Broad Market Outlook for Jan 29, 2018

Stocks are dipping lower this morning but will likely find value buyers at lower levels. That said, drifting strength could mean deeper dips in hours ahead. Keep careful watch on those price support levels for holds to enter. As well, watch for old resistance on bigger timeframes to prove out as new support.

Note that you can access today’s economic calendar with a full rundown of releases.

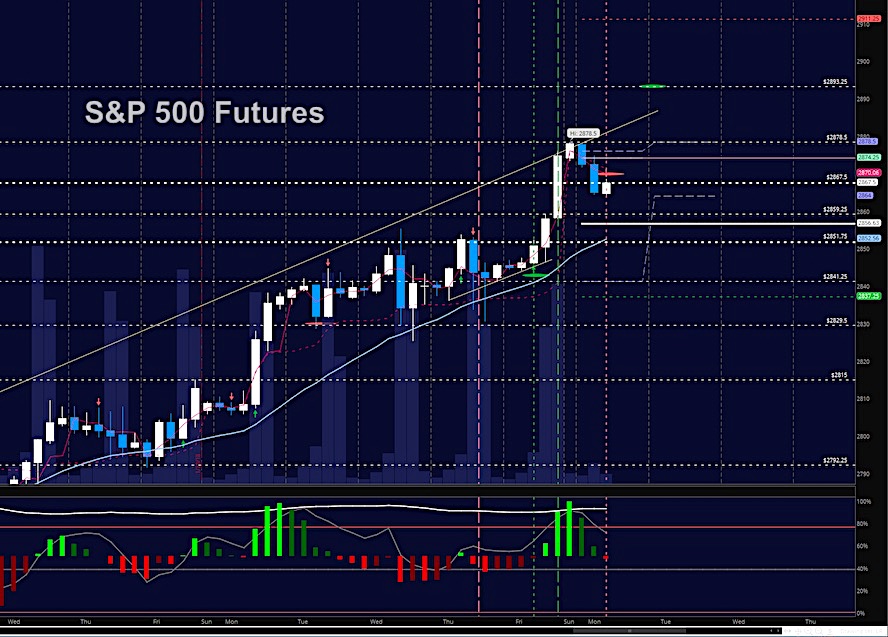

S&P 500 Futures

Mixed momentum continues in a swing back and forth between dip buyers and new resistance sellers. Buying the breakouts will stretch our risk thresholds and continue to be ill-advised. This morning’s drift is sure to bounce, but how well that first bounce holds will likely deliver the path for the day ahead. The bullets below represent the likely shift of trading momentum at the positive or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 2874.75

- Selling pressure intraday will likely strengthen with a failed retest of 2862.75

- Resistance sits near 2872.75 to 2878.75, with 2882.25 and 2893.5 above that.

- Support holds between 2864.25 and 2859.25, with 2851.25 and 2841.75 below that.

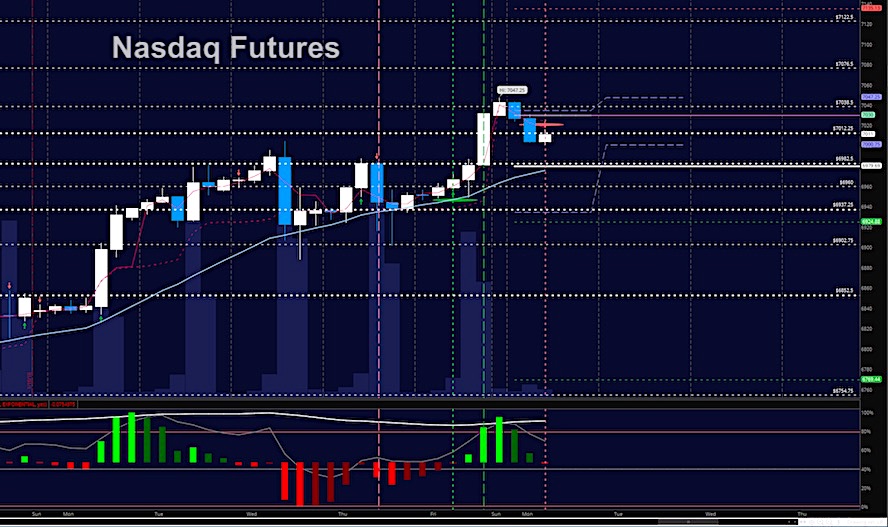

NASDAQ Futures

The traders working with this chart pressed new highs well into further target zones defined in the Members Only blog. With that key level of 7038 tested (seen on Friday’s images) was breached and rejected and remains a key resistance level. Today we expect a test of support areas near 6982.5 before a solid bounce holds but with divergent action all around we could whipsaw within a broader range. The bullets below represent the likely shift of intraday trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 7014.75

- Selling pressure intraday will likely strengthen with a failed retest of 6979.5

- Resistance sits near 7012.25 to 7030.25 with 7038.5 and 7076.5 above that.

- Support holds near 7004.75 and 6994.75, with 6982.25 and 6863.25 below that.

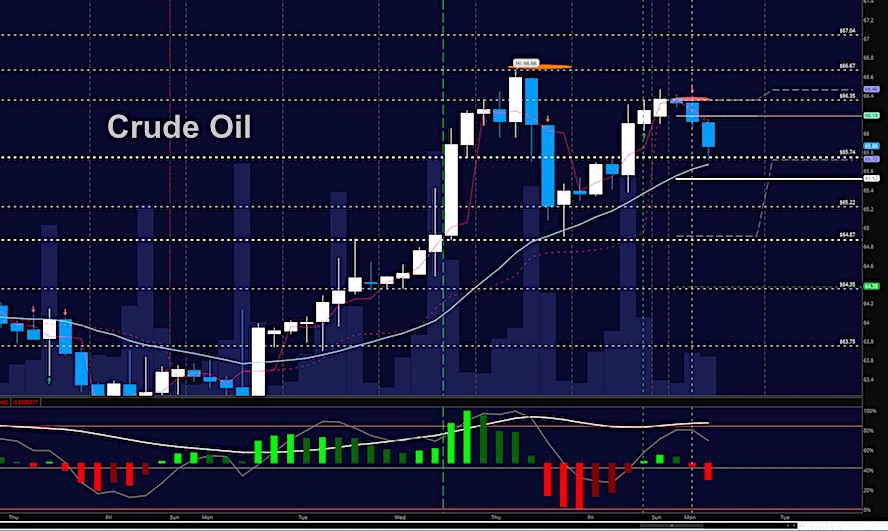

WTI Crude Oil

The support level to watch remains near 65.8 was traders chop back and forth in congestion almost 100 ticks wide from 65.22 to 66.2. Failure to hold 65.24 today will bring the lows of Thursday into view. The bullets below represent the likely shift of trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 66.36

- Selling pressure intraday will strengthen with a failed retest of 65.24

- Resistance sits near 66.18 to 66.36, with 66.74 and 67.46 above that.

- Support holds near 65.64 to 65.24, with 64.92 and 64.4 below that.

If you’re interested in the live trading room, it is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.