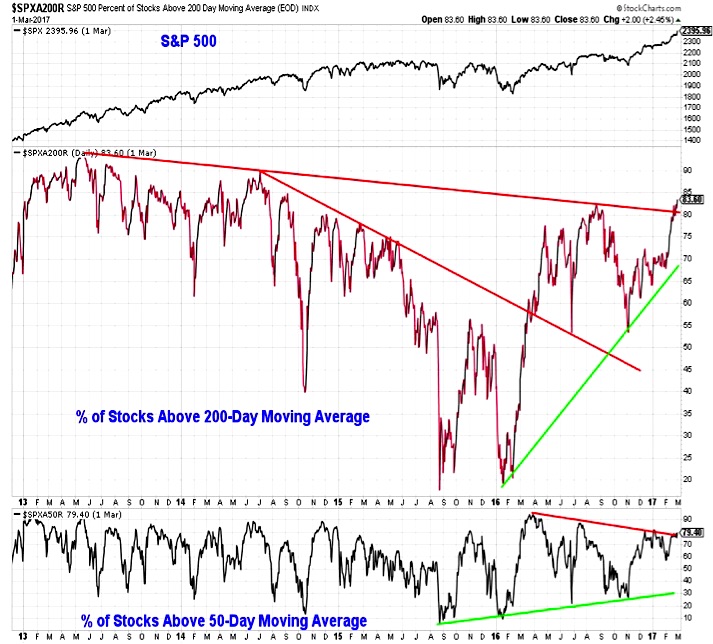

Several weeks ago we cautioned that while the indexes were making new highs the percentage of stocks in uptrends was relatively muted. We noted, however, that this could quickly rectify itself. That appears to be what has happened. Over the past month, the percentage of stocks trading above their 200-day averages has surged from 70% to nearly 85% – moving to the highest level since 2014 and breaking a down-trend that stretches back to 2013.

Treasury Rates & Investor Sentiment

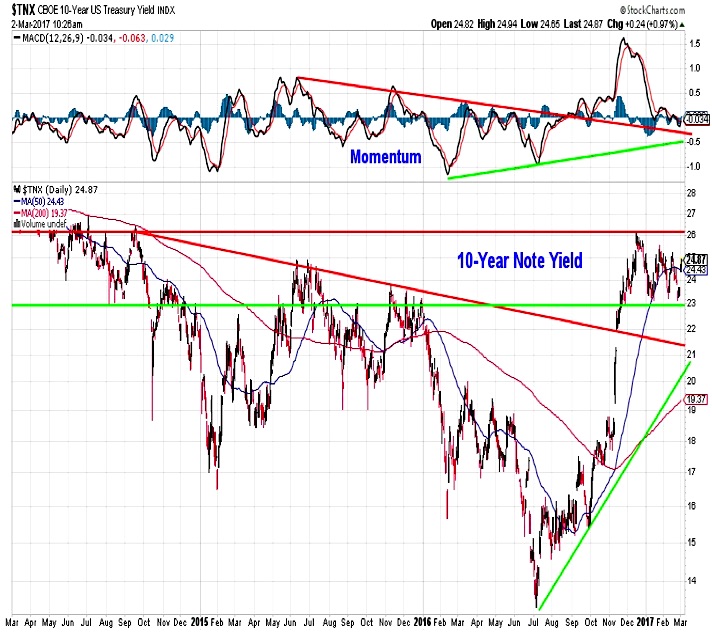

Sentiment overall looks stretched to the upside. We have our eyes on two indicators that have not confirmed the message of optimism. Despite evidence of improving global growth, an uptick in inflation and a host of Fed speakers this week prepping the market for a March interest rate hike (Fed funds futures have gone from rating a March hike as a 1-in-3 chance to almost 90% likely), the yield on the 10-year remains in range that goes back to the fourth quarter of 2016 (between 2.3% and 2.6%). A break-out above 2.6% could be evidence that the skeptics in the bond market have thrown in the towel.

