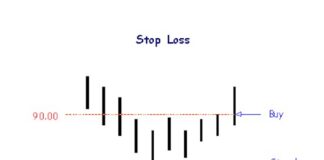

The 1-to-2 Percent Rule Every Investor Should Know

Today, we go evergreen with an important investing tactic to save you a lot of money and keep you investing for a lifetime.

If Bitcoin...

Was This the Death of Bitcoin?

The new Mish’s daily market update format is here.

Welcome to Mish’s Market Minute, an avatar (of me) that will give you analysis and actionable...

What Utilities, Energy, Industrials, and Banks Could Tell Stock Market

The bull market has broadened out, and several non-tech Investor Days, Analyst Days, and Business Updates could offer color on the Main Street economy

Improved...

AI Capex Clouds Tech Horizon, Even as Meta and Tesla Shine

With roughly a third of companies reporting thus far, S&P 500 EPS growth for Q4 2025 currently stands at 11.9%

This week, Alphabet, Amazon, and...

Euro Currency: 2026 Peak and Turn Lower (Elliott wave analysis)

The Euro is nearing important price resistance, and we believe there is potential for a downward reversal that would take it to new lows.

Today...

Important Stocks, Earnings, and Data Insights: $TSM, $TSLA, $COST

Market-moving information surfaces between earnings events, reshaping expectations before quarterly reporting cycles

Interim data updates offer early insight into demand, production, and profitability across key...

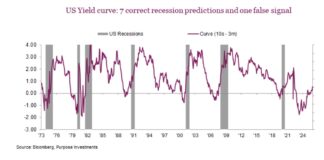

Why Steep Yield Curves Aren’t Always Good

If an inverted yield curve is a harbinger of a near-term recession, then a steeper yield curve must be good news, right? Not so...

Tech Stocks Rebound Soothing Greenland-Induced Shivers as Earnings Season Hits Stride

With only 13% of companies reporting thus far, S&P 500 EPS growth for Q4 2025 currently stands at 8.2%

The tech sector continues to dominate,...

Energy Stocks Steady Amid Macro Chaos; Sunday Night Earnings Surprise Ahead

Bond market stress, global geopolitical risk, and weather shocks at home have lifted Energy to the top sector spot YTD

Baker Hughes’ Q4 report this...

Bank Stocks: Another Quarter of Double-Digit S&P 500 Earnings Growth?

Q4 earnings for big banks were marked by robust bottom-line performance despite some top-line misses

CEOs appear confident as the earnings season kicks off according...