The equity markets, after a slow start, recovered late in the week with many of the popular stock market averages finishing the period within a fraction of the record highs. This suggests that the path of least resistance remains to the upside.

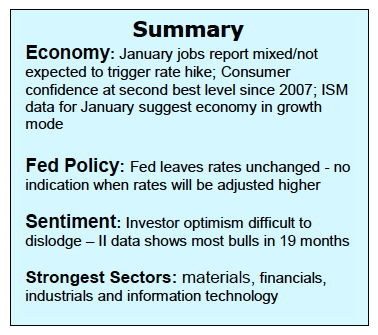

Stocks were supported by fresh economic data indicating business conditions are improving, albeit slowly. This theme was supported by the January Employment report that showed job creation continuing at a moderate pace without the burden of rising wage costs on profits and inflation. This news bumped the S&P 500 (INDEXSP:.INX) higher on Friday.

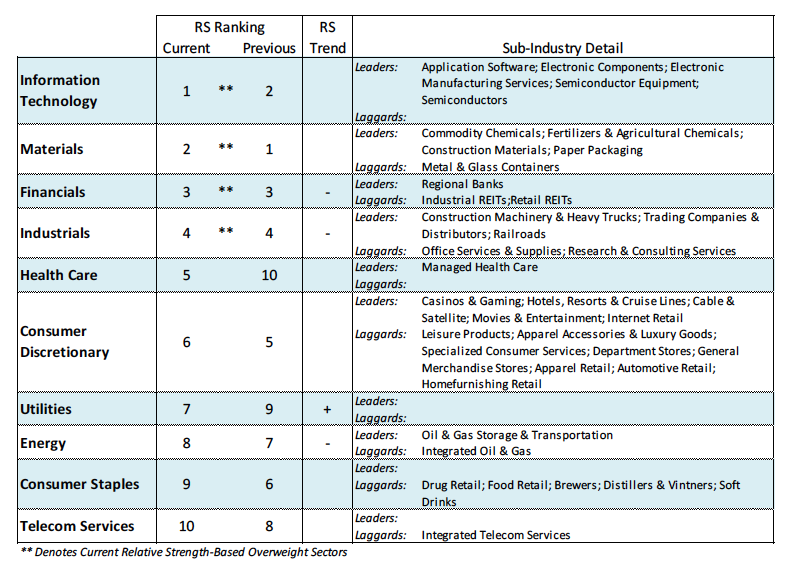

Federal Reserve Chief Janet Yellen appeared to be sending a corresponding message earlier in the week with dovish remarks on the future path of interest rate increases. Despite news concerning international trade, the latest global PMIs indicated that the world economy was gaining a measure of upside strength and momentum. Improving economic trends have not been lost on the stock market with cyclical and commodity sectors outpacing defensive sectors in 2017. The equity markets tend to do best during periods when economic growth is not too fast paced to cause inflation to interfere.

The technical indicators for the equity markets are bullish on balance but measures of investor psychology remain problematic. Although market trends have been decidedly positive, forward progress in the stock market since mid-December has been handicapped by historically high valuations and excessive investor optimism.

Stock Market valuation models are not very reliable when used as forecasting tools but they do offer insight when trying to evaluate market risk and investor sentiment. The fact that investors are willing to pay a lofty premium for stocks relative to earnings and revenue indicates an unusually high level of confidence. Typically, when optimism becomes excessive it is an indication that near-term liquidity has been exhausted which impedes forward progress.

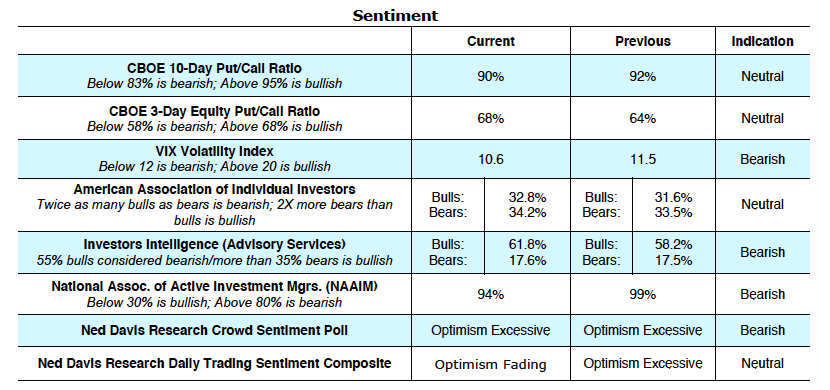

Several surveys of investor sentiment including the latest report from Investors Intelligence (II) also show an unusually high level of investor confidence. Last week’s II data showed 62% of Wall Street letter writers bullish on the stock market, a 19-month high. This is in sharp contrast to just 25% bulls at the bottom of the market in February 2016. The latest report from the National Association of Active Investment Managers (NAAIM) points to a similar outlook. The NAAIM data shows the professional money managers have a nearly fully invested allocation to stocks of 94%. At the February 2016 lows, this group of investors’ allocation to stocks was just 22%. The sentiment statistics suggest that stocks remain vulnerable to a short-term pullback but any weakness that could develop is expected to be limited in both time and price.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.