Questioning why

There is a cause and effect to everything, so what caused this recent rapid pullback? There are two catalysts that seem to be getting most of the blame. Firstly, it seems the implosion of short volatility investment products at least exasperated the sell-off. These strategies have ballooned in popularity as volatility in the market remained benign for an extended period.

We view these strategies similar to picking up nickels in front of a steam roller. It is really easy money until your shoelace gets stuck and you get flattened.

That moment happened last Monday when the S&P Volatility Index (VIX) more than doubled in one trading session causing these products to implode. The strategy of being short equity volatility goes beyond a few popular ETFs to managers employing risk parity, shorting long volatility and other similar strategies. The massive amount of capital in this trade sucked up a lot of the liquidity in the market, because those investors had to sell stocks to cover their shorts, switch to bonds or chase the losing trade, in hopes that volatility will normalize.

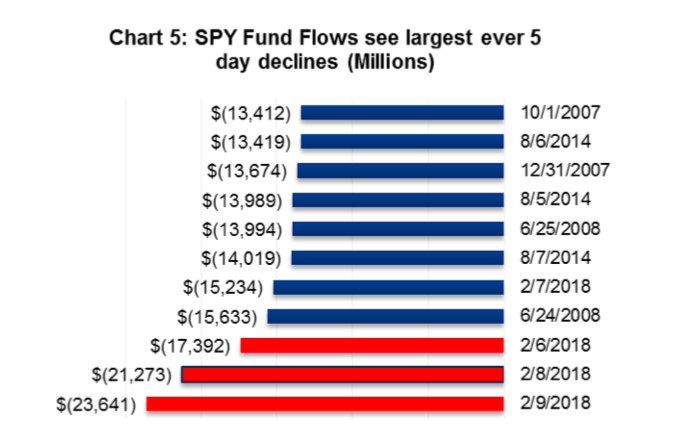

As evidence of the unwind out of equities, the largest ETF in the world SPY saw three of its largest ever rolling 5-day outflows last week with the fund shrinking by $23.6 billion last week. (Chart 5 below)

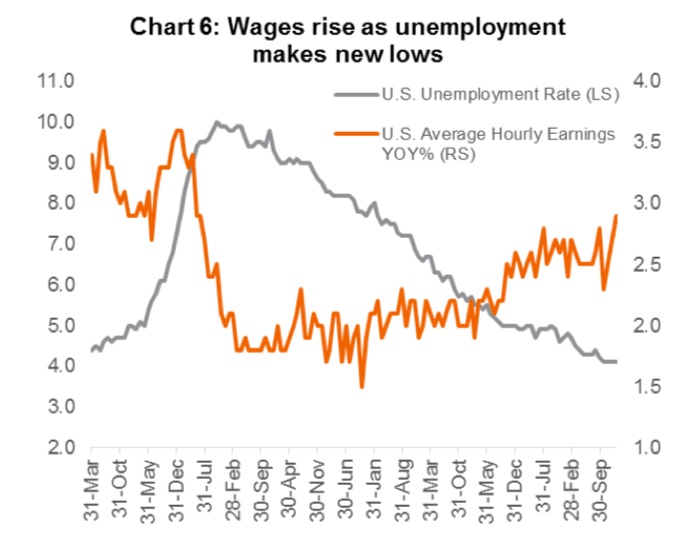

The other potential cause, and one to which we are paying more attention, came from the jobs report last Friday, when the U.S. reported the largest average hourly earnings increase since 2009. (Chart 6 below)

Labor is the biggest input cost in almost every business and the fear is that higher wages and a tighter labour market will spur inflation. Benign inflation has been the reason why the Federal Reserve (FED) has been able to be so accommodative for so long. Despite the FED hiking rates for over a year, they have been tepid, cautious and very data dependent. Should the “FED put” (the feeling that the FED will back stop the markets) be removed and rate hikes happen more rapidly, that could invert the yield curve, derail growth and potentially tip the economy into a recession.

We are on guard, looking for green shoots of inflation and were going to write about it in this Ethos but then the DOW Jones Industrial Average traveled 20,000 points over the week, so we pivoted our publication.

Portfolio Implications

Our thoughts are that inflation is still being undervalued by the market and that the rise in bond yields will continue. This will be negative for long duration assets like bonds or high yielding, interest rate sensitive equities but positive for cyclicals. We have positioned our fundamental portfolios to tilt toward cyclical stocks with a yield and underweighting interest rate sensitive securities. This positioning has been working as of late and is likely how we will remain positioned until we see yields reaching a crescendo, where they would start to move lower. In the meantime, we have been taking advantage of the recent market weakness using dry powder (cash) to buy names on our shopping list that are now looking much more attractive.

Charts are sourced to Bloomberg unless otherwise noted.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.