European Stocks

Investors that are solely focused on domestic opportunities may be missing out on overseas strength. Not only have European stocks continued to trend higher and make new highs, they have done so with improving momentum. The new highs in European stocks have come as economic data there continues to surprise to the upside (contrary to US economic data which has been surprising to the downside).

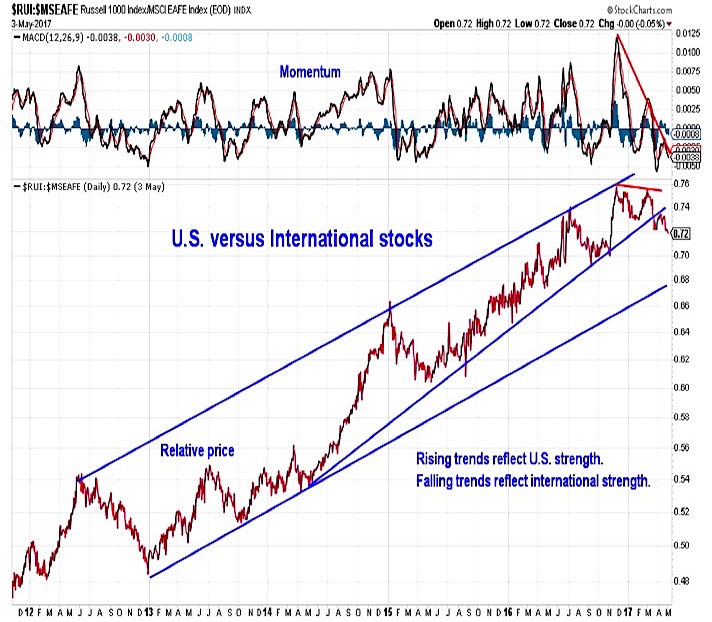

US vs. International Stocks

Better global trends come after an extended period of U.S. relative strength. The ratio between U.S. stocks and international stocks has been trending in favor of U.S. stocks for better than five years. That could be coming to an end. Momentum has shifted in favor of international stocks, and the price trend has faltered. For asset allocators this may mean a return to the benefits of diversification. For tactical investors it may mean better near-term opportunities can be found overseas.

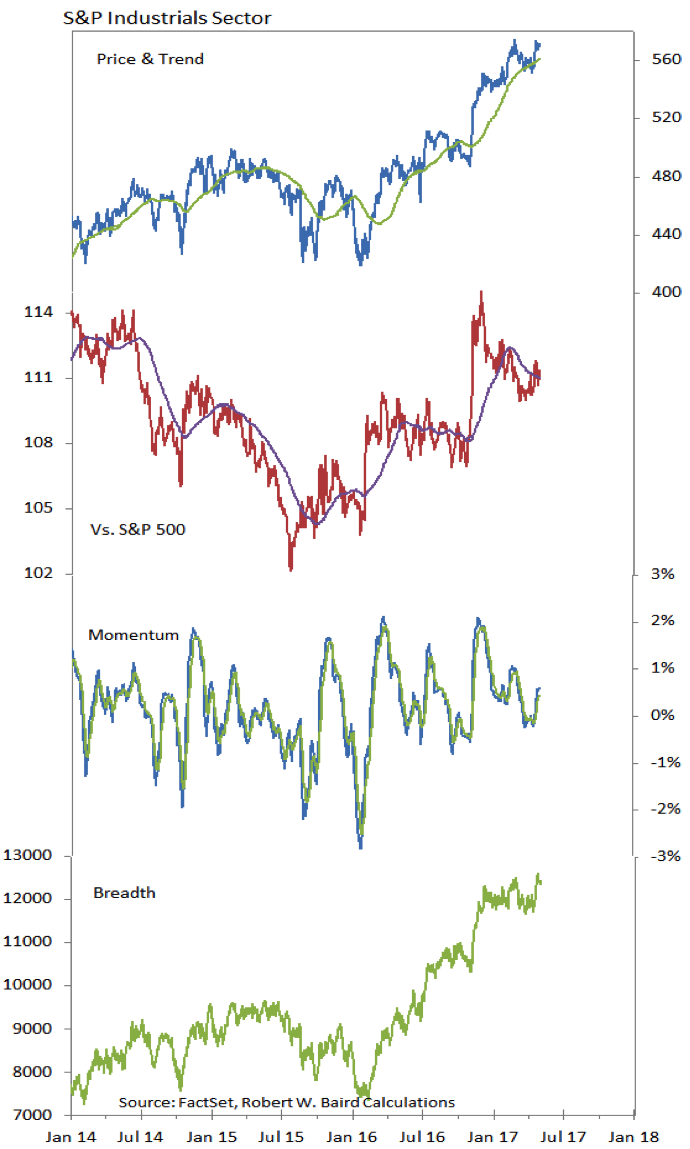

S&P Industrials Sector

The Industrials sector continues to be among the relative strength leaders in the U.S. While the relative price (vs. the S&P 500) has pulled back from its recent peak, the longer-term up-trend is intact and both price and breadth trends remain strong. Momentum has turned higher, but has not yet broken the pattern of lower highs and lower lows that define a downtrend.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.