The stock market rallied last week as the Federal Reserve came out with a multi-trillion-dollar stimulus to help businesses, workers and municipalities and with measures to continue to stabilize the markets.

Congress approved a Phase Three relief package for small businesses and workers.

These efforts are still working their way through our economic and financial system.

The markets also reacted to signs that the efforts to contain the covid-19 virus are starting to pay off in New York and in other countries like Spain, Italy, France and Austria.

Last week’s 6.6 million jobless claims was bad, but it was not unexpected. In just three weeks, 17 million people joined the unemployed which is 10% of the United States labor force. This week quarterly earnings announcements will begin.

The S&P 500 Index and broader stock market has likely priced in a painful quarter or two and may react with the same resiliency that followed last week’s dismal jobless claims number.

The consumer was the backbone of our economy before we were hit with the virus. Consumers want clarity regarding the outlook for the virus and the economy in order to gain the confidence to be able to leave their homes and resume some semblance of their previous lives.

We are seeing that progress is being made in our fight to defeat this virus. Hospitalizations and new cases are slowing and the outlook for deaths has been slashed down to 60,000 (about half of the original projection).

The focus is now on opening the economy back up. We have the risk, as the President says, of the cure being worse than the disease if we don’t begin to safely restart the economy. The plan will be to unlock the economy on a rolling basis over the next four to eight weeks. Every section of the country is on a different part of this roller coaster. Different policies will be required for different areas of the country.

Next week, the President will announce an economic task force comprised of business leaders and government officials to determine how and when to open the economy.

The rally the past two weeks has produced two sessions with upside volume overwhelming downside volume by a ratio of 10-to-1 or more. This indicates that the downside momentum has been broken, which is an important step for a sustainable recovery. The improved market breadth does not eliminate the possibility of a retest, but it suggests the magnitude of any retest could be less damaging.

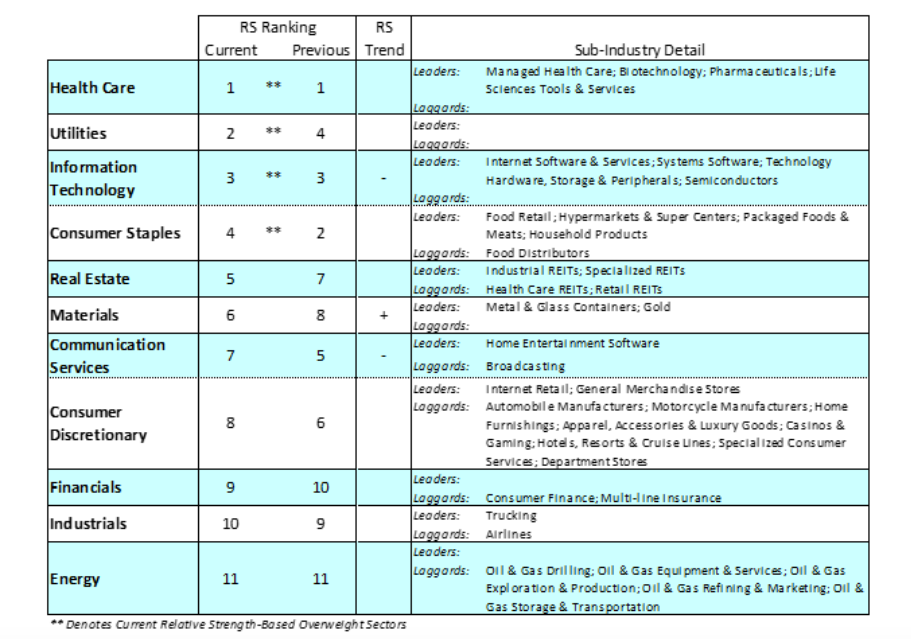

Volatility will likely continue based on the markets’ reactions to the daily headlines. This should give investors opportunities to rebalance their portfolios to match their goals and risk tolerances. The strongest areas of the market include healthcare, information technology, consumer staples and utilities.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.