Broad Stock Market Outlook for March 9, 2018

Stocks jumped higher on the jobs report, but have stalled around 2750-2755 resistance. We sit in congested zones in a simmering battle of power between buyers and sellers. Any pullbacks will still find buy zones.

A shift of momentum now has us bullish in these intraday spaces with tests of resistance likely to slow trading before attempting another press forward.

S&P 500 Futures

Price resistance holds near 2749.5 today and above that at 2762.5. A failure to hold above 2734.75 would force traders back to contested regions further below. Sellers will need to force price below 2712 before they have a shot at re-taking control. The bullets below represent the likely shift of trading momentum upon positive or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 2750.25

- Selling pressure intraday will likely strengthen with a bearish retest of 2712.5

- Resistance sits near 2749.75 to 27454.5, with 2762.25 and 2773.75 above that.

- Support sits between 2734.5 and 2720.5, with 2712.25 and 2689.5 below that.

NASDAQ Futures

Bounce patterns continue as we breach all-time highs on the horizon. Momentum is still bullish and pullbacks will be buy zones. Solid support today sits higher near 6974 – but we have a gap due to the contract roll that is likely to fill after the spike up fades. The bullets below represent the likely shift of intraday trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 7047.5

- Selling pressure intraday will likely strengthen with a bearish retest of 7008.25

- Resistance sits near 7049.75 to 7102.5 with 7125.5 and 7142.5 above that.

- Support sits between 7014.5 and 7002.75, with 6987.5 and 6932.75 below that.

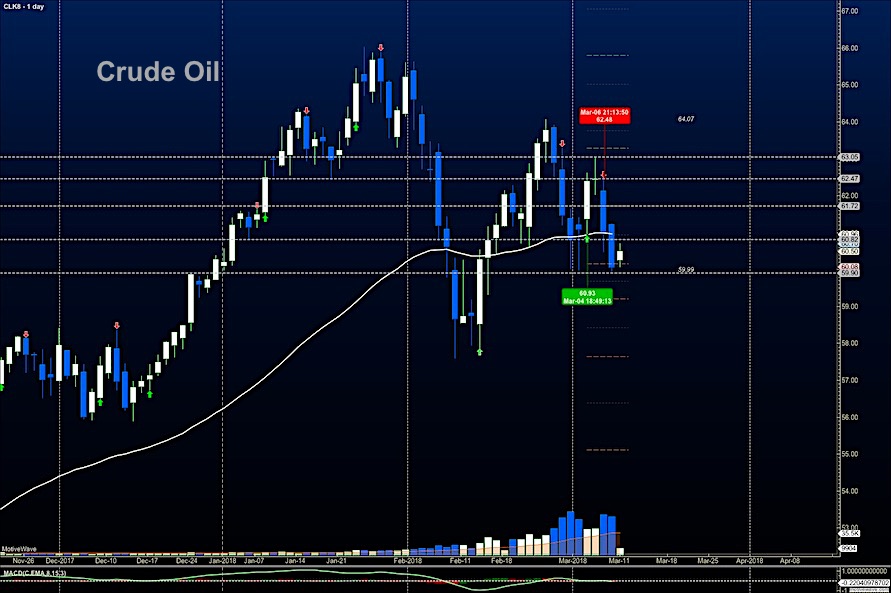

WTI Crude Oil

Buyers hold 60 against the sellers and we have been forced into regions near 61 once again- though without a breach. For yet another day, we sit with new lower resistance and lower support – suggesting that bounces will fail. The bullets below represent the likely shift of intraday trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 61.35

- Selling pressure intraday will strengthen with a bearish retest of 60.7

- Resistance sits near 60.89 to 61.35, with 61.85 and 62.39 above that.

- Support holds near 60.21 to 59.96, with 59.56 and 59.12 below that.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.