The outlook for stock market futures is a bit uncertain today as it is likely to be affected by the jobs report, as well as a rising wedge that persists on the S&P 500 futures.

Quiet trading into the monthly job numbers highlighted the suspense and backdrop for trading in stock market futures today. A test of support below is still likely. That said, buying pressure still remains in full swing.

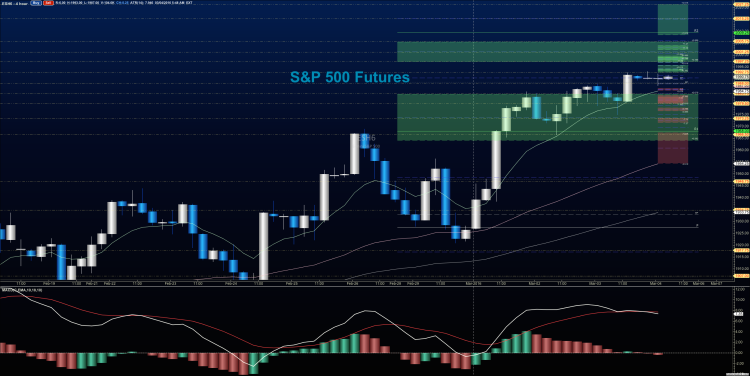

A breach above the premarket highs of 1993 may test 1995.25 and 2001.25. Charts do not point to any range expansion today that will hold. Rejection at the top edges seems quite likely, but again down into higher support levels. S&P 500 futures charts will likely become vulnerable to sellers on a decline below 1984.5 – and that could accelerate on a move below 1974.

Momentum on the four hour chart is flat, and some negative divergence is present. The jobs number should provide the catalyst for movement out of the tight trading range this morning. Daily charts continue to show momentum as trending positive, and in positive territory.

Shorter time frame momentum indicators are sloping down but still in positive territory. 1971-1974 is the support region to watch for sellers to test and for buyers to hold if this chart rolls over.

See today’s economic calendar with a rundown of releases.

THE RANGE OF TUESDAY’S MOTION

Crude Oil Futures (CL_F)

Crude Oil is in a trading range between 34.2 and 34.9 – price pressure seems strong, but negative divergence continues.

Today, the trading ranges on crude oil futures are between 33.5 and 35.78. Expansions outside those zones will retest, and if held will advance in the direction of the break. Use the 1hr chart to assist there.

Moving averages in oil show us at a decision zone with drifting momentum on longer time frames. This generally gives rise to buyers showing up when it seems like the chart will roll. Support holds tightly at 33.5

Intraday long trading setups on crude oil futures suggest a long off 34.98 positive retest, or 34.24 bounce into 34.46, 34.78, 35.05, 35.2 and if buyers hold on, we’ll see 35.45 to potentially 35.75.

Intraday short trading setups suggest a short below a 34.3 failed retest with negative divergence, or the failed retest of 35.48 sends us back through targets at 34.2, 33.86, 33.56, 33.23, 32.87, 32.59, 32.35, 32.02.

Have a look at the Fibonacci levels marked in the blog for more targets.

E-mini S&P 500 Futures (ES_F)

Below is a S&P 500 futures chart with price support and resistance trading levels for today. Click to enlarge.

Overnight behavior has been very quiet as traders await the Jobs report. Stock market futures for March 4 may struggle to breakout as we have yet to see range expansion. We are retesting 1992 on S&P 500 futures from yesterday’s resistance with minor divergent momentum.

If the chart rolls over and loses 1984, the region of 1971-1974 remains a congested zone and may provide support, else we have those levels near 1968 to look toward as targets. The S&P 500 futures chart will be vulnerable to selling below 1984 if it does not quickly recover after losing the level.

Upside motion has the best setup on the retest of 1987.75 or a breach of 1993 with positive momentum. I use the 30min to 1hr chart for the breach and retest mechanic. Targets from 1987.75 are 1991, 1993, 1995.25, 1997.25, and if we can catch a bid there, we could expand into 2001.25 and beyond. The next big resistance test sits at the region between 2011-2015. Watch the higher lows to keep you on the right side of the long trade. Charts are firming up, but expect pullbacks into higher support. The shallower they are, the more likely the chart is to rise.

Downside motion opens below the failed retest of 1984 or at the failed retest of 1997.5 with negative divergence – but really watch for the higher lows there to tell you the short is ill positioned. Retracement into lower levels from 1984 gives us the targets 1981.5, 1974.75, 1971.25, 1968.75 and perhaps 1964.5 if selling really takes hold.

Have a look at the Fibonacci levels marked in the blog for more targets.

If you’re interested in the live trading room, it is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as traders remain aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders. Visit The Trading Vault to learn how to trade the way I do.

Thanks for reading.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.