What if sugar futures are really onto something?

What if they are relaying food shortages? More social disruption?

The Start of Russian hoarding?

Which leads to Geopolitical hell?

And all the inflation theories that could still develop are staring us right in the face?

In the face of a rising U.S. dollar..

In the face of higher yields and a more hawkish Fed..

In the face of some cooling inflation indicators and a correction in gold..

In the face of a soft GDP..

In the face of a persistent trading ranges in the key indices..

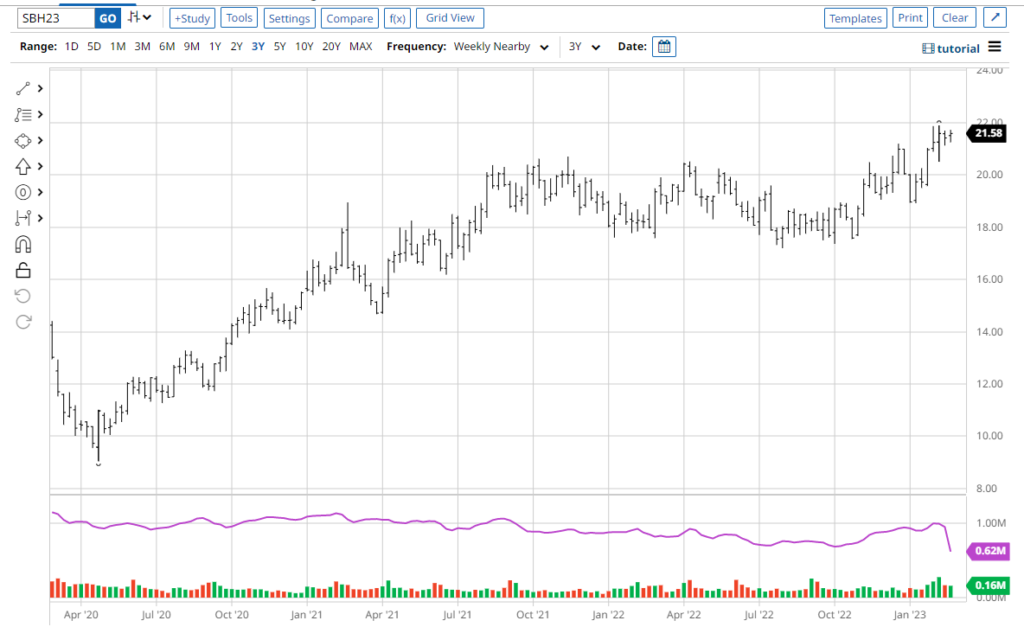

Sugar has gone up 225% since April 2020. Sugar led the inflation rout in 1976 and then again in 1979. Sugar is in pretty much everything we consume.

Heck, even Apple just announced a way to gauge your sugar levels if you have diabetes (1 in 3 Americans do)..in other words, eat sugar; we (Apple) got you.

The point is this..

Should this rout continue (pay attention), AI and growth stocks will not help feed the planet. Not for a long time.

P.S. Tweet 2/22/23 at 8:19 AM ET:

$UNG textbook blow off potential bottom on high volume. One to watch

Price 7.30 at the time. Up over 12% since then.

Commodities don’t give up.

Stock Market ETFs Trading Analysis & Summary:

S&P 500 (SPY) 390 support with 405 closest resistance

Russell 2000 (IWM) MA support around 184. 190 has to clear again

Dow Jones Industrials (DIA) 326 support 335 resistance

Nasdaq 100 (QQQ) 300 the pivotal area 290 major support284 big support 300 resistance

Regional Banks (KRE) 65.00 resistance 61 support

Semiconductors (SMH) 240 pivotal with 248 key resistance 248 resistance 237 then 229 support

Transportation (IYT) Why we look for 2-day confirms on phases-back over the 50-DMA-228 support 232 resistance

Biotechnology (IBB) 125-130 new range

Retail (XRT) 66-68 huge area to hold if the market still has legs

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.