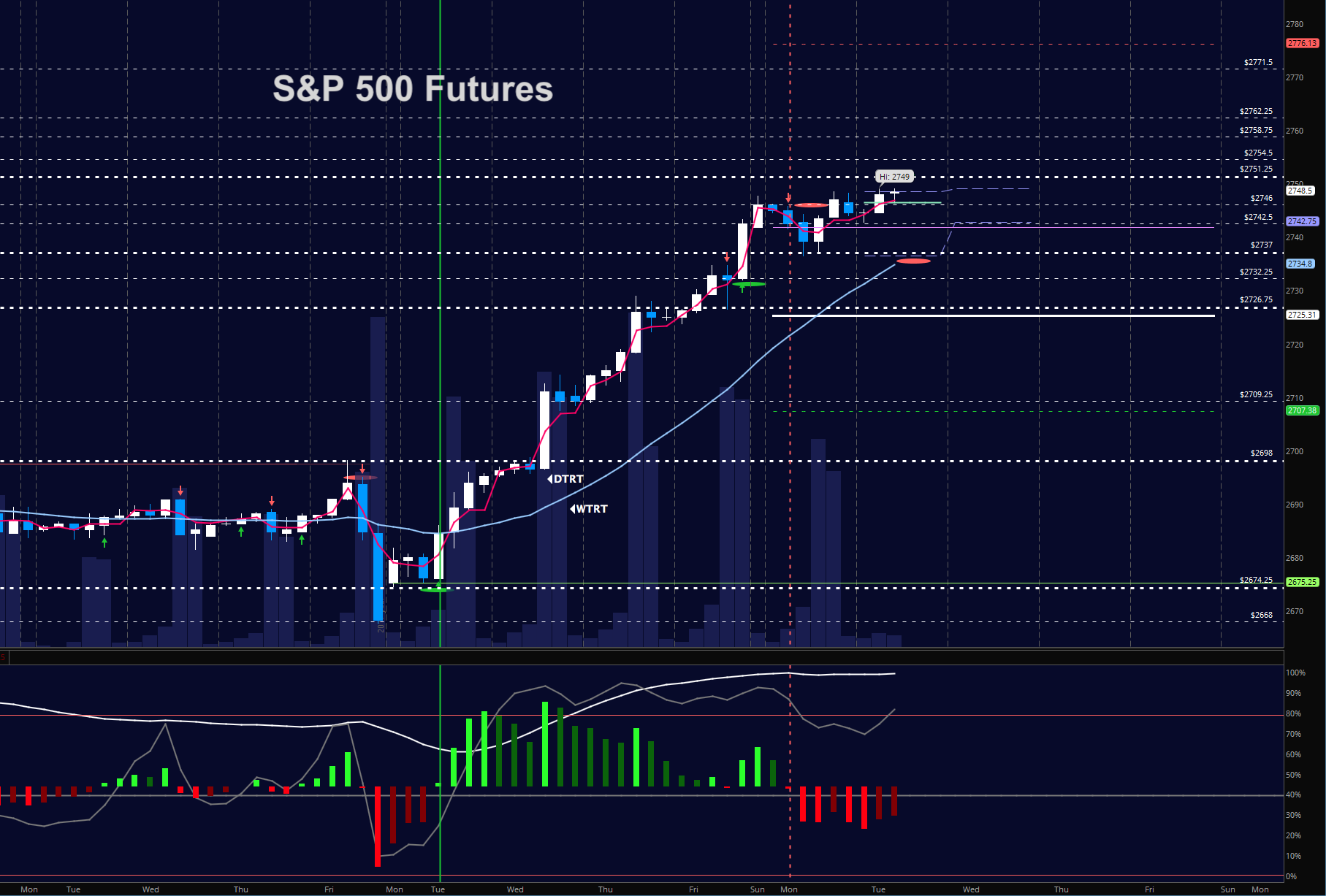

The S&P 500 continues to grind higher and the action thus far today is more of the same. But traders need to stay alert here, as complacency is present.

S&P 500 Trading Considerations For January 9, 2018

Traders held 2736 as support nicely in this chart and climbed to new highs once more. WSJ suggests that traders are not purchasing insurance in the form of puts with any regularity as they consider it a waste of money at this time. This type of news always makes me consider potential downside action so I’m watching support for the bounce play and not the breakout continuation long intraday. Swift short trades will be considered with the loss of 2746 if momentum drifts negative. Currently, this momentum holds steady and bullish on longer time frames meaning that fades will be met by value buyers again. The bullets below represent the likely shift of trading momentum at the positive or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 2748.5

- Selling pressure intraday will likely strengthen with a failed retest of 2736

- Resistance sits near 2751.5 to 2753.25, with 2757.25 and 2762.75 above that.

