We are seeing a continuation of yesterday’s reversal in equities. And after the first signs of a meaningful pullback from highs yesterday, a flight towards safety and safe havens looks to have begun.

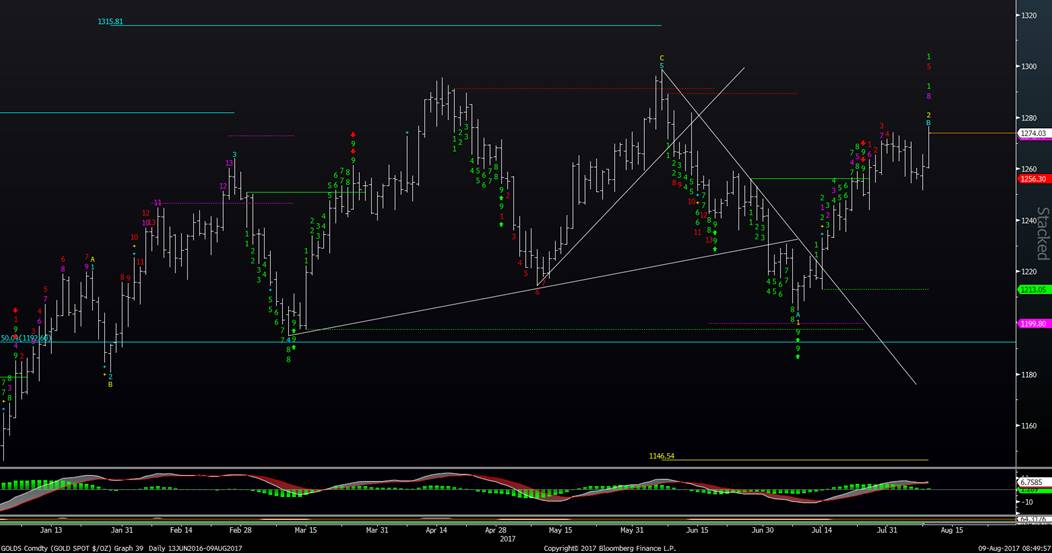

This is evident with the rallies in Gold (NYSEARCA:GLD) and Treasury Bonds. Also notable in the price action on the Japanese Yen (CURRENCY:YEN).

The USDJPY is undercutting prior lows while Gold is making its biggest move since June. See these charts below and more.

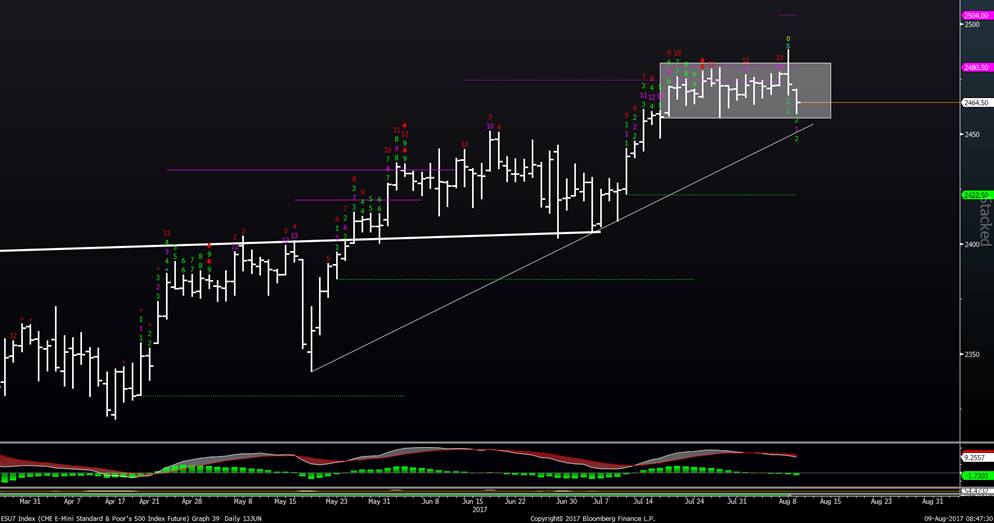

Looking at the U.S. equity market, the S&P 500 (INDEXSP:.INX) went from having a chance to breakout again yesterday to failing and getting back inside its range – a definite negative. And today it is seeing prices pull back down towards the lows of the prior range for equities.

Below are 3 Charts that I’m watching…

S&P 500: UNDER 2457 or the intraday lows from 7/27 and we can expect additional weakness, perhaps all the way down towards 2400. Note that there is a 20-week cycle low around the August 18-August 21 timeframe. Overall, a defensive stance is preferred given yesterdays reversal and shorts can be undertaken with stops above yesterday’s highs.

USDJPY: Extending lower. Movement down to 108.85 looks likely, so YCS is a potential vehicle for Yen

GOLD: The yellow metal is also making its largest move since June and decidedly more positive in moving to multi-day highs. Movement up above 1274 on a close should lead to 1300 and slightly above.

Thanks for reading and good luck out there.

Twitter: @MarkNewtonCMT

Author has positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.