Under SEC rules companies are required to pause stock buybacks about 5 weeks before earnings.

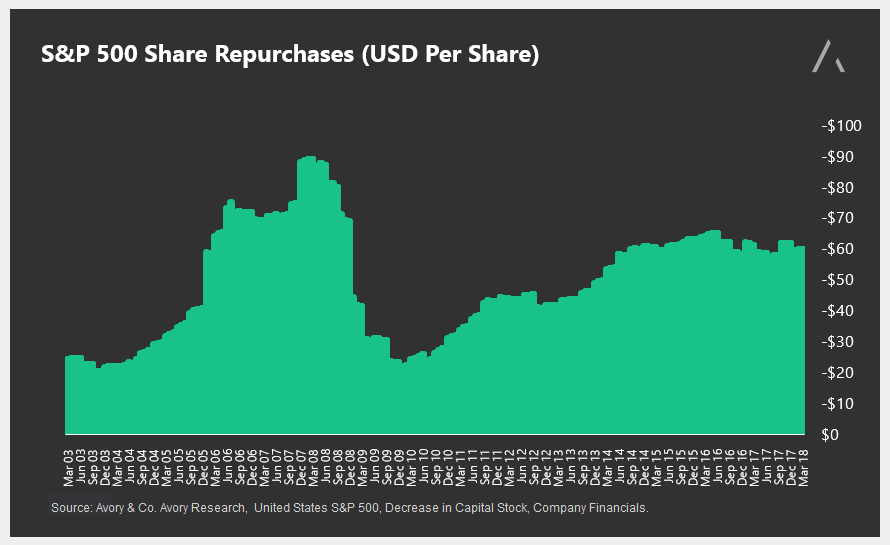

Since the end of the great recession in 2009 companies have been allocating capital back into the equity of their businesses through stock buybacks. Over the trailing 12 months, companies have repurchased about $520B of their own shares.

Below is one of our charts showing the trailing 12-month share repurchases for the S&P 500 (NYSEARCA:SPY) on a per share basis.

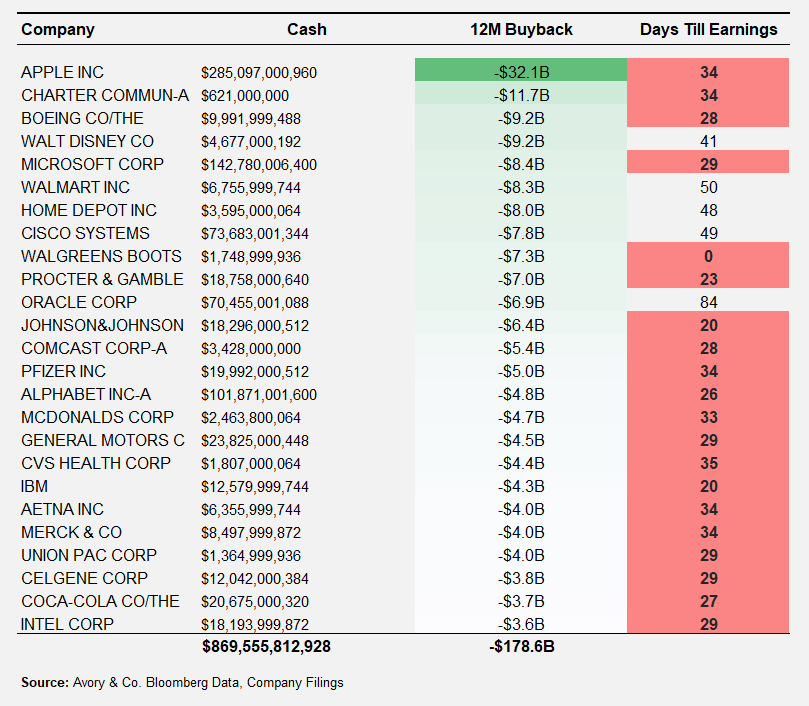

Given the influence of stock buybacks, we wanted to take a look at the companies who have been repurchasing the largest dollar amount of shares, along with analyzing the recent performance of those companies with blackout periods looming.

Our table above ranks companies within the S&P 500 ex-financials by their trailing 12-month share repurchase amount. Additionally, we added a column for cash on hand and a column for the days until their next earnings release.

What we found was that nearly 80% of the top 25 companies who repurchased shares over the last 12 months are reporting within 5 weeks from today. This leaves those 20 companies vulnerable as support from share repurchases will be non-existent. Keep in mind, however, those 25 companies are loaded with over $869B in cash, therefore any downside moves will likely be repurchased post-blackout.

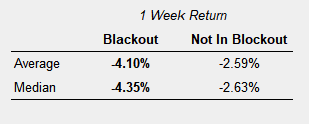

Additionally, we analyzed the entire S&P 500 and calculated the current trailing 1-week return of companies which are/were within 5 weeks of reporting earnings, versus those companies who are not. The returns were as follows.

As the data suggests, volatility met with a blackout period is already showing its colors as companies within a potential blackout period underperformed. While these are not fundamental factors which drive long-term returns, we do understand the potential short-term nature of supply and demand imbalances.

Lastly, we asked what happens when the blackout period ends? The data shows that since 2000 when buying after a blackout period and holding for a month, returns are highest in

- Utilities: Up 71% of the time

- Financials: Up 63% of the time.

- Consumer Discretionary: Up 66% of the time

I’d like to end with a positive thought. Despite all the volatility, we are about 30 days from large companies reporting earnings. At that time we will get tangible fundamental information which could settle investor sentiment. That’s all, have a good one.

Disclaimer from author: THIS IS NOT A RECOMMENDATION FOR PURCHASE OR SALE OF ANY SECURITIES. AVORY & CO. IS A REGISTERED INVESTMENT ADVISER. INFORMATION PRESENTED IS FOR EDUCATIONAL PURPOSES ONLY AND DOES NOT INTEND TO MAKE AN OFFER OR SOLICITATION FOR THE SALE OR PURCHASE OF ANY SPECIFIC SECURITIES, INVESTMENTS, OR INVESTMENT STRATEGIES. INVESTMENTS INVOLVE RISK AND UNLESS OTHERWISE STATED, ARE NOT GUARANTEED. BE SURE TO FIRST CONSULT WITH A QUALIFIED FINANCIAL ADVISER AND/OR TAX PROFESSIONAL BEFORE IMPLEMENTING ANY STRATEGY DISCUSSED HEREIN.

Twitter: @_SeanDavid

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.