Earnings Expectations Dropping Rapidly

Markets tend to peak before weakness shows up in economic and corporate data. The S&P 500 has not posted a new high since May 2015. Markets may have anticipated a slowdown in corporate earnings. From The Wall Street Journal:

Wall Street’s earnings estimates for S&P 500 companies are falling at the fastest pace since the height of the financial crisis. Since the start of 2016, Wall Street has gone from anticipating 0.3% growth in first-quarter earnings for S&P 500 companies to an 8% decline, according to FactSet. It is the biggest such shift since the start of 2009.

Has The Rally In Stocks Changed The Primary Trend?

This week’s stock market video asks numerous binary questions about the stock market’s primary trend in an attempt to better understand the context of the strong three-week rally in equities.

This Week’s Stock Market Video:

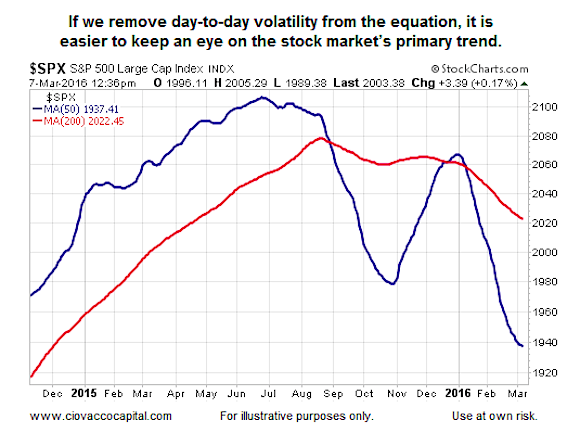

A Picture Is Worth A Thousand Words

The S&P 500’s 50-day moving average can help us monitor the market’s intermediate-term trend. The 200-day can be used as a gauge for longer-term trends. Even after the strong rally in stocks, the trends can still be categorized as concerning.

Given the facts in hand as of last Friday’s close, our allocations are still carrying an overweight to defensive assets relative to growth-oriented assets. If the S&P 500 is able to recapture and hold 2020, our market model’s interest in growth assets should begin to pick up at a more meaningful rate.

Thanks for reading.

Twitter: @CiovaccoCapital

Read more from Chris on the CCM blog.

Author or his funds have long positions in related securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.