Near-Term Stock Market Outlook: Stocks Consolidating Gains After Rally to New Highs

Highlights & Considerations:

- Economy Providing Upside Surprises

- Investor Optimism Moves Toward Elevated Levels

- Presidential Election Noise Could Be a Distraction

- Bullish Breadth a Tailwind for Stocks

As the stock market rollercoaster that has been 2016 heads through the third quarter, the weight of the evidence remains mildly bullish. In some ways the last six weeks have been a microcosm of the entire first half. An early swoon and recovery followed by an abrupt settling into a narrow trading range. The two-day plunge in stocks (in the wake of the Brexit vote) was followed by a sharp turn higher. This carried the S&P 500 Index (INDEXSP:.INX) through resistance and into record high territory. New highs, however, brought increased (and by some measures excessive) optimism. Stocks struggled to make headway over the course of the second half July and rally yielded consolidation.

Following the nearly 10% rally off of the post-Brexit lows and the increase in optimism that accompanied it, consolidation at this point is a healthy development. But that does not mean that it is not at times frustrating. Working off overbought conditions through time allows optimism to ease. Importantly, breadth remains robust. This Fundamentals are not expected to change much on the second half of the year, although we are hopeful that economic growth will re-accelerate and this could provide a boost to earnings. More likely, we will continue to watch the interplay between breadth and sentiment, with the presidential election likely to keep the roller coaster ride going as we head toward Election Day. The good news is that regardless of near-term seasonal uncertainties, stocks tend to rally post-election, regardless of the outcome.

The noise of 2016 is diminished somewhat if we look at a weekly chart of the S&P 500. Put into broad perspective, the July rally to new highs follows 18 months of price consolidation and suggests a new up-trend is emerging. This is supported by evidence of an up-turn in momentum. The initial stages of the price consolidation were accompanied by a deteriorating trend in momentum. That has now changed and momentum broke out to the upside ahead of price.

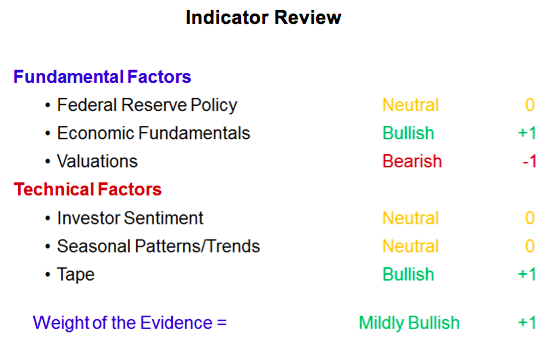

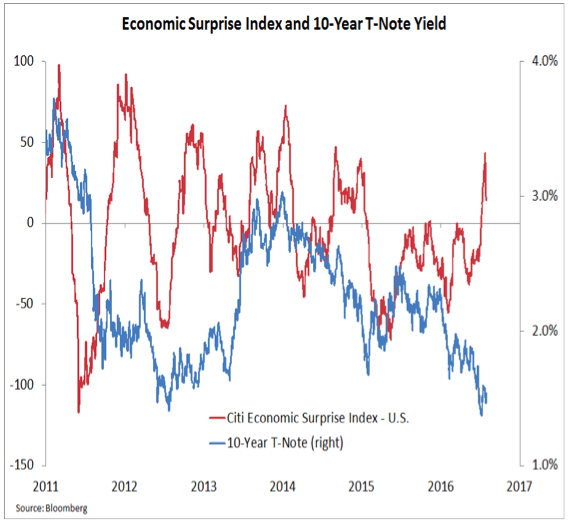

Fed policy is neutral. Actual Fed actions could probably be considered bullish, but in an effort to provide clear communications, the Fed itself, and its coterie of officials on the speaking circuit contribute a fair amount of noise and uncertainty. The Fed did not take action in June (apparently spooked by a poor jobs report for May and not wanting to move ahead of the Brexit vote). It held its fire again in July, although indicated that global risks seemed to be diminishing. If economic data continues to surprise on the upside (as it has over the past month), pressure may build for the Fed to move rates higher in September.

Economic fundamentals remain bullish. Not only has the data surprised to the upside relative to expectations, but we are seeing evidence of real progress in slowly developing trends. Overall labor market conditions remain on firm footing (the disappointing May jobs report was followed by a much stronger-than-expected increase in hiring in June). Better evidence of the health of the labor market comes from the trend in wage growth. Especially noteworthy is the uptick in the growth of wages for job switchers (at its highest point since 2007). Fueled by rising wages and steady job growth, consumption rose by over 4% in the second quarter of 2016.

continue reading on the next page…