Broad Market Outlook for Jan 30, 2018

As mentioned yesterday and in days before, price support watches become very important as price expands and falls through initial support. Once that break occurs across the stock market indices, traders have to be patient with the charts.

Note that you can access today’s economic calendar with a full rundown of releases.

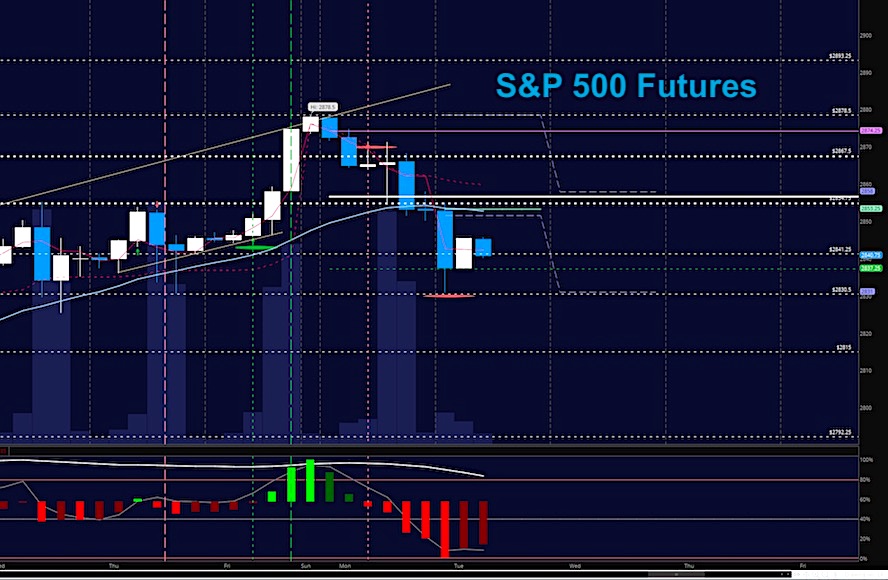

S&P 500 Futures

Weak morning bounces yesterday delivered the ‘one-two’ punch to buyers eager to get involved and the loss of the 2862 level did advance selling as suspected. Today the VERY important level of 2829 is on the horizon as support to hold. You can clearly see what I mean about buying breakouts from yesterday’s price action being the poor course of action. This morning’s drift is sure to bounce as well but a failure to breach 2852 will bode poorly for the buyer. Watch your resistance – if buyers can’t breach and hold, we have another drift down on the horizon. The bullets below represent the likely shift of trading momentum at the positive or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 2854.75

- Selling pressure intraday will likely strengthen with a failed retest of 2829.75

- Resistance sits near 2847.75 to 2854.75, with 2861.25 and 2872.5 above that.

- Support holds between 2836.25 and 2831, with 2825.25 and 2809.75 below that.

NASDAQ Futures

Yesterday we had quite the battle at 6982 but buyers did not prevail. As a result, this will be resistance to overcome on the bounce in progress. Momentum slips bearish but buyers are clearing at work this morning. Watch that level at 6982. The bullets below represent the likely shift of intraday trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 6986.75

- Selling pressure intraday will likely strengthen with a failed retest of 6941.5

- Resistance sits near 6982.25 to 7002.25 with 7028.5 and 7047.5 above that.

- Support holds near 7004.75 and 6943.75, with 6925.25 and 6887.25 below that.

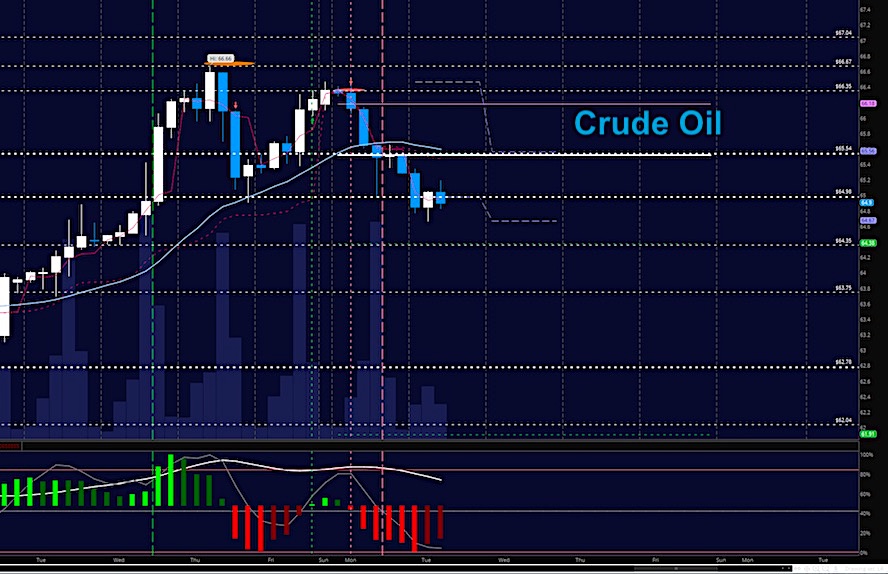

WTI Crude Oil

We tested the lows of Thursday on the predicted path of price with the loss of 65.24 – but that is now resistance in the grind downward as traders jockey position. With a record number of long positions, shifts to price could be erratic so use caution and watch for the known regions of congestion to give us a lifting space. Failure to hold 64.6 today will bring the target of 64.04 into view. Watch resistance to see the strength of sellers show their hands. The bullets below represent the likely shift of trading momentum at the positive or failed tests at the levels noted. API after the close today.

- Buying pressure intraday will likely strengthen with a positive retest of 65.56

- Selling pressure intraday will strengthen with a failed retest of 64.6

- Resistance sits near 65.4 to 66.18, with 66.35 and 67.04 above that.

- Support holds near 64.67 to 64.35, with 63.78 and 63.11 below that.

If you’re interested in the live trading room, it is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.