Broad Market Outlook for January 22, 2018

The grinding bullish undercurrents that investors have seen to start the new year are currently being tested. Traders may try to take advantage of potential reversals. Be patient and watch your price supports! S&P 500 futures are trading flat (no change) in early trade.

Note that you can access today’s economic calendar with a full rundown of releases.

S&P 500 Futures

Resistance remain near 2809 and support to watch today is 2797. The government shutdown with a goal to keep it in play until the presidential address on Jan 30 sends a bit of a messy patch to traders. Short triggers are in play into support. The bullets below represent the likely shift of trading momentum at the positive or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 2806.75

- Selling pressure intraday will likely strengthen with a failed retest of 2790.75

- Resistance sits near 2806.75 to 2815.5, with 2818.5 and 2821.5 above that.

- Support holds between 2802.25 and 2791.25, with 2781.5 and 2768.5 below that.

NASDAQ Futures

The NQ_F had stalled as with the others but has not decisively determined a region for support tests and this instrument remains strong. Support watch is important in this formation, so we need to keep an eye on 6830.5 to see how strong the bearish action. The bullets below represent the likely shift of intraday trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 6846.75

- Selling pressure intraday will likely strengthen with a failed retest of 6830.75

- Resistance sits near 6846.5 to 6856.5 with 6872.5 and 6912.5 above that.

- Support holds near 6830.25 and 6827.75, with 6819.5 and 6789.25 below that.

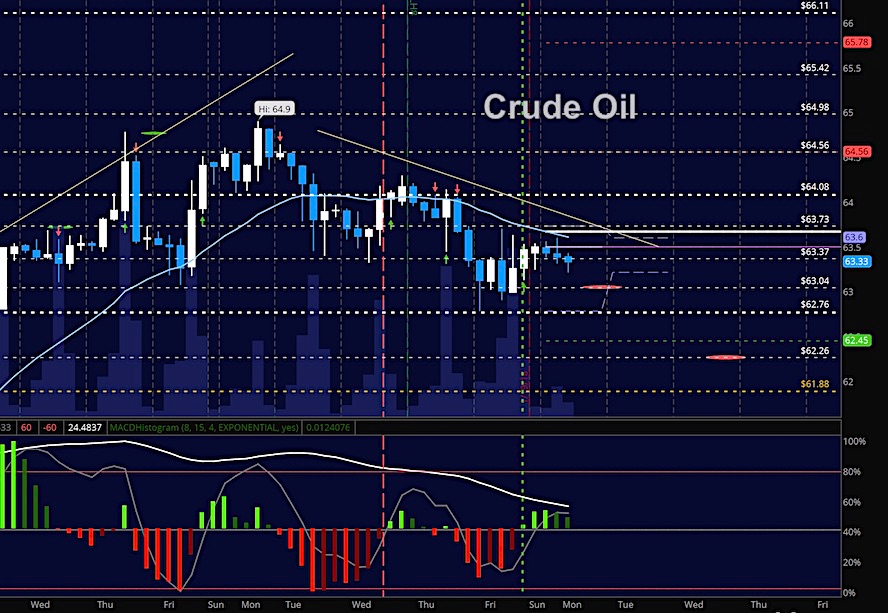

WTI Crude Oil

Weakness continues to develop as traders offload contracts for profit while a smaller group begins to short. The region to watch today will be near 63 as losing this area will send us to 62.72 and then 62.2. Momentum continues slightly bearish suggesting another test of support below is ahead. The bullets below represent the likely shift of trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 63.76

- Selling pressure intraday will strengthen with a failed retest of 63.12

- Resistance sits near 63.6 to 63.94, with 64.3 and 65.14 above that.

- Support holds near 63.13 to 62.72, with 62.26 and 61.89 below that.

If you’re interested in the live trading room, it is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.