- Support holds between 2742.5 and 2736.5, with 2726.25 and 2709.25 below that.

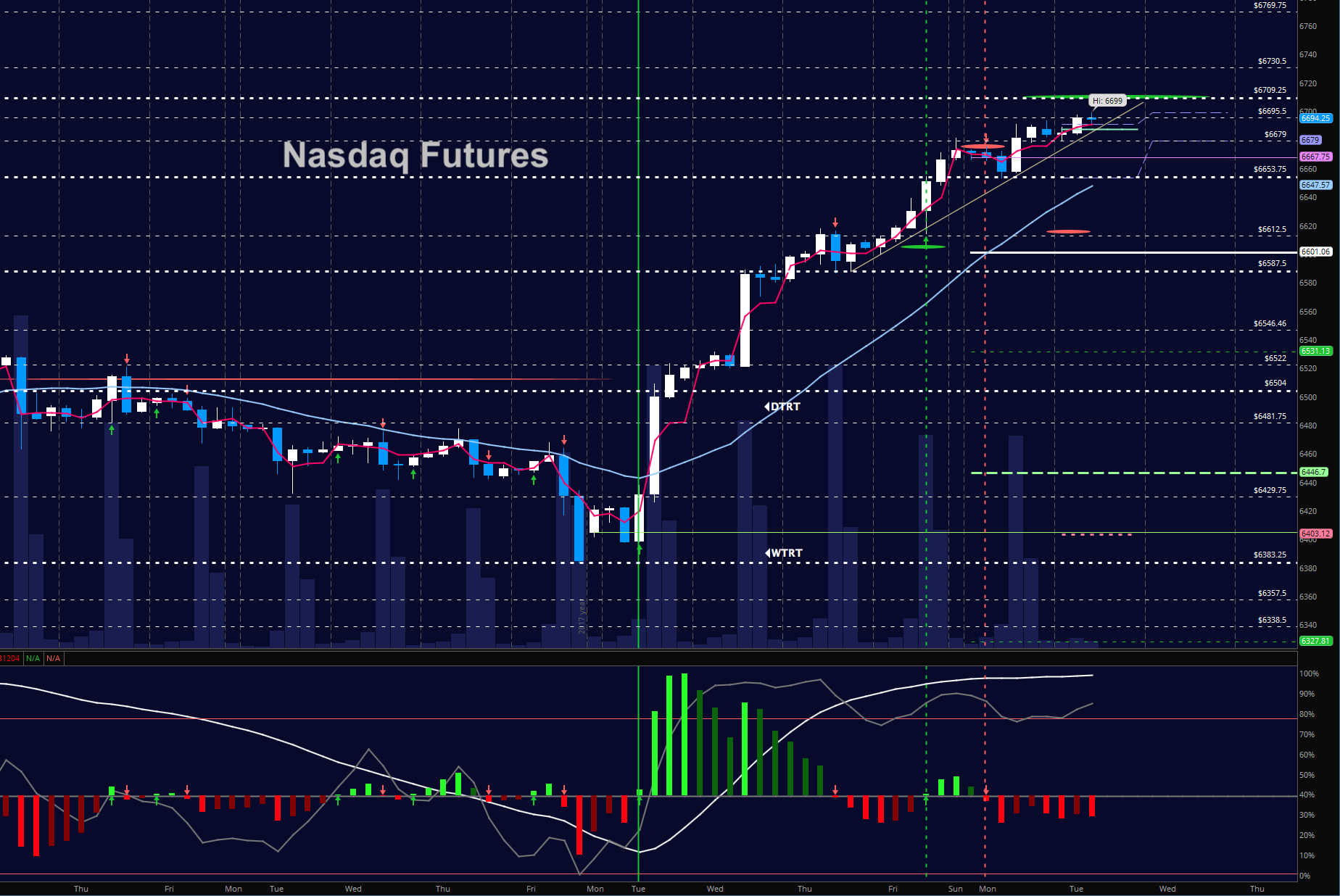

NASDAQ Futures

New highs continue here with support mow sitting near the breakout region of 6680. As I mentioned yesterday, buying pressure remains quite strong so a breakdown of any kind will need a failed retest of old support. As the formation sits now, there is the possibility of a rising wedge breaking down but value participants will enter to slow the drift. The bullets below represent the likely shift of intraday trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 6696.75

- Selling pressure intraday will likely strengthen with a failed retest of 6672.75

- Resistance sits near 6699.5 to 6709.75 with 6716.5 and 6730.75 above that.

