It’s been two decades since stock market valuation metrics such as eyeballs, page-views-per-quarter or price/click have been used.

Yet, just because those dotcom-era terms have disappeared from the investment landscape doesn’t mean the flawed thinking behind them has gone away.

After all, the basic premise of the NASDAQ / internet stock market bubble of the late 1990s was that growth, not profits, was what mattered.

The thinking went that a company needed to be fast out of the gate in building an audience for its brand and that pesky details like profits would eventually follow.

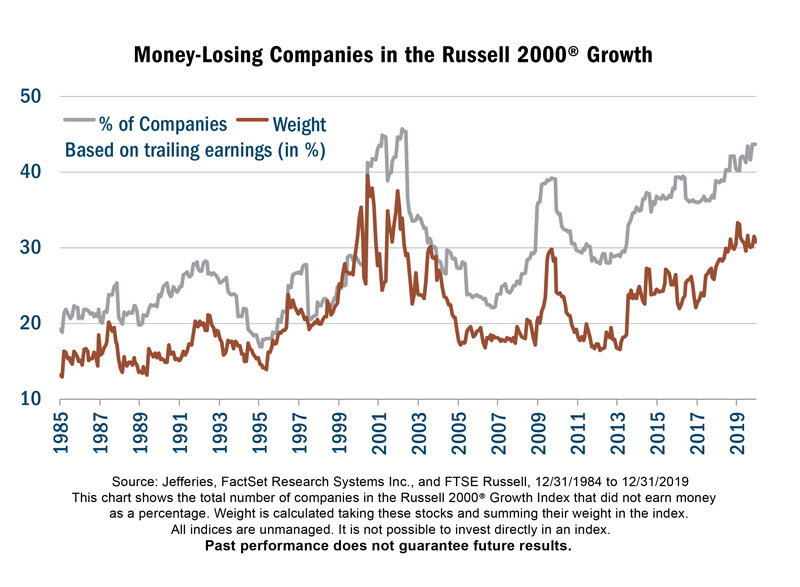

Fast forward 20 years and as the chart above shows, the percentage of money-losing companies that make up in the Russell 2000 Growth Index is beginning to nudge near levels not seen since the days of Pets.com..

Unfortunately for growth-first investors, history has been unkind to money-losers over the long haul.

The messy reality of economic uncertainty has a way of derailing lofty projections of future earnings.

As the major indices continue to reach new highs, we believe investors will be better served by focusing on money-making companies trading at compelling stock valuations rather than tales of future windfalls that may never appear.

This article is by Will Nasgovitz, CEO and portfolio manager.

Disclosure: Past performance does not guarantee future results.

Investing involves risk, including the potential loss of principal. There is no guarantee that a particular investment strategy will be successful. Value investments are subject to the risk that their intrinsic value may not be recognized by the broad market.

The statements and opinions expressed in the articles or appearances are those of the presenter. Any discussion of investments and investment strategies represents the presenters’ views as of the date created and are subject to change without notice. The opinions expressed are for general information only and are not intended to provide specific advice or recommendations for any individual. Any forecasts may not prove to be true. Economic predictions are based on estimates and are subject to change.

Definitions

Russell 2000® Growth Index measures the performance of those Russell 2000® companies with higher price/book ratios and higher forecasted growth characteristics. All indices are unmanaged. It is not possible to invest directly in an index. Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indices. Russell® is a trademark of the Russell Investment Group.