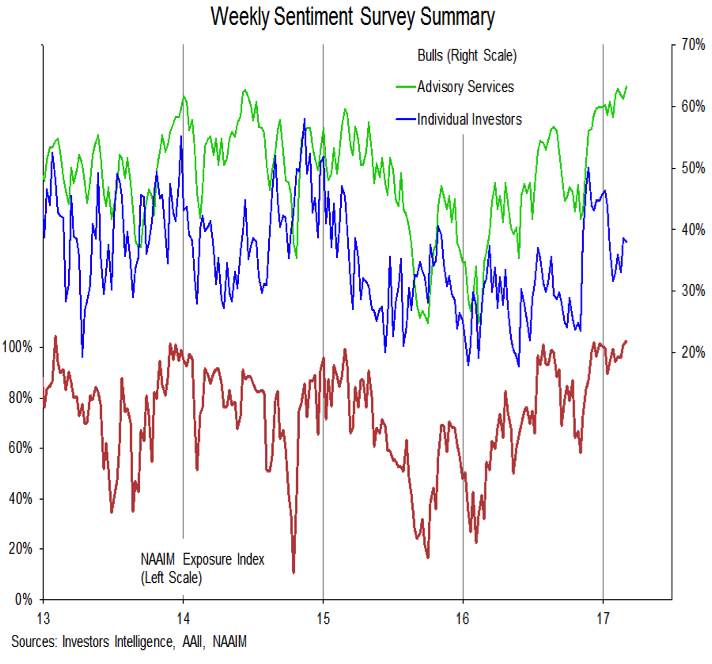

Another area of divergent sentiment has been the individual investors surveyed by the AAII. After a brief surge in optimism in the immediate wake of the November elections, bulls on the AAII survey have drifted lower since the beginning of the year and are now below their long-term average. This contrasts with a 30-year high in Advisory Services bulls (as measured by Investors Intelligence) and the second highest on record from the NAAIM exposure index. By way of caveat, the only time the NAAIM index was higher than this week was in early 2013 (when the S&P 500 was on its way to a 30% yearly gain).

A surge in optimism among individual investors could make further upside for stocks hard fought without a meaningful retrenchment in sentiment (which is what was seen in mid-2013).

Health Care Sector

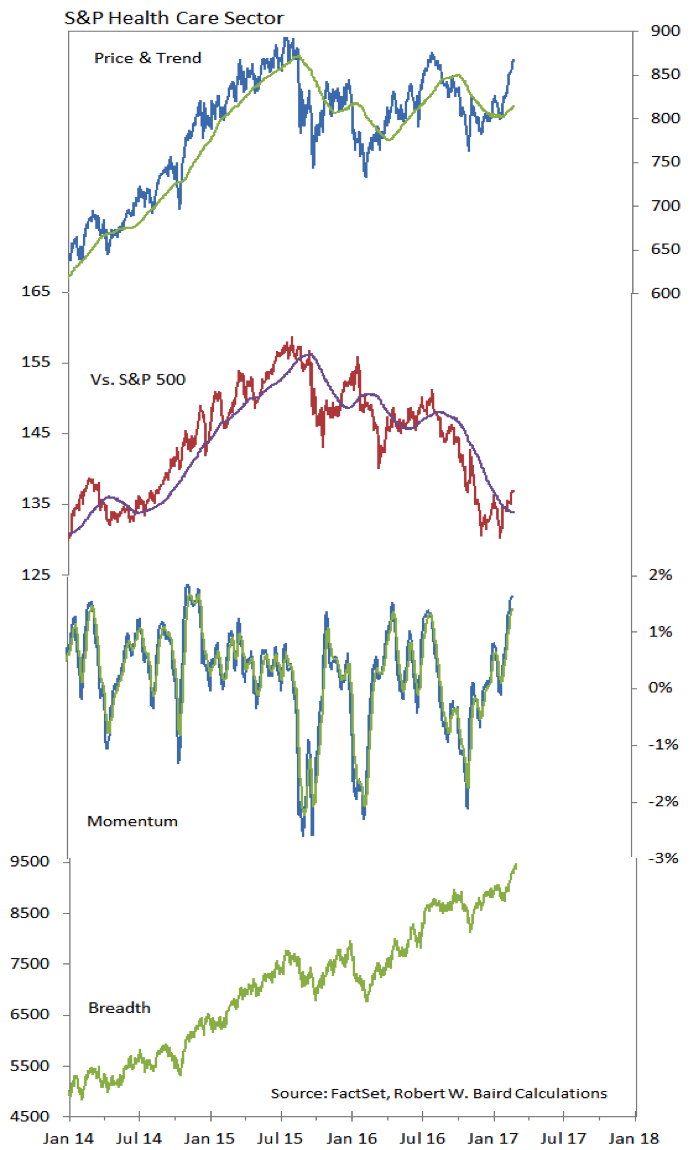

Health Care has continued to make progress to the up-side. The relative price line is moving higher, although a longer-term down-trend is still intact. The sector is improving in our relative strength rankings and both momentum and breadth have broken out to new highs.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.