- Support holds near 6679 and 6653.75, with 6627.5 and 6594.5 below that.

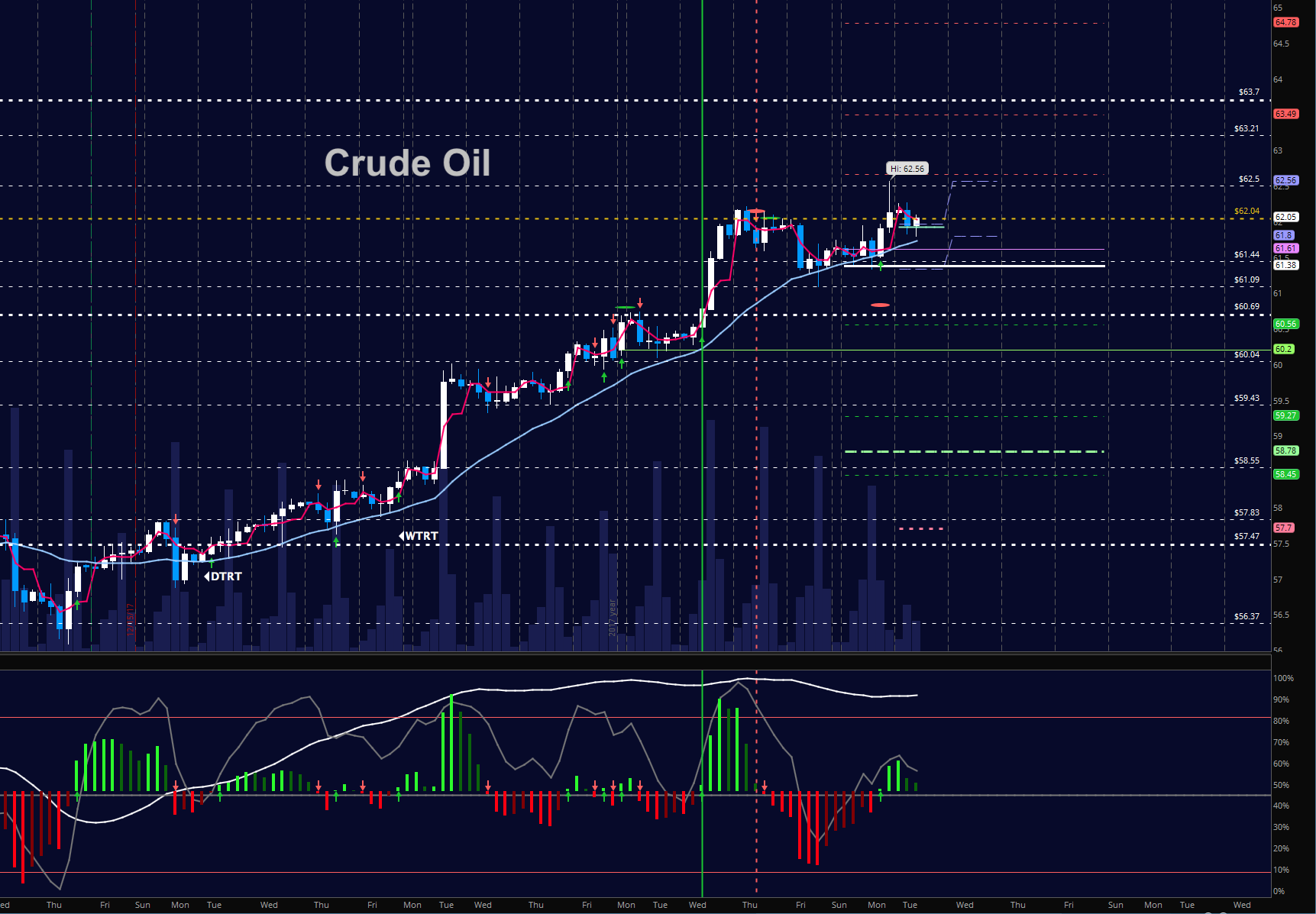

WTI Crude Oil

Traders hold their bullish stance for another as we work towards the tests of higher levels near 62.65 but with bigger numbers near 63.7 and 65.4 as quite likely. The key level for buyers to hold today still sits near 61.3. The bullets below represent the likely shift of trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 62.14

- Selling pressure intraday will strengthen with a failed retest of 61.09

- Resistance sits near 62.1 to 62.56, with 62.78 and 63.27 above that.

- Support holds near 61.34 to 61.09, with 60.77. and 60.24 below that.

If you’re interested in the live trading room, it is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.