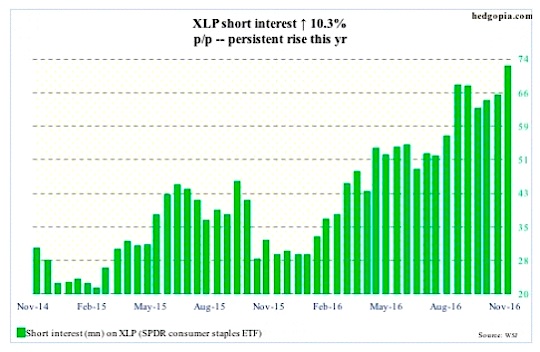

SPDR Consumer Staples Sector ETF (NYSEARCA:XLP) – short interest ↑ 10.3% p/p, ETF ↓ 3.9%

The ETF represents one of the sectors that have been on the receiving end post-Trump win. Leading up to this, XLP had been hovering around the 200-day moving average, which it tried to rally past on the 8th but the attempt was vehemently rejected at the 50-day. Once the election results were out, the ETF got slammed.

Interestingly, rather than locking in profit, shorts piled on. This could potentially be a source of squeeze once interest rates peak, and money begins to shift toward high dividend yielders.

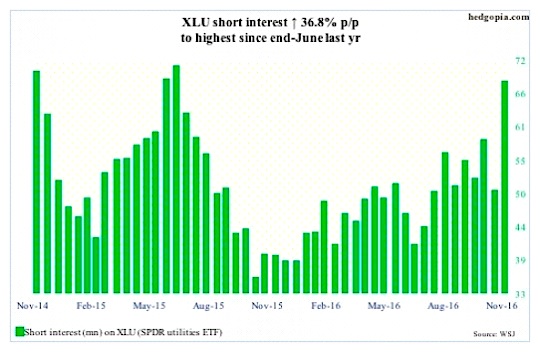

SPDR Utilities Sector ETF (NYSEARCA:XLU) – short interest ↑ 36.8% p/p, ETF ↓ 5.4%

Another one of those sectors that was taken to the woodshed post-election. XLU lost both 50- and 200-day moving averages. As is the case with XLP, shorts used this as an opportunity to add to. A squeeze waiting to happen in due course?

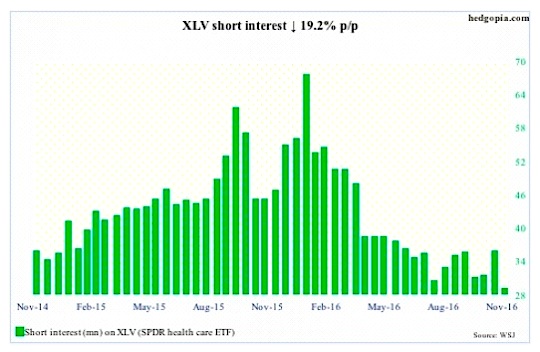

SPDR Health Care Sector ETF (NYSEARCA:XLV) – short interest ↓ 19.2% p/p, ETF ↑ 4.6%

Going into this, XLV was increasingly pricing in a Clinton victory, as it had been under pressure since early August.

Despite this, shorts were not too aggressive. Tough to say if they sensed something or it was sheer luck. But those that stayed short got squeezed, as post-election the ETF, which closed the period at $70.47, rallied as high as $72.08.

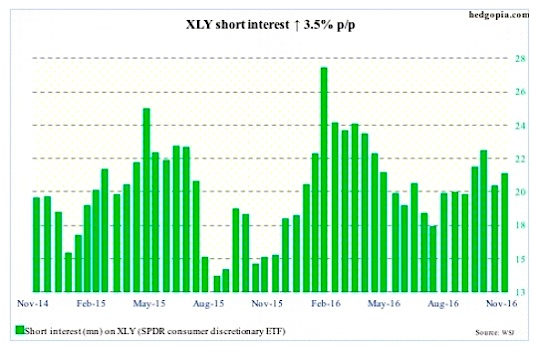

SPDR Consumer Discretionary Sector ETF (NYSEARCA:XLY) – short interest ↑ 3.5% p/p, ETF ↑ 2.5%

The ETF lost the 200-day moving average early on during the period, but its fortunes quickly did a 360 thanks to the election results. Both 50- and 200-day moving averages were recaptured. To boot, a two-month downtrend line was taken out as well. Shorts are betting – albeit not too aggressively – that the rally is not going to last.

Thanks for reading!

Get more investing insights from Paban’s blog.

Twitter: @hedgopia

Author may hold a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.